United States Fluoroelastomer Market Size, Share, and COVID-19 Impact Analysis, By Type (Fluorocarbon, Fluorosilicone, and Perfluoroelastomer), By End-use (Automotive, Aerospace, Chemicals, Oil & Gas, Energy & Power, and Others), and United States Fluoroelastomer Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Fluoroelastomer Market Insights Forecasts to 2035

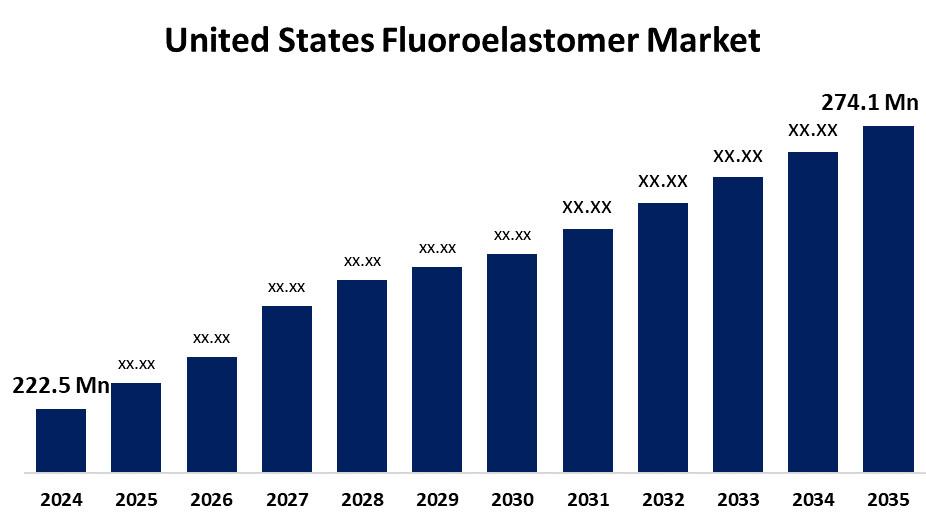

- The US Fluoroelastomer Market Size Was Estimated at USD 222.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 1.91% from 2025 to 2035

- The US Fluoroelastomer Market Size is Expected to Reach USD 274.1 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Fluoroelastomer Market Size is Anticipated to reach USD 274.1 Million by 2035, Growing at a CAGR of 1.91% from 2025 to 2035. The expansion of the United States fluoroelastomer market is propelled by increased use in chemical processing due to its outstanding heat and chemical resistance, as well as growing demand for high-performance sealing solutions from the automotive and aerospace industries.

Market Overview

A fluoroelastomer is a synthetic rubber material with exceptional thermal resistance, chemical resistance, and lubricant resistance. These properties enable fluoroelastomers to be able to be utilized in mature markets that demand durability, such as oil and gas, chemical processing, automotive, and aerospace markets. Several key market drivers are affecting the fluoroelastomers market in the US today. Because of their exceptional chemical resistance and thermal stability, fluoroelastomer materials have seen expansion in the chemical processing, automotive, and aerospace industries. These industries are trying to replace existing production materials with stronger and more "smart" materials that have similar or sustainable end-of-life consequences. The persistent heel-dragging on primary pollution regulations, as well as the evolving compliance infrastructure in the US, is impelling industries to adopt materials that enable regulatory compliance without damaging performance. I think there is still considerable room in this market area, specifically concerning bio-fluoroelastomers and recycling of fluoroelastomer waste and companies that start to dabble with sustainable projects, research & development, and developing materials with fully biofluorinated or recycled possibilities and capabilities will realize a competitive advantage over time, and have a greener offering for end consumers or companies, who seek to satisfy environmental-related requests from stakeholders. In addition to this, any revival of the US electric vehicle market offers considerable opportunities for the development of alternative applications for fluoroelastomers in battery sealing and insulation. In the manufacture of fluoroelastomers, across the US, manufacturers focus on innovation and technological improvements. New formulations with enhanced properties for specific applications can emerge as manufacturers seek to improve processing and decrease production costs.

The US government invests heavily in research and development projects to advance fluoroelastomer technology. This comprises financing for private businesses, academic organisations, and research centres to create novel fluoroelastomer materials and uses.

Report Coverage

This research report categorizes the market for the United States fluoroelastomer market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States fluoroelastomer market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States fluoroelastomer market.

United States Fluoroelastomer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 222.5 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 1.91% |

| 2035 Value Projection: | USD 274.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By End-use, and COVID-19 Impact Analysis. |

| Companies covered:: | The Chemours Company, Minnesota Rubber and Plastics, Eagle Elastomer, Dupont, Parker Hannifin, Kraton, Honeywell International, Inc and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States fluoroelastomer market is fueled by the increasing demand for more fuel-efficient vehicles, several automakers are altering their vehicle designs and concentrating on lightweighting through material substitution. As a result, automakers have reduced the engine, powertrain, and engine compartments. In addition, an elaborate air management system is incorporated to increase fuel efficiency.

Restraining Factors

The United States fluoroelastomer market faces obstacles as the earth and human well-being are in danger due to the environment's growing concentration of greenhouse gases, rising water levels, and shifting temperatures. Biodegradable materials are becoming more popular among manufacturers and consumers as knowledge of sustainability and recyclability grows.

Market Segmentation

The United States fluoroelastomer market share is classified into type and end-use.

- The fluorocarbon segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States fluoroelastomer market is segmented by type into fluorocarbon, fluorosilicone, and perfluoroelastomer. Among these, the fluorocarbon segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. Their remarkable resistance to high temperatures (up to 250°C), oils, fuels, solvents, and a variety of chemicals propels the market, making them perfect for usage in automotive, aerospace, and industrial applications. They are the most widely used kind of fluoroelastomers because of their affordable price and adaptable performance traits. The automobile industry's requirement for high-performance sealing solutions in engines, fuel systems, and gearboxes is the main factor driving the demand for fluorocarbon elastomers.

- The automotive segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-use, the United States fluoroelastomer market is segmented into automotive, aerospace, chemicals, oil & gas, energy & power, and others. Among these, the automotive segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to the growth of the automotive sector, which widely uses their excellent thermal, chemical, and fuel resistance. They are often used for seals, gaskets, hoses, and O-rings in applications such as engines, fuel systems, and gearboxes where performance and durability over time and in harsh environments are critical. Automakers are being pressured to accept newer technologies like fluoroelastomers to achieve longevity of components and maintain system integrity with the application of electric vehicles, hybrid vehicles, and even tougher emissions requirements. Additionally, the need for high-performance and lightweight materials in next-gen vehicles has increased demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States fluoroelastomer market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Chemours Company

- Minnesota Rubber and Plastics

- Eagle Elastomer

- Dupont

- Parker Hannifin

- Kraton

- Honeywell International, Inc

- Others

Recent Development

- In April 2024, by doing away with fluorinated polymerisation aids, The Chemours Company developed a sustainable manufacturing method for its Viton fluoroelastomers. Using a non-fluorinated surfactant, this industry-first technique preserves the performance of all Viton products, including APA grades, for important sectors like electronics, transportation, industrial, and oil and gas.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States fluoroelastomer market based on the following segments:

United States Fluoroelastomer Market, By Type

- Fluorocarbon

- Fluorosilicone

- Perfluoroelastomer

United States Fluoroelastomer Market, By End-use

- Automotive

- Aerospace

- Chemicals

- Oil & Gas

- Energy & Power

- Others

Need help to buy this report?