United States Fructose Market Size, Share, and COVID-19 Impact Analysis, By Product (Fructose Solids, High Fructose Corn Syrup, and Fructose Syrups), and US Fructose Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUSA Fructose Market Insights Forecasts to 2035

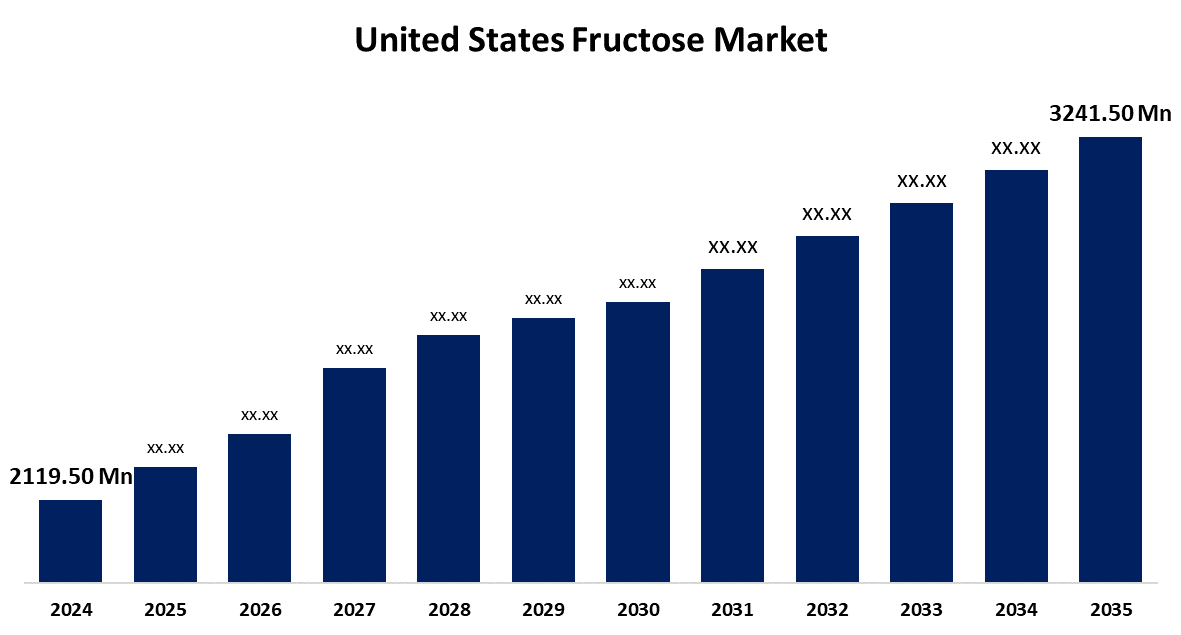

- The US Fructose Market Size was Estimated at USD 2119.50 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.94% from 2025 to 2035

- The USA Fructose Market Size is Expected to Reach USD 3241.50 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Fructose Market Size is Anticipated to Reach USD 3241.50 Million by 2035, Growing at a CAGR of 3.94% from 2025 to 2035. The industry is expected to experience growth due to the increasing demand for low-sugar, low-fat, and processed low-calorie food products.

Market Overview

The US fructose market is fueled by growing consumer demand for healthier substitutes such as crystalline fructose and high-fructose corn syrup. It includes the production, distribution, and consumption of fructose, a natural sweetener. A common nutrient in fruits, berries, and honey is fructose. It is a naturally occurring sweet, low-calorie sugar that is 1.5–2.0 times sweeter than sucrose and can be found in a variety of fruits and vegetables. In the human body, fructose has many physiological and advantageous functions, such as reducing the glycemic index, speeding up the metabolism of ethanol, improving iron bioavailability, and avoiding the metabolism of glucose. As a flavor enhancer, good humectant, low molecular weight, high osmotic pressure, high solubility, smooth consistency, and stability in acidic foods, it also has technical and functional advantages over disaccharide sugars. Fructose is now a vital and healthful food ingredient in many food industries, including dairy products like ice cream, yogurt, and chocolate milk, owing to these qualities.

Report Coverage

This research report categorizes the market for the US fructose market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US fructose market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US fructose market.

United States Fructose Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2119.50 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 3.94% |

| 2035 Value Projection: | USD 3241.50 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product, and COVID-19 Impact Analysis. |

| Companies covered:: | Cargill, Galam, ADM, Shijiazhuang Huaxu Pharmaceutical Co., DuPont de Nemours Inc, Ingredion Inc, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing usage in the pharmaceutical sector:

Fructose is a popular ingredient in pharmaceutical formulations owing to its sweetness and solubility, which is driven by the pharmaceutical companies' notable growth. Syrups, chewable tablets, and liquid oral medications all contain fructose to enhance taste and palatability, especially for elderly and pediatric patients. Fructose intake has been linked to lipid dysregulation and visceral adiposity, which are linked to conditions like type 2 diabetes and cardiovascular disease, according to a study published in the Journal of Clinical Investigation. Additionally, fructose can be used in pharmaceuticals to stabilize active ingredients, change the bitter taste of some medications, and make suspensions.

Rising need for healthier sweeteners and extensive usage in food industries:

Health-conscious consumers looking for natural and low-calorie sweeteners are driving the growth of healthier substitutes for traditional sugar, such as high-fructose corn syrup (HFCS). The sweeter taste and lower glycemic index of fructose, which comes from natural sources like fruits, make it a better option. As a result, smaller amounts of fructose can be used in food and drinks. Fructose is being used in a variety of consumer goods as a result of food and beverage manufacturers reformulating their products with it due to growing consumer preferences and awareness for healthier sweeteners. Because it provides health benefits like better digestion, increased energy, and improved immune function, fructose is being used more and more in functional food products and beverages. It is an excellent option for controlling diabetes and weight because of its long-lasting energy release and low glycemic index, which escalates the growth of the market.

Restraining Factors

The US fructose market faces challenges due to health concerns, shift towards alternative sweeteners, price volatility, sustainability concerns, and competition from natural sweeteners, affecting growth and adoption.

Market Segmentation

The USA fructose market share is classified by product.

- The high fructose corn syrup segment held the largest market share of 56.34% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US fructose market is segmented by product into fructose solids, high fructose corn syrup, and fructose syrups. Among these, the high fructose corn syrup segment held the largest market share of 56.34% in 2024 and is expected to grow at a significant CAGR during the forecast period. In addition to being easier to make and more affordable than other caloric sweeteners, high fructose corn syrup is well-liked for its ability to improve the texture, color, quality, and flavor of a wide range of foods and beverages.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US fructose market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill

- Galam

- ADM

- Shijiazhuang Huaxu Pharmaceutical Co.

- DuPont de Nemours Inc

- Ingredion Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US fructose market based on the below-mentioned segments:

US Fructose Market, By Product

- Fructose Solids

- High Fructose Corn Syrup

- Fructose Syrups

Need help to buy this report?