United States Foodservice Market Size, Share, and COVID-19 Impact Analysis, By Foodservice Type (Cafes & Bars, Cloud Kitchen, Full-Service Restaurants, and Quick Service Restaurants), By Outlet (Chained Outlets and Independent Outlets), and United States Foodservice Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited States Foodservice Market Insights Forecasts to 2035

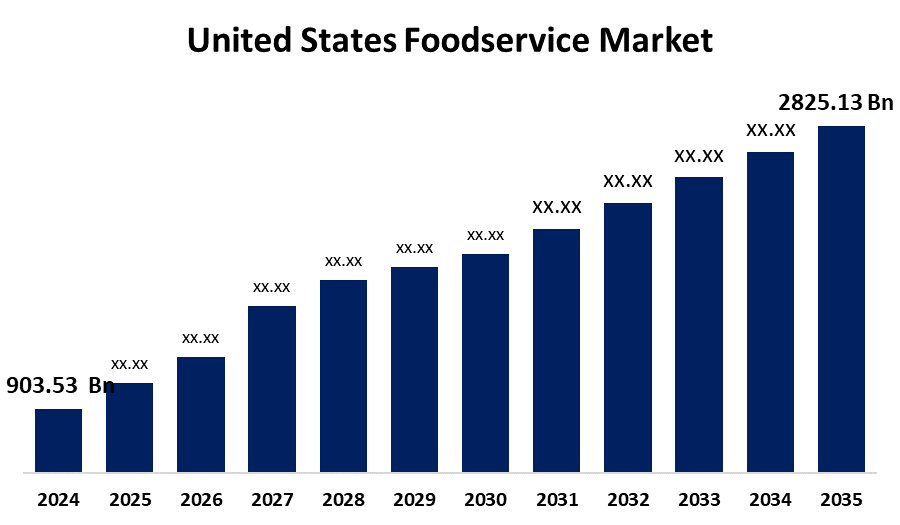

- The U.S. Foodservice Market Size was estimated at USD 903.53 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.92% from 2025 to 2035

- The USA Foodservice Market Size is Expected to Reach USD 2825.13 Billion by 2035

Get more details on this report -

The US Foodservice Market Size is anticipated to reach USD 2825.13 Billion by 2035, Growing at a CAGR of 10.92% from 2025 to 2035. Growth in the U.S. foodservice market is driven by rising consumer demand for convenience, expansion of quick-service restaurants, increasing online food delivery, and innovation in menu offerings catering to diverse dietary preferences.

Market Overview

The United States foodservice market refers to all types of establishments preparing and serving food and beverages away from home for immediate consumption. It has a large variety of operations, including full-service restaurants, quick-service restaurants, cafes, bars, cloud kitchens, and institutional food providers such as school and hospital cafeterias. All these establishments cover a variety of dining occasions and preferences, with the range of services extending from dine-in to takeout and delivery. Moreover, the U.S. foodservice market is driven by increasing consumer demand for convenience, fast service, and diverse food options. Rising disposable income, changing dining habits, and the growing popularity of delivery and takeout services are also fueling market growth. Additionally, innovations in technology and healthier menu offerings contribute to expansion. For instance, in December 2023, MTY Food Group Inc., one of its wholly owned subsidiaries, purchased all of the issued and outstanding shares of COP WP Parent Inc. (Wetzel's Pretzels) from CenterOak Partners. Wetzel's Pretzels is a United States-based chain of fast-food restaurants serving pretzels and hot dogs, with operations in the United States, Canada, and Central America.

Report Coverage

This research report categorizes the U.S. foodservice market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States foodservice market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA foodservice market.

United States Foodservice Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 903.53 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.92% |

| 2035 Value Projection: | USD 2825.13 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | By Foodservice Type, By Outlet and COVID-19 Impact Analysis |

| Companies covered:: | McDonald’s Corporation, Domino’s Pizza Inc., Papa John’s International, Inc., Chipotle Mexican Grill, Inc, Darden Restaurants, Inc., Bloomin’ Brands, Inc., Brinker International, Inc., Doctor’s Associates, Inc., Restaurant Brands International Inc., Inspire Brands, Inc., MTY Food Group Inc., and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

he U.S. foodservice market is propelled by the rise of digital ordering platforms, the demand for personalized dining experiences, and the expansion of plant-based and sustainable food options. Consumer interest in unique dining experiences, coupled with the growing trend of casual dining and hybrid models (e.g., ghost kitchens), is further driving growth. Additionally, the adoption of contactless payment systems and eco-friendly packaging enhances convenience and supports market development.

Restraining Factors

High operating costs, labor shortages, and supply chain disruptions restrain the U.S. foodservice market. Additionally, fluctuating food prices, health and safety regulations, and increased competition from delivery services hinder growth potential.

Market Segmentation

The United States foodservice market share is classified into foodservice type and outlet.

- The quick service restaurants segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States foodservice market is segmented by foodservice type lighting into cafes & bars, cloud kitchen, full-service restaurants, and quick service restaurants. Among these, the quick service restaurants segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by consumer demand for fast, affordable, and convenient dining options. Their widespread adoption is further supported by the expansion of delivery services and digital ordering platforms. Major QSR chains are also diversifying their menus to include healthier and plant-based choices, catering to evolving consumer preferences.

- The chained outlets segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States foodservice market is segmented by outlet into chained outlets, independent outlets. Among these, the chained outlets segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their ability to offer personalized experiences, local flavors, and flexibility in menu offerings. Consumers seek unique dining experiences, driving demand for these establishments over larger chains.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US foodservice market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- McDonald's Corporation

- Domino's Pizza Inc.

- Papa John's International, Inc.

- Chipotle Mexican Grill, Inc

- Darden Restaurants, Inc.

- Bloomin' Brands, Inc.

- Brinker International, Inc.

- Doctor's Associates, Inc.

- Restaurant Brands International Inc.

- Inspire Brands, Inc.

- MTY Food Group Inc.

- Others

Recent Developments:

- In December 2022, MTY Food Group Inc., one of its wholly owned subsidiaries, purchased all of the issued and outstanding shares of COP WP Parent Inc. (Wetzel's Pretzels) from CenterOak Partners. Wetzel's Pretzels is an American fast-food restaurant chain with a specialty in pretzels and hot dogs, operating in the United States, Canada, and Central America.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S., regional, and country levels from 2020 to 2035. Spherical Insights has segmented the USA foodservice market based on the below-mentioned segments:

United States Foodservice Market, By Foodservice Type

- Cafes & Bars

- Cloud Kitchen

- Full-Service Restaurants

- Quick Service Restaurants

United States Foodservice Market, By Outlet

- Chained Outlets

- Independent Outlets

Need help to buy this report?