United States Fitness Rings Market Size, Share, and COVID-19 Impact Analysis, By Type (Smart Fitness Rings, Traditional Fitness Rings, and Stylish Fitness Rings), By Functionality (Heart Rate Monitoring, Sleep Tracking, Activity Tracking, and Calorie), and United States Fitness Rings Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited States Fitness Rings Market Insights Forecasts to 2035

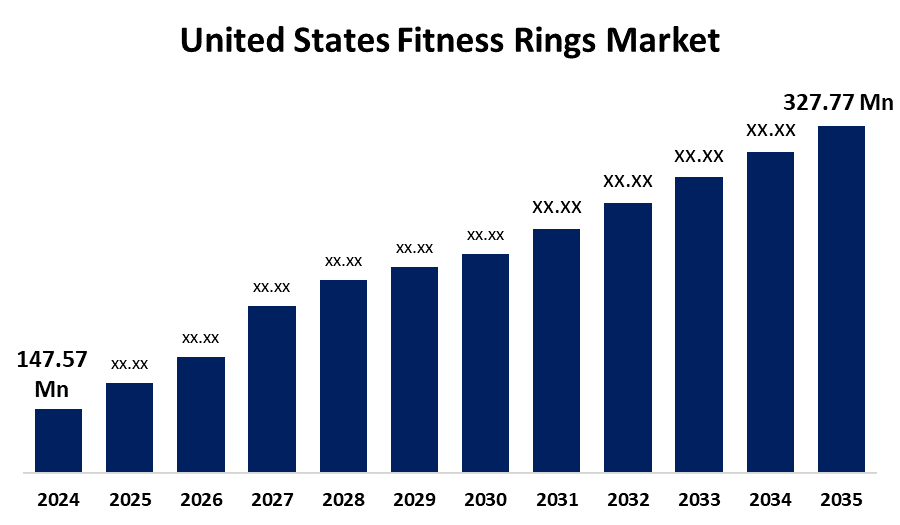

- The U.S. Fitness Rings Market Size was estimated at USD 147.57 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.52% from 2025 to 2035a

- The USA Fitness Rings Market Size is Expected to Reach USD 327.77 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The US Fitness Rings Market Size is anticipated to reach USD 327.77 Million by 2035, growing at a CAGR of 7.52% from 2025 to 2035. The U.S. fitness rings market is growing rapidly, driven by demand for discreet, advanced health tracking solutions. Innovations in biometric sensors and rising wellness awareness fuel strong consumer adoption across demographics.

Market Overview

The United States market for fitness rings, also known as the smart ring market, refers to small, wearable devices that are meant to track several health and fitness parameters. These rings provide features like monitoring heart rate, sleep, activity, and body temperature, acting as subtle substitutes for conventional fitness trackers and smartwatches. Moreover, the U.S. fitness rings market is spurred by subtle health monitoring preferences from professionals, increased interest in biohacking for optimal performance, integration with mental well-being platforms, increased adoption by athletes for ongoing recovery data, and company wellness programs that encourage wearable adoption to improve productivity, alleviate stress, and enable long-term employee health. Furthermore, technologies such as sophisticated biometric sensors, artificial intelligence-based health analytics, and frictionless app integration by major players such as Oura Health, Samsung, and Ultrahuman are driving the U.S. fitness rings market, improving accuracy, comfort, and multi-device ecosystem compatibility for wider consumer adoption.

Report Coverage

This research report categorizes the market for the U.S. fitness rings market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States fitness rings market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA fitness rings market.

United States Fitness Rings Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 147.57 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 7.52% |

| 2035 Value Projection: | USD 327.77 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 265 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | By Type and By Functionality |

| Companies covered:: | Oura Health Oy, Samsung Electronics, Ultrahuman, Fitbit Inc. (Google Inc.), Circular Ring, RingConn, Sleepon, Amazfit, Motiv Ring, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The U.S. fitness rings market drivers are rising insurance partnerships that reward the use of wearables, rising demand from age-bracketed populations looking for non-invasive vital sign monitoring, and compatibility with telehealth platforms for remote diagnosis. Rising interest in preventive care and ongoing vital sign monitoring during exercise or sleep also drives demand. Lastly, clean design fashions and the rise of smartphone independence make fitness rings attractive to tech-inclined, fashion-oriented consumers that want convenience without sacrificing anything.

Restraining Factors

Restraints are high product prices, low battery life, privacy issues related to sensitive health information, absence of common metrics across brands, and lower awareness than conventional wearables such as fitness bands and smartwatches.

Market Segmentation

The United States fitness rings market share is classified into type and functionality.

- The smart fitness rings segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States fitness rings market is segmented by type into smart fitness rings, traditional fitness rings, and stylish fitness rings. Among these, the smart fitness rings segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their multifunctional capabilities, including health monitoring, activity tracking, and app integration. Their popularity is driven by growing health awareness, demand for discreet wearables, and advancements in biometric sensors that offer accurate, real-time insights for users.

- The heart rate monitoring segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States fitness rings market is segmented by functionality into heart rate monitoring, sleep tracking, activity tracking, and calorie tracking. Among these, the heart rate monitoring segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This prominence is driven by the increasing consumer focus on cardiovascular health and the demand for real-time, continuous heart rate data to optimise workouts and monitor overall well-being. Fitness rings equipped with advanced sensors provide users with accurate heart rate measurements, enabling them to tailor their fitness routines and track progress effectively.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US fitness rings market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Oura Health Oy

- Samsung Electronics

- Ultrahuman

- Fitbit Inc. (Google Inc.)

- Circular Ring

- RingConn

- Sleepon

- Amazfit

- Motiv Ring

- Others

Recent Developments:

- In July 2024, Samsung introduced its new innovation: an AI-based smart ring. This smart ring comes with sensors that track vital health parameters in real-time. These parameters include sleep patterns, heart rate variability, and activity. The data thus gathered is analysed using Samsung's own AI and algorithms, leading to a new feature: the Energy Score. This score provides users with personalised information about their overall well-being.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the USA fitness rings market based on the below-mentioned segments:

United States Fitness Rings Market, By Type

- Smart Fitness Rings

- Traditional Fitness Rings

- Stylish Fitness Rings

United States Fitness Rings Market, By Functionality

- Heart Rate Monitoring

- Sleep Tracking

- Activity Tracking

- Calorie

Need help to buy this report?