United States Gabapentin Market Size, Share, and COVID-19 Impact Analysis, By Dosage Form (Tablet, Capsule, and Oral Solution), By Type (Generic and Branded), and United States Gabapentin Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Gabapentin Market Insights Forecasts to 2035

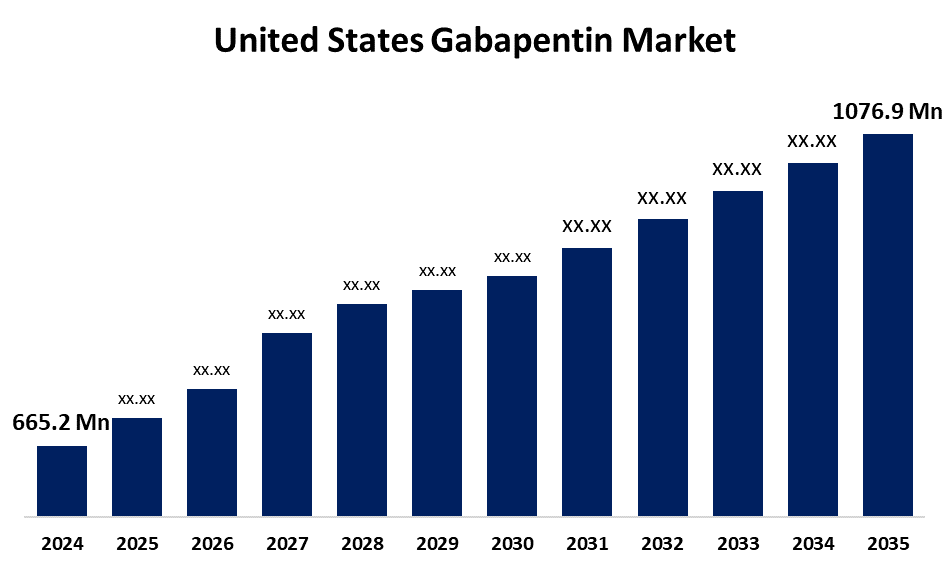

- The US Gabapentin Market Size Was Estimated at USD 665.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.48% from 2025 to 2035

- The US Gabapentin Market Size is Expected to Reach USD 1076.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Gabapentin Market Size is Anticipated to Reach USD 1076.9 Million by 2035, Growing at a CAGR of 4.48% from 2025 to 2035. The expansion of the United States gabapentin market is propelled by surging demand in the construction and automotive sectors, where rigid foams offer superior thermal insulation for energy-efficient buildings, and lightweight flexible foams help lower the weight in vehicles, boosting fuel efficiency and enabling EV design flexibility.

Market Overview

Gabapentin is a structural analogue of the neurotransmitter GABA and belongs to the gabapentinoid class of anticonvulsants. The rise in neuropathic pain, epilepsy, and other neurological problems has been the chief catalyst driving growth in the US gabapentin market. As the population ages, there is an increased demand for effective solutions for pain management, which helps elevate the importance of gabapentin as a recommended drug choice. The growth in the market is only compounded by the steady rise and movement towards the use of generic drugs as an additional pointer towards the affordability of treatment options in the market. There are emerging opportunities in the pharmaceutical market, particularly with further research for new uses of gabapentin for indications such as anxiety disorders and fibromyalgia. The gabapentin market will benefit from increased rates of diagnosis and treatment resulting from campaigns to increase public awareness of neurological health. A positive outlook on the market is supported by observable growth in awareness and acceptance of gabapentin in the form of recommendations made by healthcare professionals for a variety of treatment options in the US as a result of increased awareness of gabapentin's efficacy in managing chronic pain.

Report Coverage

This research report categorizes the market for the United States gabapentin market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States gabapentin market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States gabapentin market.

United States Gabapentin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 665.2 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.48% |

| 2035 Value Projection: | USD 1076.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Type, By Dosage Form and COVID-19 Impact Analysis. |

| Companies covered:: | Ascendis Pharma, Assertio Holdings Inc, Amneal Pharmaceuticals, Arbor Pharmaceuticals, Pfizer Inc, LGM Pharma, HealthWarehouse.com, Glenmark Pharmaceuticals Limited and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States gabapentin market is boosted by its increasingly prevalent use for the management of neuropathic pain has created a driving need for the medication, as gabapentin is effective in treating this condition, and patients rely on the medication for comfort and enhancement of their quality of life. As the prevalence of neuropathic pain is increasing, so is the need for gabapentin to alleviate neuropathic pain. Demand for gabapentin is further enhanced given the expanding use of gabapentin for the treatment of epilepsy, a neurological disorder characterized by defined recurrent seizure episodes. It is because of the increasing prevalence of epilepsy and gabapentin's effectiveness in controlling these seizure episodes that physician prescribing is a vital aspect of care for epilepsy.

Restraining Factors

The United States gabapentin market faces obstacles like patient non-compliance. Patient non-compliance could adversely impact the best therapeutic outcome from gabapentin treatment regimens and could worsen the patient's underlying condition.

Market Segmentation

The United States gabapentin market share is classified into dosage form and type.

- The capsule segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States gabapentin market is segmented by dosage form into tablet, capsule, and oral solution. Among these, the capsule segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because they are ideal for the patient population, including youth and the elderly, and they are easy to use. The ease of administration and rapid absorption of capsules guarantees accurate dosing, providing assurances to health professionals and encouraging patient compliance.

- The generic segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the United States gabapentin market is segmented into generic and branded. Among these, the generic segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because it is cheaper than branded drugs and are accessible to a wider range of patients, The emergence of the generic category after the patents expired on gabapentin, coupled with the increasing occurrence of neuropathic pain and epilepsy, has encouraged many health practitioners, especially in areas where cost is a consideration, to use gabapentin generics as a substitute for potentially more expensive alternatives. The increased competition has greatly reduced the price of gabapentin.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States gabapentin market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ascendis Pharma

- Assertio Holdings Inc

- Amneal Pharmaceuticals

- Arbor Pharmaceuticals

- Pfizer Inc

- LGM Pharma

- HealthWarehouse.com

- Glenmark Pharmaceuticals Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States gabapentin market based on the following segments:

United States Gabapentin Market, By Dosage Form

- Tablet

- Capsule

- Oral Solution

United States Gabapentin Market, By Type

- Generic

- Branded

Need help to buy this report?