United States Food Thickeners Market Size, Share, and COVID-19 Impact Analysis, By Type (Protein, Starch, and Hydrocolloids), By Source (Animal, Plant, and Microbial), and USA Food Thickeners Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited States Food Thickeners Market Insights Forecasts to 2035

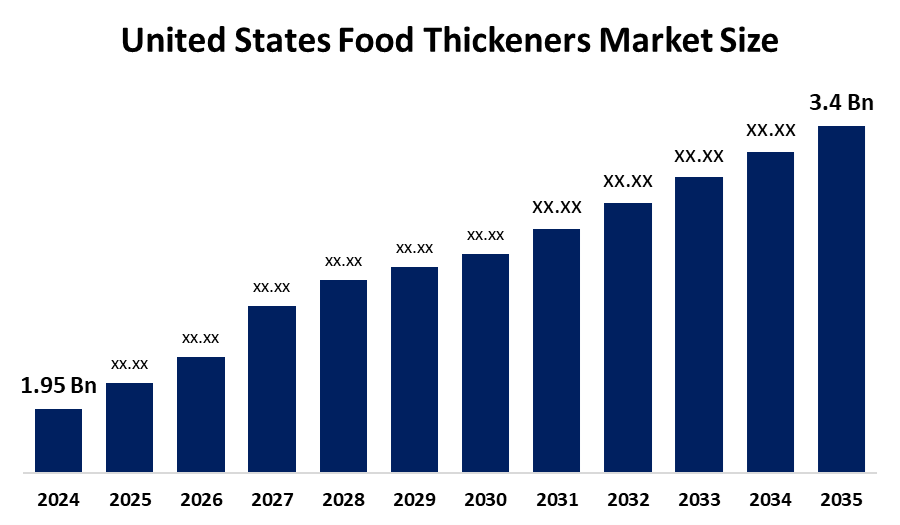

- The U.S. Food Thickeners Market Size Was Estimated at USD 1.95 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.18% from 2025 to 2035

- The USA Food Thickeners Market Size is Expected to Reach USD 3.4 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The U.S. Food Thickeners Market is anticipated to reach USD 3.4 Billion by 2035, Growing at a CAGR of 5.18% from 2025 to 2035. The U.S. food thickeners market is driven by increasing demand for processed and convenience foods, the growing consumer awareness about health and wellness, and innovations in processed foods.

Market Overview

The U.S. food thickeners market focuses on the production, distribution, and sale of food thickeners. food thickeners are the ingredients that increase the viscosity, texture, and stability of food and beverages without changing their properties. Food thickeners are critical for improving the mouthfeel, appearance, and shelf life of food while preserving uniformity during processing and storage. These thickeners not only improve the texture of food but also give nutritional advantages, hence they are widely used in various industries, including dairy, bakery, sauces, and health and wellness sectors. Food thickeners include natural agents like starches, gums, pectin, and gelatin. The fast-paced, urbanized lifestyle in the U.S has boosted demand for processed, packaged, and ready-to-eat foods is one of the major contributors to this market. Food thickeners maintain consistency in texture, stability, and sensory quality, preventing syneresis and allowing producers to provide high-quality, long-lasting convenience meals. The rising consumer preferences for clean label and natural ingredients are key trends for this market. The growing demand for vegan and vegetarian goods creates opportunities for the development of plant-based thickeners, expanding product offerings.

Report Coverage

This research report categorizes the market for the United States food thickeners market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA food thickeners market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA food thickeners market.

United States Food Thickeners Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.95 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.18% |

| 2035 Value Projection: | USD 3.4 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type and By Source |

| Companies covered:: | Cargill Incorporated, Archer Daniels Midland Company (ADM), Ingredion Incorporated, E. I. du Pont de Nemours and Company (DuPont), CP Kelco, Kerry Group plc, Tate & Lyle PLC, Ashland Global Holdings Inc., Darling Ingredients, FDL Limited, and Naturex S.A. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rapid growth of the U.S dairy and bakery sectors drives the demand for food thickeners, improving yogurt creaminess, ice cream stability, and overall product quality and shelf life. The U.S. has a busy lifestyle, which increases the demand for ready-to-eat and convenience foods, which further drives the demand for food thickeners. The growing health and wellness trends are one of the major catalysts for the food thickener market. Additionally, technological advancements and increased demand from the beverages industry play an important role in market growth.

Restraining Factors

The high cost of premium thickeners limits the adoption among price-sensitive consumers, which further limits the market expansion. Additionally, rising references for fresh foods may reduce the demand for thickened convenience products.

Market Segmentation

The United States food thickeners market share is classified into type and source.

- The hydrocolloids segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The USA food thickeners market is segmented by type into protein, starch, and hydrocolloids. Among these, the hydrocolloids segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to hydrocolloids are obtained from natural sources such as plants and seaweed, and consumers are increasingly interested in natural and clean-label components.

- The plant segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The USA food thickeners market is segmented by source into animal, plant, and microbial. Among these, the plant segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segmental growth is attributed to rising preferences for natural and plant-based ingredients. These plant-based thickeners meet the growing trend of better eating and are compatible with the growing popularity of vegan and vegetarian diets.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States food thickeners market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill Incorporated

- Archer Daniels Midland Company (ADM)

- Ingredion Incorporated

- E. I. du Pont de Nemours and Company (DuPont)

- CP Kelco

- Kerry Group plc

- Tate & Lyle PLC

- Ashland Global Holdings Inc.

- Darling Ingredients

- FDL Limited

- Naturex S.A.

Recent Developments

- In February 2024, Ingredion launched NOVATION® Indulge 2940, a non-GMO clean-label thickener enhancing texture in U.S. dairy products.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the U.S. food thickeners market based on the below-mentioned segments:

United States Food Thickeners Market, By Type

- Protein

- Starch

- Hydrocolloids

United States Food Thickeners Market, By Source

- Animal, Plant

- Microbial

Need help to buy this report?