United States Food Preservatives Market Size, Share, and COVID-19 Impact Analysis, By Label (Conventional and Clean Label), By Type (Synthetic and Natural), By Function (Anti-Oxidant, Anti-Microbial, and Others), By Application (Beverages, Snacks, Meat & Poultry Products, Dairy Products, Bakery Products, and Others), and U.S. Food Preservatives Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited States Food Preservatives Market Insights Forecasts to 2035

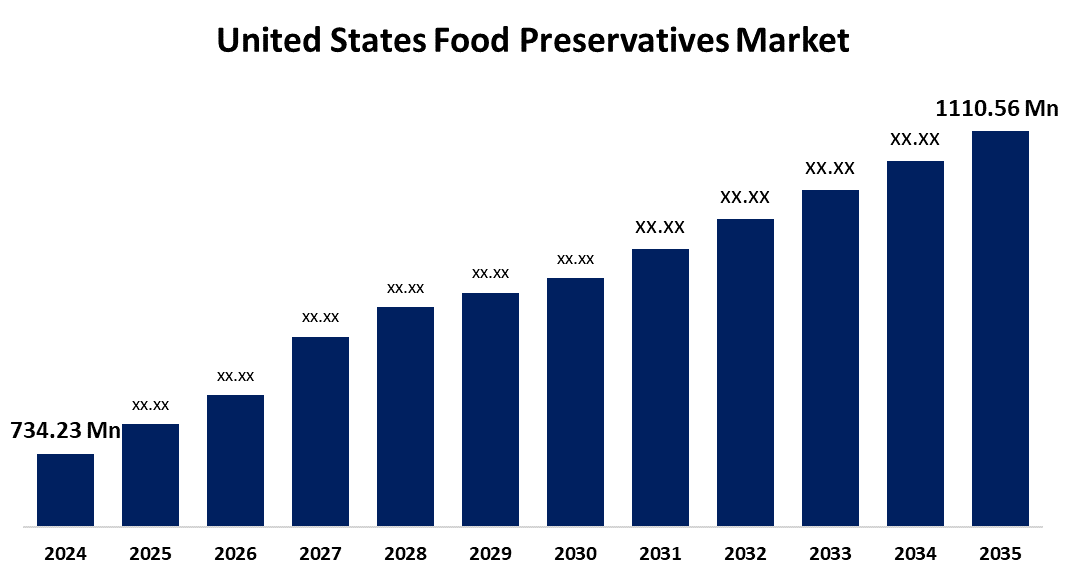

- The USA Food Preservatives Market Size was Estimated at USD 734.23 Million in 2024

- The Market Size is expected to grow at a CAGR of around 3.83% from 2025 to 2035

- The US Food Preservatives Market Size is Expected to reach USD 1110.56 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Food Preservatives Market Size is Anticipated to Reach USD 1110.56 Million by 2035, Growing at a CAGR of 3.83% from 2025 to 2035. The market expansion is attributed to the growing food and beverages industry, rising utilization of packaged food, and innovations in natural preservatives.

Market Overview

The U.S. food preservatives market is a sector that manufactures, distributes, and applies preservatives to extend food product shelf life, maintain freshness, flavor, texture, and nutritional value, and prevent spoilage. Food preservatives are chemicals that are added to food to prevent microorganisms from growing. They are usually esters or protonated acids that can pass through the cell wall of microorganisms. For processed foods to have a longer shelf life and not deteriorate, these ingredients are necessary. Sorbic acid, benzoic acid, propionic acid, and methyl-, ethyl-, and propyl-esters of p-hydroxybenzoic acid (PHB, parabens) are examples of common preservatives. A common preservative used to improve color and prolong the shelf life of processed meats is sodium nitrite. It prevents harmful microbes like Clostridium botulinum from growing. All things considered, food preservatives are essential to food preservation. The growing demand for convenience and ready-to-eat food items by consumers is driving growth in the US food preservatives market. The need for efficient preservation techniques has been highlighted by the food-away-from-home industry, which includes eateries and food delivery services. Customers are learning more about the nutritional value of food, where ingredients come from, and how it is preserved. Customers are more aware of the possible health hazards linked to contaminated or spoiled food owing to social media and easy access to information, which fuels the market for safer and longer-lasting food products.

