United States Frozen Food Processing Machinery Market Size, Share, and COVID-19 Impact Analysis, By Type of Machinery (Freezers and Coolers), By Application (Fruits & Vegetables and Meat & Poultry), By Technology (Cryogenic Freezing and Blast Freezing), and United States Frozen Food Processing Machinery Market Insights, Industry Trend, Forecasts to 2035

Industry: Machinery & EquipmentUnited States Frozen Food Processing Machinery Market Insights Forecasts to 2035

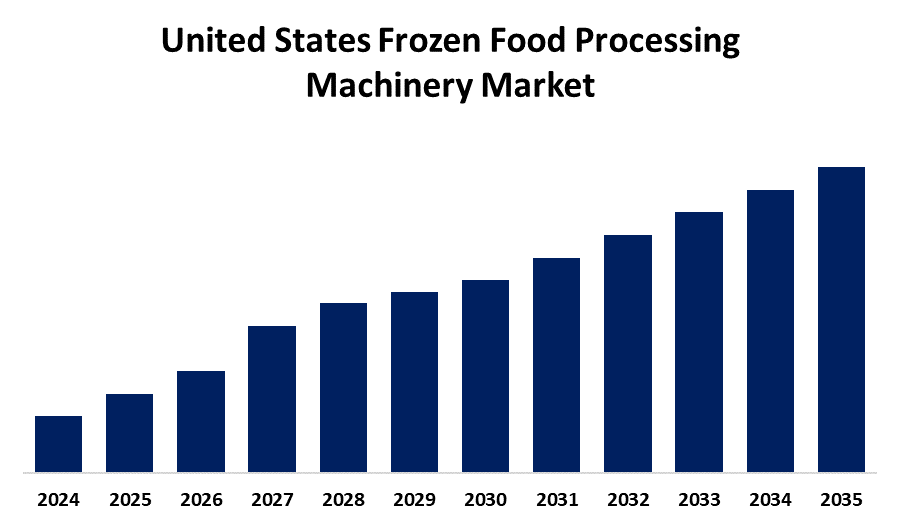

- The United States Frozen Food Processing Machinery Market Size is Expected to Grow at a CAGR of around 4.6% from 2025 to 2035.

- The U.S. Frozen Food Processing Machinery Market Size is Expected to Hold a Significant Share by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Frozen Food Processing Machinery Market Size is Expected to hold a significant share by 2035, Growing at a CAGR of 4.6% from 2025 to 2035. The Growth of the United States frozen food processing machinery market is driven by increasing consumer demand for convenient, ready-to-eat frozen meals and expanding frozen food retail and foodservice sectors. Technological advancements and automation improve efficiency and product quality, attracting manufacturers, along with government regulations on food safety, promote investment in advanced machinery.

Market Overview

The United States frozen food processing machinery market encompasses equipment used to prepare, process, and package frozen food products, including meat, vegetables, ready meals, and bakery items. These machines play an important role in preserving food quality, extending shelf life, and ensuring safety standards. Market growth is primarily driven by rising consumer demand for convenient, ready-to-eat meals and the expansion of the frozen food sector in retail and foodservice industries. Strengths of the market include advanced technological innovation, automation capabilities, and the presence of well-established U.S.-based manufacturers offering diverse machinery solutions. Opportunities lie in increasing health-conscious consumer behavior, leading to a surge in demand for frozen organic and plant-based foods, and in export potential due to the global reputation of U.S. food equipment. Government initiatives, such as food safety regulations by the FDA and USDA, encourage investments in modern, hygienic machinery, while tax incentives for manufacturing upgrades support industry growth.

Report Coverage

This research report categorizes the market for the United States frozen food processing machinery market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States frozen food processing machinery market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States frozen food processing machinery market.

United States Frozen Food Processing Machinery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 4.6% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 188 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type of Machinery, By Application, By Technology and COVID-19 Impact Analysis |

| Companies covered:: | Jarvis Products Corporation, Bettcher Industries, Inc., Provisur Technologies, Heat and Control, Inc., Urschel Laboratories, Siemens Corporation, Markel Food Group, Grote Company, Taylor Company, Ross Industries, Rotex Global, Demaco, Reiser, Mepaco, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The growing popularity of frozen organic, plant-based, and health-focused options further expands market potential, with consumers increasingly preferring convenient, ready-to-eat frozen meals due to busy lifestyles, boosting demand for efficient food processing solutions. Technological innovations in automation, robotics, and energy-efficient machinery are enhancing productivity and food quality, encouraging manufacturers to upgrade equipment. Additionally, strict food safety and hygiene standards enforced by regulatory bodies like the FDA and USDA are prompting companies to invest in modern, compliant machinery, which further drives the market. The rising number of supermarkets, quick-service restaurants, and e-commerce platforms also supports sustainability initiatives, making modernization more accessible and appealing.

Restraining Factors

The high capital and maintenance costs, supply chain disruptions, and skilled labor shortages, along with Regulatory compliance, adds complexity, while fluctuating raw material prices increase operational expenses. Infrastructure deficiencies and rapid technological changes further challenge manufacturers, alongside shifting consumer preferences toward minimally processed foods, necessitating continuous adaptation and innovation in equipment design.

Market Segmentation

The United States frozen food processing machinery market share is classified into type of machinery, application, and technology.

- The freezers segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States frozen food processing machinery market is segmented by type of machinery into freezers and coolers. Among these, the freezers segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is mostly because of the necessity of quick freezing to maintain food quality and safety. Moreover, the rising demand for frozen foods within the U.S., especially convenience foods and ready-to-eat meals, drives the demand for effective freezing technologies.

- The meat & poultry segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States frozen food processing machinery market is segmented by application into fruits & vegetables and meat & poultry. Among these, the meat & poultry segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is primarily due to the high consumption of meat and poultry products, which are popular for their nutritional value, leading to a strong demand for frozen packaging solutions to maintain freshness and extend shelf life.

- The blast freezing segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States frozen food processing machinery market is segmented by technology into cryogenic freezing and blast freezing. Among these, the blast freezing segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the design of blast freezers to handle large quantities of food and it can rapidly freeze the food successfully by maintaining texture, taste, and nutritional content while reducing damage and ice crystal development.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States frozen food processing machinery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Jarvis Products Corporation

- Bettcher Industries, Inc.

- Provisur Technologies

- Heat and Control, Inc.

- Urschel Laboratories

- Siemens Corporation

- Markel Food Group

- Grote Company

- Taylor Company

- Ross Industries

- Rotex Global

- Demaco

- Reiser

- Mepaco

- Others

Recent Developments:

- In November 2024, Nestlé unveiled plans to invest $150m to expand a production facility for frozen meals in the US. The investment will add a production line for single-serve frozen meals and upgrade automation technology.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States frozen food processing machinery market based on the below-mentioned segments:

U.S. Frozen Food Processing Machinery Market, By Type of Machinery

- Freezers

- Coolers

U.S. Frozen Food Processing Machinery Market, By Application

- Fruits and Vegetables

- Meat and Poultry

U.S. Frozen Food Processing Machinery Market, By Technology

- Cryogenic Freezing

- Blast Freezing

Need help to buy this report?