United States Foot Orthotic Insoles Market Size, Share, and COVID-19 Impact Analysis, By Type (Prefabricated, Customized), By Material (Thermoplastics, Ethyl-vinyl Acetate (EVA), Foam, Composite Carbon Fiber, Others), By Distribution Channel (Hospital & Clinics, Retail Stores, Online Stores), and United States Foot Orthotic Insoles Market Insights Forecasts to 2033

Industry: HealthcareUnited States Foot Orthotic Insoles Market Insights Forecasts to 2033

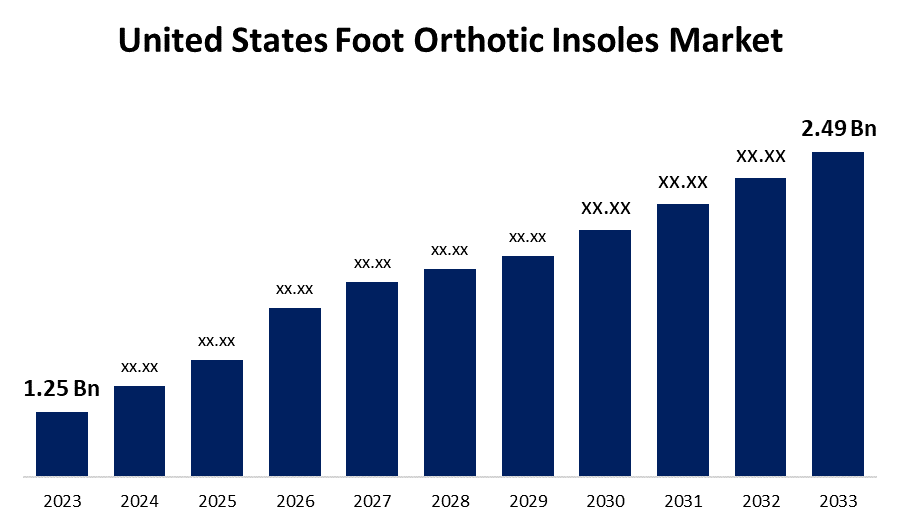

- The United States Foot Orthotic Insoles Market Size was valued at USD 1.25 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.1% from 2023 to 2033.

- The United States Foot Orthotic Insoles Market Size is Expected to Reach USD 2.49 Billion by 2033.

Get more details on this report -

The United States Foot Orthotic Insoles Market Size is Expected to Reach USD 2.49 Billion by 2033, at a CAGR of 7.1% during the forecast period 2023 to 2033.

Market Overview

Foot orthotic insoles are shoe inserts that help with mobility, comfort, and pain relief by supporting the arch. They have a soft foam that relieves pressure points, relieves flat foot pain, and improves lower limb motion and alignment. As a result, they're frequently used to treat conditions like plantar fasciitis, metatarsalgia, shin pain, overpronation, collapsed arches, bunions, and Achilles tendonitis. Depending on the desired therapeutic effects, they are currently available in a variety of styles, types, shapes, and thicknesses. A podiatrist creates a customized foot orthotic after thoroughly evaluating the user's foot structure. The market is expanding due to rising demand and adoption of customized foot orthotics. In terms of dynamic balance, pressure relief, and load redistribution across plantar regions, these foot orthotics outperform prefabricated ones.

Report Coverage

This research report categorizes the market for United States Foot Orthotic Insoles market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States Foot Orthotic Insoles market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States Foot Orthotic Insoles market.

United States Foot Orthotic Insoles Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.25 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.1% |

| 2033 Value Projection: | USD 2.49 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Material, By Distribution Channel, and COVID-19 Impact Analysis. |

| Companies covered:: | Implus Footcare LLC, Hanger Inc, Aetrex Worldwide, Inc, Footbalance System Ltd, Tynor, Digital Orthotics Laboratories Australia Pty Ltd, Thuasne, Foot Science International, Superfeet Worldwide, LLC, OttoBock, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising prevalence of diabetic foot ulcers, arthritis, and other foot conditions is expected to drive market growth. Orthotic insoles relieve pressure on the foot, potentially preventing foot conditions such as diabetic foot ulcers. Diabetic foot ulcers are a common symptom in patients with poorly controlled diabetes mellitus. Furthermore, due to the increased prevalence of diabetes, there has been a rapid increase in diabetic foot ulcers. As a result, the aforementioned factors are influencing the growth of the foot orthotic insoles market in the United States. Moreover, the rising prevalence of plantar fasciitis among sedentary middle-aged and elderly people is expected to fuel market growth in the near future. These factors, along with the increasing focus of market participants on developing and introducing advanced products to treat the conditions, are expected to drive the growth of the United States market during the forecast period.

Restraining Factors

Custom foot insoles are designed to address a specific person's foot issues and provide the most rigid support for proper alignment for people with diabetes or other foot conditions. Custom-designed orthotic insoles are fit and comfortable, but they are expensive. The overall treatment cost varies depending on the professional. Most podiatrists quote a price for the entire treatment program rather than a specific fee. The factors listed above are responsible for limiting the growth of the United States foot orthotic insoles market.

Market Segment

- In 2023, the customized segment accounted for the largest revenue share over the forecast period.

Based on the type, the United States foot orthotic insoles market is segmented into prefabricated and customized. Among these, the customized segment has the largest revenue share over the forecast period. The expansion is primarily due to market participants' ongoing R&D investments in order to introduce more innovative customized insoles using cutting-edge 3D printing technology. Furthermore, most orthotists prescribe customized foot insoles to improve clinical outcomes, propelling segmental growth during the forecast period. Furthermore, the prefabricated segment is expected to grow at a lower CAGR during the forecast period.

- In 2022, the ethyl-vinyl acetate (EVA) segment accounted for the largest revenue share over the forecast period.

Based on the material, the United States foot orthotic insoles market is segmented into thermoplastics, ethyl-vinyl acetate (EVA), foam, composite carbon fiber, and others. Among these, the ethyl-vinyl acetate (EVA) segment has the largest revenue share over the forecast period, owing to its simple accessibility and recyclable property as compared to other materials.

- In 2022, the hospital & clinics segment accounted for the largest revenue share over the forecast period.

Based on the distribution channel, the United States foot orthotic insoles market is segmented into hospital & clinics, retail stores, and online stores. Among these, the hospital & clinics segment has the largest revenue share over the forecast period, this is mainly due to the fact that patients and their preferences account for a sizable portion of the consumer base. These patients prefer to purchase foot orthotic insoles from hospitals and clinics. Hospitals and clinics provide highly skilled and experienced personnel, as well as adequate infrastructure for treatments and reliable sales channels.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States foot orthotic insoles market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Implus Footcare LLC

- Hanger Inc

- Aetrex Worldwide, Inc

- Footbalance System Ltd

- Tynor

- Digital Orthotics Laboratories Australia Pty Ltd

- Thuasne

- Foot Science International

- Superfeet Worldwide, LLC

- OttoBock

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In April 2022, the world's first OrthoLite ESD Shield was introduced by O2 Partners LLC. A mechanically bonded electrostatic discharge protection insole technology is the solution.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States foot orthotic insoles market based on the below-mentioned segments:

United States Foot Orthotic Insoles Market, By Type

- Prefabricated

- Customized

United States Foot Orthotic Insoles Market, By Material

- Thermoplastics

- Ethyl-vinyl Acetate (EVA)

- Foam

- Composite Carbon Fiber

- Others

United States Foot Orthotic Insoles Market, By Distribution Channel

- Hospital & Clinics

- Retail Stores

- Online Stores

Need help to buy this report?