United States Food Processing Machinery Market Size, Share, and COVID-19 Impact Analysis, By Type (Depositor, Extruding Machines, Mixers, Refrigeration, Slicers & Dicers, and Others), By Application (Bakery & Confectionery, Meat, Poultry & Seafood, Dairy, Beverages, and Others), By Mode of Operation (Semiautomatic and Fully Automatic), and United States Food Processing Machinery Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsUnited States Food Processing Machinery Market Insights Forecasts to 2035

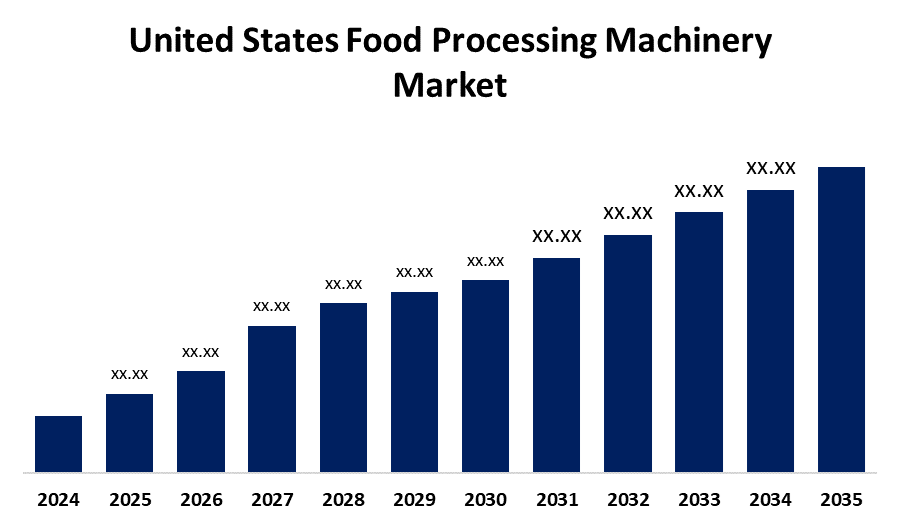

- The USA Food Processing Machinery Market Size is Expected to Grow at a CAGR of around 4.7% from 2025 to 2035.

- The U.S. Food Processing Machinery Market Size is Expected to Hold a Significant Share by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the USA food processing machinery market is expected to hold a significant share by 2035, growing at a CAGR of 4.7% from 2025 to 2035. The U.S. food processing machinery market is growing due to rapid advancements in automation, robotics, and smart technologies, rising demand for ready-to-eat and healthy food, and increased focus on sustainability. Government support through innovation funding and infrastructure development, along with expanding adoption by small and mid-sized manufacturers, further fuels growth and modernization across the industry.

Market Overview

The U.S. food processing machinery market refers to the industry that produces and supplies equipment used to convert raw food ingredients into packaged, ready-to-consume products. This includes machines for mixing, cooking, cutting, packaging, and preserving food. The market is growing fast due to new technologies like automation, robotics, and smart systems that help manufacturers boost efficiency, improve quality, and cut down on costs. With more people looking for quick, ready-to-eat meals and healthier food choices, there's a rising demand for flexible, high-speed machinery. One of the market’s biggest strengths is its ability to keep up with shifting food trends and tech developments, supported by a strong manufacturing base. Its focus on innovation, quality, and efficiency positions it as a leader in meeting diverse consumer and industry needs. It offers strong opportunities through growing investments in sustainable and energy-efficient equipment. Government initiatives, including funding for innovation, infrastructure development, and food safety regulations, are also playing a critical role in encouraging modernization across the sector, boosting overall market growth.

Report Coverage

This research report categorizes the market for the U.S. food processing machinery market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA food processing machinery market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States food processing machinery market.

United States Food Processing Machinery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.7% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Application, By Mode of Operation and COVID-19 Impact Analysis |

| Companies covered:: | Provisur Technologies, Inc., Urschel Laboratories, Inc., Hobart Corporation, Duravant Company, Lyco Manufacturing, Inc., JBT Corporation, Marlen International, Inc., Heat and Control, Inc., CTB, Inc., Intralox, LLC, C. Cretors & Co., Bettcher Industries, Grote Company, Reiser, Mepaco and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The U.S. food processing machinery market is growing due to several key trends, including advanced technologies like automation, robotics, and smart systems are helping manufacturers work more efficiently while improving consistency and product quality. As demand for ready-to-eat meals, snacks, and other convenient foods continues to grow, companies are turning to faster and more reliable machines to keep up. The shift toward healthier and more varied food choices is driving the need for flexible equipment that can handle different ingredients and processes. Government support through funding for innovation, better infrastructure, and food safety programs is giving manufacturers even more reason to upgrade, which further drives the market.

Restraining Factors

Smaller and mid-sized food manufacturers often face steep upfront costs when it comes to upgrading their machinery, making it difficult to stay competitive. Navigating complex food safety and hygiene regulations only adds to the workload. Additionally, there's a growing shortage of skilled workers to run advanced equipment. These obstacles can slow innovation and make it harder for the industry to move forward.

Market Segmentation

The United States food processing machinery market share is classified into type, application, and mode of operation.

- The depositor segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States food processing machinery market is segmented by type into depositor, extruding machines, mixers, refrigeration, slicers & dicers, and others. Among these, the depositor segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the depositor plays an essential role in ensuring precise portioning, reducing waste, and maintaining product consistency. Its versatility across various food products and compatibility with automated systems make it a key component in efficient, large-scale food production.

- The bakery & confectionery segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States food processing machinery market is segmented by application into bakery & confectionery, meat, poultry & seafood, dairy, beverages, and others. Among these, the bakery & confectionery segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to high consumer demand for baked goods, snacks, and sweets. This segment relies heavily on automated machinery for consistent quality, large-scale production, and innovation in product variety. The popularity of ready-to-eat and packaged treats further drives machinery investment and growth.

- The semiautomatic segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States food processing machinery market is segmented by mode of operation into semiautomatic and fully automatic. Among these, the semiautomatic segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because it offers a cost-effective balance between manual labor and full automation. It’s especially popular among small and mid-sized manufacturers who seek efficiency and control without the high costs of fully automated systems. Flexibility, ease of use, and lower maintenance needs also boost its appeal.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States food processing machinery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Provisur Technologies, Inc.

- Urschel Laboratories, Inc.

- Hobart Corporation

- Duravant Company

- Lyco Manufacturing, Inc.

- JBT Corporation

- Marlen International, Inc.

- Heat and Control, Inc.

- CTB, Inc.

- Intralox, LLC

- C. Cretors & Co.

- Bettcher Industries

- Grote Company

- Reiser

- Mepaco

- Others

Recent Developments:

- In May 2025, Urschel Laboratories Becomes Minority Stakeholder in KRONEN GmbH, Expanding Product Offerings and Strengthening Market Presence in the USA, Mexico, and Asia. Urschel Laboratories, a global leader in food cutting technology, is set to expand its product offerings by soon providing KRONEN machinery and systems to its customers, enhancing its portfolio with KRONEN’s advanced solutions for fruit, vegetable, and salad processing.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States food processing machinery market based on the below-mentioned segments:

U.S. Food Processing Machinery Market, By Type

- Depositor

- Extruding Machines

- Mixers

- Refrigeration

- Slicers & Dicers

- Others

U.S. Food Processing Machinery Market, By Application

- Bakery & Confectionery

- Meat

- Poultry & Seafood

- Dairy

- Beverages

- Others

U.S. Food Processing Machinery Market, By Mode of Operation

- Semiautomatic

- Fully Automatic

Need help to buy this report?