United States Fungicide Market Size, Share, and COVID-19 Impact Analysis, By Crop Type (Commercial Crops, Fruits & Vegetables, Grains & Cereals, Pulses & Oilseeds, and Turf & Ornamental), By Application Mode (Chemigation, Foliar, Fumigation, Seed Treatment, and Soil Treatment), and United States Fungicide Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureUnited States Fungicide Market Insights Forecasts to 2035

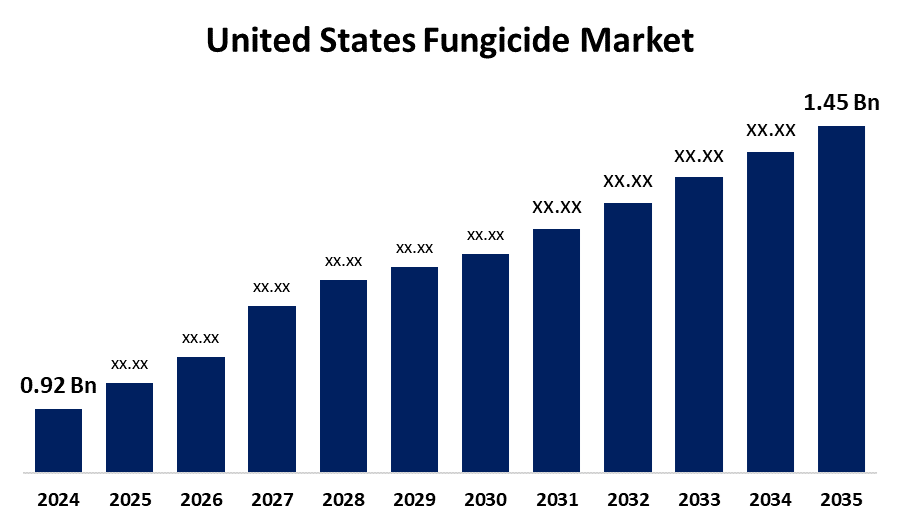

- The U.S. Fungicide Market Size Was Estimated at USD 0.92 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.22% from 2025 to 2035

- The US Fungicide Market Size is Expected to Reach USD 1.45 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Fungicide Market is anticipated to reach USD 1.45 billion by 2035, growing at a CAGR of 4.22% from 2025 to 2035. The U.S. fungicide market is growing steadily, driven by increasing crop disease pressures, demand for high-quality produce, and advancements in agrochemical technologies supporting sustainable and efficient disease management practices.

Market Overview

The United States fungicide industry involves the manufacture, production, and distribution of chemical and biological products intended to prevent or destroy fungal pathogens that infect crops. The fungicides play a vital role in protecting agricultural harvests by preventing diseases that can undermine plant health and productivity. Moreover, the U.S. fungicide market growth is particularly influenced by growing resistance management, escalating demand for residue-free fruits and vegetables, and precision agriculture technology adoption. Increased data analytics and AI-based disease forecasting systems are facilitating the precision application of fungicides, improving efficiency and reducing environmental footprint considerations not often highlighted in overall analysis. Furthermore, innovations by industry players are driving the US fungicide market. Players such as Bayer have launched innovative fungicides like Luna Flex, which target diseases such as scab and powdery mildew. BASF's Revysion provides improved efficacy against resistant strains. Moreover, Eden Research's plant-based products address the increasing demand for sustainable agriculture. These innovations combined improve crop protection and address changing agricultural requirements.

Report Coverage

This research report categorizes the U.S. fungicide market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States fungicide market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US fungicide market.

United States Fungicide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 0.92 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.22% |

| 2035 Value Projection: | USD 1.45 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Crop Type, By Application Mode and COVID-19 Impact Analysis |

| Companies covered:: | FMC Corporation, UPL Limited, ADAMA Agricultural Solutions Ltd., Bayer AG, Syngenta Group, Corteva Agriscience, American Vanguard Corporation, Sumitomo Chemical Co., Ltd, BASF SE, Nufarm Ltd and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The U.S. market for fungicides is driven by rising adoption of integrated pest management (IPM) techniques, growing consumer demand for cosmetically flawless produce, and growing protected cultivation like greenhouses. Furthermore, climate uncertainty is creating new fungal outbreaks, encouraging proactive fungicide application. Support from governments for research on crop protection and collaborations between agri-tech companies and farmers to create location-specific solutions are also driving market growth beyond conventional agricultural methods. For instance, in October 2022, FMC launched Adastrio fungicide, a new three-mode foliar fungicide that controls late-season diseases. This new product delivers essential Lepidopteran pest control that is convenient, targeted, and long-lasting on a range of permanent crops.

Restraining Factors

The U.S. fungicide market faces restraints from stringent regulatory approvals, rising environmental and health concerns, increasing resistance in fungal strains, and growing preference for organic, chemical-free farming alternatives among consumers.

Market Segmentation

The United States fungicide market share is classified into crop type and application mode.

- The fruits & vegetables segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States fungicide market is segmented by crop type into commercial crops, fruits & vegetables, grains & cereals, pulses & oilseeds, turf & ornamental. Among these, the fruits & vegetables segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their high economic value and susceptibility to fungal infections. Ensuring crop quality and shelf life drives the frequent use of fungicides, especially in perishable produce, to meet both domestic consumption and export quality standards.

- The foliar segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States fungicide market is segmented by application mode into chemigation, foliar, fumigation, seed treatment, and soil treatment. Among these, the foliar segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its ease of use, rapid action, and effectiveness in targeting above-ground fungal infections. It allows direct contact with infected plant parts, improving efficiency and reducing crop loss, making it a preferred method among commercial and small-scale farmers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US fungicide market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- FMC Corporation

- UPL Limited

- ADAMA Agricultural Solutions Ltd.

- Bayer AG

- Syngenta Group

- Corteva Agriscience

- American Vanguard Corporation

- Sumitomo Chemical Co., Ltd

- BASF SE

- Nufarm Ltd

- Others

Recent Developments:

- In January 2023, Oerth Bio and Bayer partnered to develop more environmentally friendly crop protection products and advance crop protection technologies.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the USA fungicide market based on the below-mentioned segments:

United States Fungicide Market, By Crop Type

- Commercial Crops

- Fruits & Vegetables

- Grains & Cereals

- Pulses & Oilseeds

- Turf & Ornamental

United States Fungicide Market, By Application Mode

- Chemigation

- Foliar

- Fumigation

- Seed Treatment

- Soil Treatment

Need help to buy this report?