United States Gaming Market Size, Share, and COVID-19 Impact Analysis, By Device (Console, Mobile, and Computer), By Type (Online and Offline), and United States Gaming Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited States Gaming Market Insights Forecasts to 2035

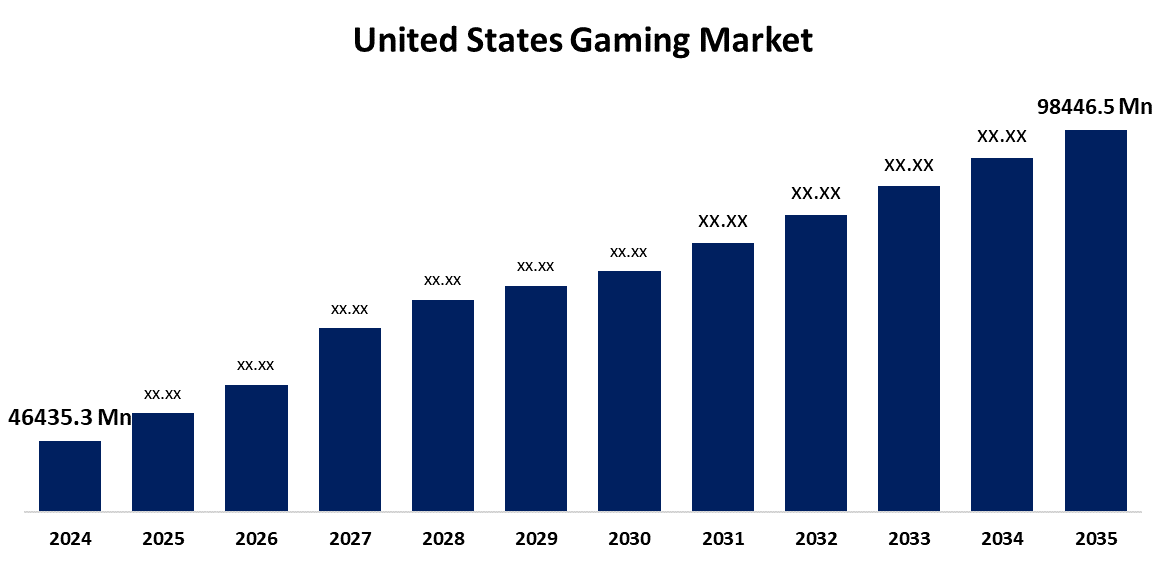

- The US Gaming Market Size Was Estimated at USD 46435.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.07% from 2025 to 2035

- The US Gaming Market Size is Expected to Reach USD 98446.5 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Gaming Market Size is Anticipated to Reach USD 98446.5 Million by 2035, Growing at a CAGR of 7.07% from 2025 to 2035. The expansion of the United States gaming market is propelled by developments in AR/VR technology, the growth of cloud and mobile gaming, and the growing appeal of e-sports.

Market Overview

Gaming is the practice of using electronic devices to play video games for enjoyment, competitiveness, or social engagement. Across the United States, the gaming sector has expanded rapidly because of the increased adoption of smartphones. Smartphones have made gaming more available than ever before. Rugged technologies and fast internet on smartphones allow users to play many kinds of games anytime, anywhere, without needing special gaming devices or even personal computers. The introduction of smartphones has also enabled social gaming where users can connect and play with their friends, family, and other players. Online multiplayer games, social gaming networks, and adding social components to games have become prevalent on mobile devices. For example, BitNile Metaverse, Inc. launched Roulette in May 2023.

The U.S. government's role in the gaming industry has gradually increased due to strategic investments, educational programs, defence uses, and encouragement of innovation and research. The government has provided funding for serious game creation and game-based learning resources through organisations like the Department of Education and the National Science Foundation (NSF) to enhance educational outcomes, particularly in STEM (science, technology, engineering, and math) disciplines. These include funding for gamification platforms and educational game design with the goal of better involving students.

Report Coverage

This research report categorizes the market for the United States gaming market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States gaming market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States gaming market.

United States Gaming Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 46435.3 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.07% |

| 2035 Value Projection: | USD 98446.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Device, By Type and COVID-19 Impact Analysis. |

| Companies covered:: | BlueStacks, BlueStacks, Microsoft Corp, Activision Blizzard, Inc., Electronic Arts Inc., Take-Two Interactive Software, Inc., Zynga Inc., Valve Corporation, Apple, Inc and Others. |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The growth of the United States gaming market is boosted by a large increase in young individuals who use video games as a way to spend time. A 2020 study by the Entertainment Software Association (ESA) found that 73% of US parents believe that video games can provide learning, while 66% believe family video game time is more fun and engaging. Also, children's increased participation in indoor games and other leisure activities, such as painting and crafts, is driving sales of the gaming market. Interactive social media games have seen an increase in popularity on mobile devices as smartphone usage continues to attach 4G connectivity.

Restraining Factors

The United States gaming market faces obstacles because video game addiction can lead to these potential mental health issues, and parents are increasingly refusing to buy the product for their children, which is impacting the growth of the market.

Market Segmentation

The United States gaming market share is classified into device and type.

- The mobile segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States gaming market is segmented by device into console, mobile, and computer. Among these, the mobile segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The market is driven by the availability of smartphones and tablets as well as improved mobile internet, particularly 5G. Mobile gaming is more popular than before, given its portability and the various game genres available for various demographics. Moreover, additional advances within game development, cloud gaming, and cross-platform play specifically are likely to elevate mobile gaming experiences and user engagement.

- The offline segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the United States gaming market is segmented into online and offline. Among these, the offline segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by a loyal customer base that appreciates local multiplayer games, as well as offline single-player experiences. The offline market is expected to evolve as game developers innovate game design elements that promote replayability and user engagement. Furthermore, game sales in physical formats are still very large in places with poor internet connectivity, as well as where online payment methods are less popular.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States gaming market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BlueStacks

- BlueStacks

- Microsoft Corp

- Activision Blizzard, Inc.

- Electronic Arts Inc.

- Take-Two Interactive Software, Inc.

- Zynga Inc.

- Valve Corporation

- Apple, Inc.

- Others

Recent Development

- In May 2022, Take-Two Interactive Software announced the completion of its combination with Zynga Inc. Under the merger agreement's terms, Zynga stockholders received USD 3.50 in cash and 0.0406 shares of Take-Two common stock per share of Zynga common stock.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States gaming market based on the following segments:

United States Gaming Market, By Device

- Console

- Mobile

- Computer

United States Gaming Market, By Type

- Online

- Offline

Need help to buy this report?