United States Forestry Machinery Market Size, Share, and COVID-19 Impact Analysis, By Type (Harvesting Machinery, Site Preparation Equipment, Transportation and Handling Equipment, Wood Processing Machinery, and Forest Fire Management Equipment), By Application (Logging, Pulp and Paper Production, Construction and Civil Engineering, Agriculture, and Others), and United States Forestry Machinery Market Insights, Industry Trend, Forecasts to 2035

Industry: Machinery & EquipmentUnited States Forestry Machinery Market Insights Forecasts to 2035

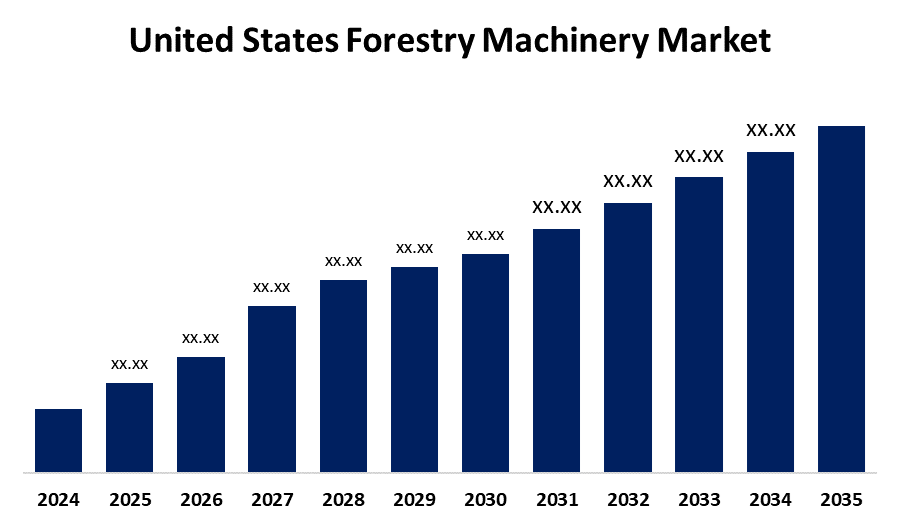

- The United States Forestry Machinery Market Size is Expected to Grow at a CAGR of around 4.7% from 2025 to 2035.

- The U.S. Forestry Machinery Market Size is Expected to Hold a Significant Share by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the USA forestry machinery market is expected to hold a significant share by 2035, growing at a CAGR of 4.7% from 2025 to 2035. The U.S. forestry machinery market is growing due to rising demand for timber, advancements in automation and precision technology, increased reforestation efforts, and government support for sustainable forestry. Additionally, the need for efficient land-clearing and logging operations amid growing construction and biomass energy sectors fuels the demand for modern, high-performance forestry equipment.

Market Overview

The USA forestry machinery market refers to the industry that produces and supplies equipment used for various forestry activities, including harvesting, processing, managing, and transporting timber and other forest resources. Market growth is driven by increasing demand for wood-based products, rising construction activity, and the surge in sustainable forest management. Advanced technologies such as automation, GPS tracking, and remote monitoring are making forestry operations more efficient, safe, and environmentally friendly. One of the market’s key strengths is its well-established logging and timber industry, supported by a network of skilled operators and robust supply chains. The market offers opportunities through rising demand for eco-friendly and low-emission equipment, adoption of automation and smart technologies, and growing investment by small and mid-sized operators looking to boost efficiency, safety, and sustainable forest management practices. Government initiatives, such as federal funding for forest restoration, wildfire prevention, and sustainable land management, are also helping modernize forestry practices.

Report Coverage

This research report categorizes the market for the United States forestry machinery market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States forestry machinery market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States forestry machinery market.

United States Forestry Machinery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.7% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 185 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Vermeer Corporation, Oregon Tool, Inc., Barko Hydraulics, LLC, Morbark, LLC, Tigercat Industries, LBX Company, Asplundh Tree Expert, LLC, Caterpillar Inc., John Deere, TimberPro Inc., Peterson Pacific Corp., Fecon Inc., Bandit Industries, Inc., Rayco Manufacturing, Inc., Rotochopper, Inc. and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

As demand for timber, paper, and bioenergy rises, there’s a greater need for efficient equipment to manage forest resources, along with the booming construction industry and increasing use of wood-based products, further contributing to this demand. Technological innovations, like automation, GPS, and remote monitoring, are making forestry operations safer, faster, and more sustainable. There’s also a noticeable shift toward eco-friendly and low-emission machinery, driven by stricter environmental regulations and growing consumer awareness. Small and mid-sized forestry businesses are investing in modern equipment to improve productivity and safety, which supports market growth. Additionally, government initiatives focused on wildfire prevention, forest restoration, and sustainable land management are helping market toward more efficient, responsible, and innovative practices.

Restraining Factors

The high cost of advanced, eco-friendly machinery can make it tough for smaller businesses to invest. Additionally, there's a shortage of skilled workers to operate these complex machines. Strict environmental regulations and safety standards also add extra layers of complexity. Furthermore, variations in wood product demand and economic downturns may cause businesses to hesitate in investing in new machinery, which can hinder the overall growth of the market.

Market Segmentation

The USA forestry machinery market share is classified into type and application.

- The harvesting machinery segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States forestry machinery market is segmented by type into harvesting machinery, site preparation equipment, transportation and handling equipment, wood processing machinery, and forest fire management equipment. Among these, the harvesting machinery segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because harvesting machines play a key role in making timber work faster and more efficiently. As demand for wood products grows, there’s a bigger need for equipment that can cut, process, and collect timber quickly and accurately. These machines not only boost productivity but also ease the physical workload and support more sustainable forestry practices.

- The logging segment held a Substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.S. forestry machinery market is segmented by application into logging, pulp and paper production, construction and civil engineering, agriculture, and others. Among these, the logging segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This growth is attributed to the key tasks like cutting down trees, moving them, and getting them ready for transport, core steps in the forestry process. As the demand for wood in construction, furniture, and paper continues to grow, having efficient equipment is more important than ever.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the USA forestry machinery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Vermeer Corporation

- Oregon Tool, Inc.

- Barko Hydraulics, LLC

- Morbark, LLC

- Tigercat Industries

- LBX Company

- Asplundh Tree Expert, LLC

- Caterpillar Inc.

- John Deere

- TimberPro Inc.

- Peterson Pacific Corp.

- Fecon Inc.

- Bandit Industries, Inc.

- Rayco Manufacturing, Inc.

- Rotochopper, Inc.

- Others

Recent Developments:

- In April 2024, Barko Hydraulics announced a financing partnership with Stearns Bank National Association. Mike Clark has joined Barko and Pettibone Traverse Lift (PTL) as the Regional EH&S Manager.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States forestry machinery market based on the below-mentioned segments:

U.S. Forestry Machinery Market, By Type

- Harvesting Machinery

- Site Preparation Equipment

- Transportation and Handling Equipment

- Wood Processing Machinery

- Forest Fire Management Equipment

U.S. Forestry Machinery Market, By Application

- Logging

- Pulp and Paper Production

- Construction and Civil Engineering

- Agriculture

- Others

Need help to buy this report?