United States Flexfuel Cars Market Size, Share, and COVID-19 Impact Analysis, By Fuel Type (Gasoline, Diesel), By Vehicle Type (Passenger Cars, Commercial Vehicles), and United States Flexfuel Cars Market Insights Forecasts to 2023 to 2033.

Industry: Automotive & TransportationUnited States Flexfuel Cars Market Insights Forecasts to 2033

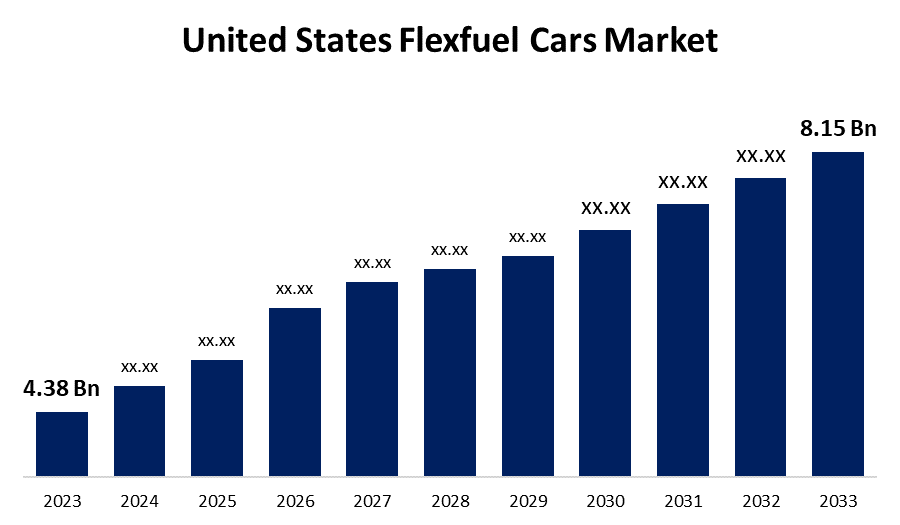

- The United States Flexfuel Cars Market Size was valued at USD 4.38 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.4% from 2023 to 2033.

- The United States Flexfuel Cars Market Size is Expected to Reach USD 8.15 Billion by 2033.

Get more details on this report -

The United States Flexfuel Cars Market Size is Expected to Reach USD 8.15 Billion by 2033, at a CAGR of 6.4% during the forecast period 2023 to 2033.

Market Overview

A flexible-fuel car is a vehicle powered by an internal combustion engine that can run on a variety of fuels, most commonly gasoline and ethanol. Despite the fact that a flex-fuel engine can be designed to run on pure ethanol, flex fuel cars in the United States are optimized to run on E85, a gasoline-ethanol blend containing 51 to 83 percent ethanol, according to the United States Department of Energy. To ensure that the car can start in cold weather, the actual composition of E85 varies depending on region and season. Leading automakers, including General Motors, Toyota Motor Corporation, Ford Motor Company, and others, have increased their efforts to develop flex-fuel engines for passenger and commercial vehicles, providing a significant growth opportunity for the United States flex-fuel cars market.

Report Coverage

This research report categorizes the market for United States flexfuel cars market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States flexfuel cars market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States flexfuel cars market.

United States Flexfuel Cars Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.38 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.4% |

| 2033 Value Projection: | USD 8.15 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | COVID-19 Impact Analysis, By Fuel Type, By Vehicle Type, and United States Flexfuel Cars Market Insights Forecasts to 2023 to 2033. |

| Companies covered:: | Ford Motor Company, General Motors, Toyota Motor Corporation, Honda Motor Co, Nissan Motor Co, Volkswagen AG, BMW Group, Daimler AG, Hyundai Motor Company, Fiat Chrysler Automobiles, Mitsubishi Motors, Mazda Motor Corporation, Subaru Corporation, Isuzu Motors Ltd, Suzuki Motor Corporation, Renault SA, PSA Group, Tata Motors, Changan Automobile, BAIC Motor Corporation, and Others Key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Utilization of Bio-Based Ethanol Currently, the ethanol used in flexfuel vehicles is primarily made from corn. There is, however, a trend toward using bio-based ethanol made from agricultural and forestry waste and residues. Several pilot projects and commercial plants to produce cellulosic ethanol from biomass feedstock are coming online in the Midwest of the United States. The use of bio-based ethanol can help to reduce the carbon footprint of flexfuel vehicles even further. Developing alongside hybrid/electric vehicles Major automakers are accelerating their transition to electric mobility. However, due to the benefits of emission reduction and energy security, flex-fuel technology is expected to co-evolve rather than be replaced by electrification. To meet sustainability goals, manufacturers are increasingly taking a portfolio approach, offering both plug-in hybrids/EVs and flex-fuel models across vehicle segments.

Restraining Factors

In flexfuel car models, E85 consumption can be 25-30% higher than gasoline consumption per mile. Engine performance and acceleration are also lower when using ethanol blends than when using only gasoline. Increased cars cost the components and modifications required to make flex-fuel capability standard in vehicle models add to automakers' costs. Some of these costs are typically passed on to consumers in the form of higher sticker prices for flex-fuel vehicles when compared to gasoline-only equivalents. The slightly higher initial vehicle cost may discourage wider adoption among price-conscious buyers.

Market Segment

- In 2023, the gasoline segment accounted for the largest revenue share over the forecast period.

Based on the fuel type, the United States flexfuel cars market is segmented into gasoline, diesel. Among these, the gasoline segment has the largest revenue share over the forecast period. Major automakers are also investing in the development of ethanol-blended gasoline engines. In United States, various grades of ethanol-blended gasoline, such as E85, E27, E20, and E10, are in use.

- In 2022, the passenger cars segment accounted for the largest revenue share over the forecast period.

Based on the vehicle type, the United States flexfuel cars market is segmented into passenger cars, commercial cars. Among these, the passenger cars have the largest revenue share over the forecast period. This market segment is being driven by rising demand for passenger cars and lower-emission technologies. Furthermore, passenger cars must follow stricter safety regulations than commercial cars. These factors are driving the growth of the passenger cars segment during the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States flexfuel cars market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ford Motor Company

- General Motors

- Toyota Motor Corporation

- Honda Motor Co

- Nissan Motor Co

- Volkswagen AG

- BMW Group

- Daimler AG

- Hyundai Motor Company

- Fiat Chrysler Automobiles

- Mitsubishi Motors

- Mazda Motor Corporation

- Subaru Corporation

- Isuzu Motors Ltd

- Suzuki Motor Corporation

- Renault SA

- PSA Group

- Tata Motors

- Changan Automobile

- BAIC Motor Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States flexfuel cars market based on the below-mentioned segments:

United States Flexfuel Cars Market, By Fuel Type

- Gasoline

- Diesel

United States Flexfuel Cars Market, By Vehicle Type

- Passenger Cars

- Commercial vehicle

Need help to buy this report?