United States Frozen Dessert Market Size, Share, and COVID-19 Impact Analysis, By Product (Sweet Treats, Sherbet, Frozen Novelties, Tofu, Ice Creams, Cakes & Pastries, and Frozen Yogurt), By Distribution Channel (Food Service and Retail), and US Frozen Dessert Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUSA Frozen Dessert Market Insights Forecasts to 2035

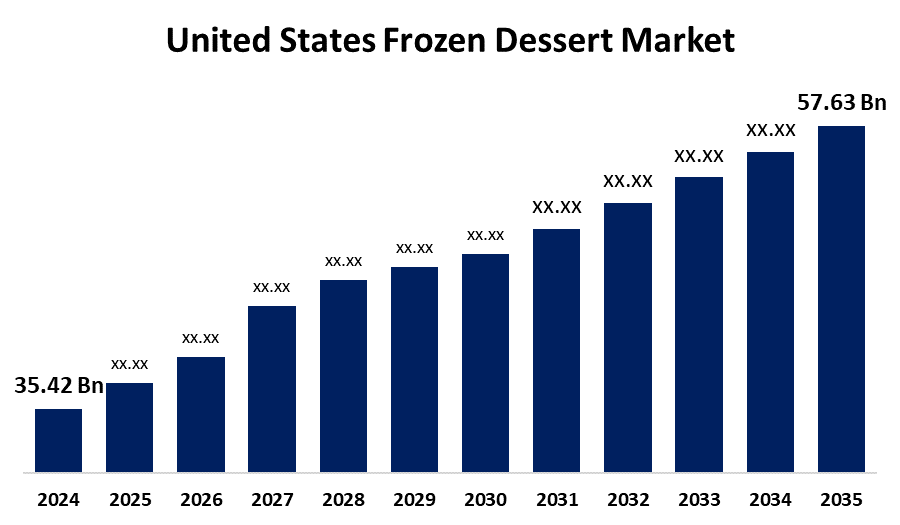

- The US Frozen Dessert Market Size was Estimated at USD 35.42 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.52% from 2025 to 2035

- The USA Frozen Dessert Market Size is Expected to reach USD 57.63 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Frozen Dessert Market Size is Anticipated to reach USD 57.63 Billion by 2035, Growing at a CAGR of 4.52% from 2025 to 2035. The market for frozen desserts in the USA is gaining due to increasing product launches, growing demand for low-calorie, dairy-free, and gluten-free options, food delivery services, and effective marketing strategies like celebrity endorsements.

Market Overview

A wide variety of sweet, frozen treats exists in the US frozen dessert market owing to changing consumer tastes, health-conscious options, and creative flavors and ingredients. Frozen desserts include various desserts like ice creams, sherbets, sorbets, frozen yogurts, and nondairy frozen desserts that are meant to be consumed frozen. These desserts can be divided into groups based on the percentage of key ingredients, such as fruit, milk, or milk fat. Having milk solids and being eaten frozen are characteristics of frozen dairy desserts. They are usually whipped and frozen under shear to produce a frozen foam. Within this category, ice cream is the most popular product. It comes in regular, low-fat, non-fat, no-sugar-added, and sugar-free varieties. These desserts, which include handheld or impulse items, come in a variety of flavors and shapes. A few noteworthy exceptions are frozen pelleted ice cream mixes that come in sphere or bead shapes. The rising temperatures in the US drive a surge in demand for refreshing desserts, prompting brands to introduce seasonal flavors, limited-time offerings, and promotions, thereby boosting consumer interest and market growth.

Report Coverage

This research report categorizes the market for the US frozen dessert market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US frozen dessert market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US frozen dessert market.

United States Frozen Dessert Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 35.42 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.52% |

| 2035 Value Projection: | USD 57.63 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Product, By Distribution Channel and COVID-19 Impact Analysis. |

| Companies covered:: | Blue Bell Ice Cream, Conagra Brands, Wells Enterprises, Inc., Froneri International Limited, Dairy Farmers of America, Inc., Winward Brands LLC, MTY Food Group (Cold Stone Creamery), Nestle, Unilever, Tofutti Brands, Inc., and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Proliferation in digitalization and rapid urbanization:

The demand for decadent frozen desserts is rising as a result of rising disposable incomes in urban areas. Urban areas' growing retail infrastructure is a result of the growing number of nuclear families and hectic lifestyles. Premium and inventive frozen dessert preferences have been impacted by urbanization, as people in cities are looking for unusual flavors and healthier substitutes. E-commerce and food delivery services have greatly increased sales of frozen desserts, which are frequently served at celebrations and urban events. Although supermarkets, hypermarkets, and organized retail stores offer refrigeration facilities as well as discounts and promotions, e-commerce platforms offer doorstep delivery and sophisticated cold-chain logistics. Shopping for frozen desserts is more alluring owing to modern retail establishments in malls that improve customer experiences.

Growing developments in flavors and aesthetic packaging of frozen desserts:

Industries are growing the frozen dessert market in the United States by providing distinctive flavors, regional combinations, and healthier substitutes. A diverse spectrum of consumers, including those who are health-conscious and appreciate unusual and exciting frozen treats, are drawn to these options. Enhancements to packaging also increase the convenience and appeal of products. Eco-conscious consumers are drawn to modern, sustainable packaging, while younger, trend-conscious consumers are drawn to aesthetically pleasing packaging. Additionally, companies are providing individualized choices and smaller portions to encourage trial purchases and accommodate a range of customer preferences.

Restraining Factors

The high transportation and storage costs, health concerns due to sugar intake, obesity, and lactose intolerance, supply chain disruptions due to fluctuating dairy prices, regulatory challenges due to strict FDA regulations, and seasonal demand variability may impede the growth of the market.

Market Segmentation

The USA frozen dessert market share is classified into product and distribution channel.

- The ice creams segment held the largest market share of 58.43% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US frozen dessert market is segmented by product into sweet treats, sherbet, frozen novelties, tofu, ice creams, cakes & pastries, and frozen yogurt. Among these, the ice creams segment held the largest market share of 58.43% in 2024 and is expected to grow at a significant CAGR during the forecast period. The sector growth is attributed to the sustainable packaging, consumer convenience, growing trend of the protein-rich ice creams, and availability of ice-creams in a variety of flavors.

- The food service segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US frozen dessert market is segmented by distribution channel into food service and retail. Among these, the food service segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Food services in the U.S., including restaurants, cafes, and ice-cream parlours, are leveraging mergers and acquisitions, advances in food technology, customized ice creams plans, and product launches to drive segment growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US frozen dessert market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Blue Bell Ice Cream

- Conagra Brands

- Wells Enterprises, Inc.

- Froneri International Limited

- Dairy Farmers of America, Inc.

- Winward Brands LLC

- MTY Food Group (Cold Stone Creamery)

- Nestle

- Unilever

- Tofutti Brands, Inc.

- Others

Recent Developments:

- In January 2025, Unilever launched its 2025 ice cream range, featuring new flavors and formats across its brands, Talenti, Breyers, Popsicle, Good Humor, Magnum, and Klondike. The new launches include bakery-inspired gelato, s'mores-themed treats, and character-branded frozen novelties, reflecting Unilever's tradition of delivering high-quality frozen treats.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US frozen dessert market based on the below-mentioned segments:

US Frozen Dessert Market, By Product

- Sweet Treats

- Sherbet

- Frozen Novelties

- Tofu

- Ice Creams

- Cakes & Pastries

- Frozen Yogurt

US Frozen Dessert Market, By Distribution Channel

- Food Service

- Retail

Need help to buy this report?