Report Coverage

This research report categorizes the market for the U.S. food preservatives market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. food preservatives market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. food preservatives market.

United States Food Preservatives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 734.23 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 3.83% |

| 2035 Value Projection: | USD 1110.56 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 135 |

| Segments covered: | By Label, By Type, By Function and COVID-19 Impact Analysis |

| Companies covered:: | Corbion N.V., Galactic S.A., Tate and Lyle, Cargill, Inc., Archer Daniels Midland Company, Kerry Group plc, BASF SE, Koninklijke DSM N.V., Kemin Industries, Inc., Celanese Corporation, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The demand for food preservatives is on the rise due to consumers' preference for healthier food options and concerns about synthetic additives. Health organizations are advocating for nutrition transparency, leading food manufacturers to explore organic and plant-based preservatives. Food safety concerns have also emphasized the importance of effective preservation methods to prolong shelf life and prevent foodborne illnesses. The development of multifunctional preservatives that appeal to health-conscious consumers by enhancing flavor, texture, and nutritional value is a significant opportunity. The demand for processed and packaged foods is also driving the food preservatives market. Consumers are seeking convenient, ready-to-eat meals, and work schedules are increasing, leading to a reliance on processed foods. The global food supply chain's rapid growth necessitates a robust preservation system that includes natural and synthetic preservatives to maintain food quality during transit and prevent spoilage.

Restraining Factors

The USA food preservatives market faces challenges such as strict regulatory compliance by the FDA and USDA, consumer shift towards clean label products, high costs of natural preservatives, health concerns, supply chain challenges, and competition from alternative preservation methods.

Market Segmentation

The United States food preservatives market share is classified into label, type, function, and application.

- The conventional segment held the largest market share of 56.74% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.S. food preservatives market is segmented by label into conventional and clean label. Among these, the conventional segment held the largest market share of 56.74% in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment's growth is attributed to the rising proportion of regulatory approvals, ease of formulation, and cost effectiveness.

- The synthetic segment accounted for the largest market share of 73.86% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.S. food preservatives market is segmented by type into synthetic and natural. Among these, the synthetic segment accounted for the largest market share of 73.86% in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of this sector is owing to cheaper prices, longer shelf life, keeping the food fresh, reliability, consistency, improving food safety, maintaining the quality and taste of food.

- The anti-microbial segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.S. food preservatives market is segmented by function into anti-oxidant, anti-microbial, and others. Among these, the anti-microbial segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental expansion is attributed to the increasing usage of packaged food and beverages, innovations in antimicrobial coating, implementation of FDA guidelines to improve food safety, and the growing food industry.

- The meat & poultry segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.S. food preservatives market is segmented by applications into beverages, snacks, meat & poultry products, dairy products, bakery products, and others. Among these, the meat & poultry segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by the seafood industry, processed meat, and poultry, which increases the shelf life of the meat products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. food preservatives market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Corbion N.V.

- Galactic S.A.

- Tate and Lyle

- Cargill, Inc.

- Archer Daniels Midland Company

- Kerry Group plc

- BASF SE

- Koninklijke DSM N.V.

- Kemin Industries, Inc.

- Celanese Corporation

- Others

Recent Developments:

- In October 2024, Amerex introduced over five new preservatives this year, tailored to meet specific food producer needs. The innovative Biamex FP product, developed by Amerex Research and Development, improves food preservation and enhances the range of natural preservatives in the Biamex range.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the USA food preservatives market based on the below-mentioned segments:

U.S. Food Preservatives Market, By Label

- Conventional

- Clean Label

U.S. Food Preservatives Market, By Type

- Synthetic

- Natural

U.S. Food Preservatives Market, By Function

- Anti-Oxidant

- Anti-Microbial

- Others

U.S. Food Preservatives Market, By Application

- Beverages

- Snacks

- Meat & Poultry Products

- Dairy Products

- Bakery Products

- Others

Need help to buy this report?