United States Femtech Market Size, Share, and COVID-19 Impact Analysis, By Type (Devices, Software, Services, and Consumer Products), By Application (Pregnancy and Nursing Care, Reproductive Health & Contraception, Menstrual Health, General Health, Pelvic & Uterine Health, Sexual Health, Womens Wellness, Menopause Care, and Longevity & Mental Health), and United States Femtech Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Femtech Market Size Insights Forecasts to 2035

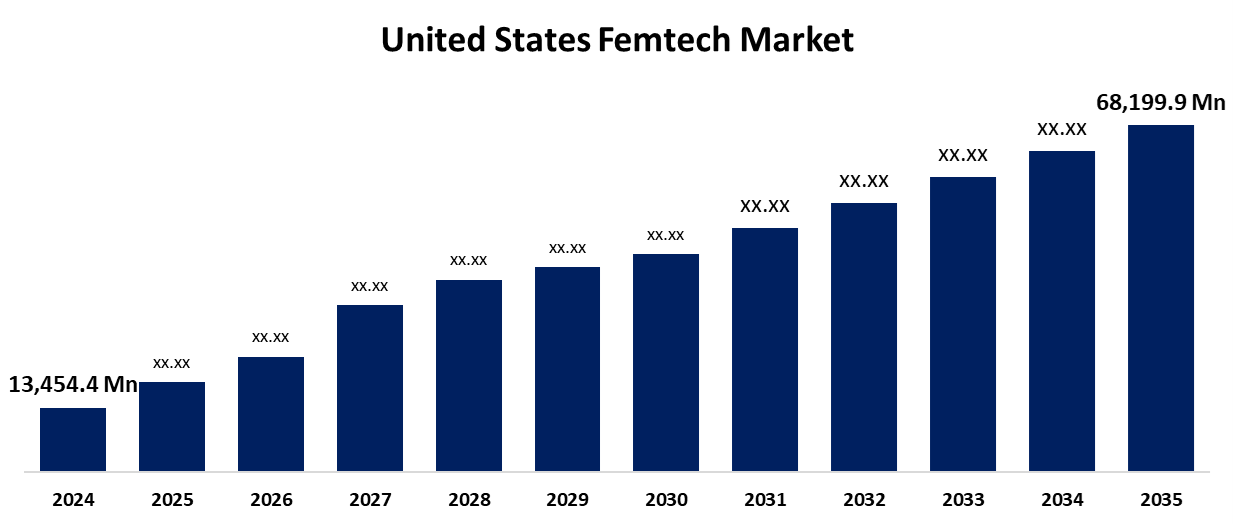

- The US Femtech Market Size Was Estimated at USD 13,454.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 15.90% from 2025 to 2035

- The US Femtech Market Size is Expected to Reach USD 68,199.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Femtech Market Size is anticipated to reach USD 68,199.9 Million by 2035, growing at a CAGR of 15.90% from 2025 to 2035. The expansion of the United States femtech market is propelled by growing use of digital health solutions, as well as the creation of more individualised, effective, and easily available femtech solutions, which are made possible by cutting-edge technology like artificial intelligence and virtual assistants.

Market Overview

Femtech is a quickly expanding industry that includes digital tools, technologies, and services aimed at meeting the health and wellness needs of women. A significant amount of money and investments have been flowing into the femtech space, which is expected to accelerate further growth and innovation in the industry. Projects that enhance women's health and fitness in areas like menopause, menstruation, mental health, and other under-invested industries are receiving more support from investors than in other sectors. It is anticipated that this will accelerate market growth. For example, Maven Clinic, a women's health teletherapy platform, secured USD 90 million in November 2022 in Series E funding. General Catalyst led this investment and was joined by Sequoia Capital, Intermountain Ventures, and CVS Health Ventures. Maven's total fundraising of almost USD 300 million shows how confident investors are in the FemTech sector, and it is anticipated that current and upcoming funding will spur industry expansion. Beyond investment and funding, the market is expected to grow due to increased R&D funding and, importantly, a raised awareness of women's health issues. The market will be expected to grow considerably because of these factors.

Report Coverage

This research report categorizes the market for the United States femtech market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States femtech market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States femtech market.

United States Femtech Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 13,454.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 15.90% |

| 2035 Value Projection: | USD 68,199.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Allara, iSono Health, Bloomlife, Athena Feminine Technologies, Apple Inc, Alphabet Inc Class A, Fitbit, Kindbody, Willow Innovations, Inc, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growth of the United States femtech market is boosted by major companies integrating technologies such as artificial intelligence, machine learning into products, applications designed specifically for women, and women's health solutions and products are increasing in popularity. Another significant factor contributing to the increasing market demand for these products is the growing level of awareness of their benefits in the US. The increasing demand has prompted major players to position research and development (R&D) projects to build and introduce new digital products and platforms. In addition, there is increasing focus on R&D funding and investment by governments and other stakeholders for the development of technology-enabled women's health products, including wearables and mobile apps.

Restraining Factors

The United States femtech market faces obstacles like the limited access to technologically advanced products in the US, such as availability, expensive devices, products, and expensive software, and, at the same time, low awareness among women compounds the situation. The rate of uptake of these products in the market is constrained further by socioeconomic and cultural factors, specifically in terms of awareness of menstruation, fertility, and other women's health issues is more egregious in rural parts of emerging markets.

Market Segmentation

The United States femtech market share is classified into type and application.

- The devices segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States femtech market is segmented by type into devices, software, services, and consumer products. Among these, the devices segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the increasing focus on women's health and wellness. Approximately 70% growth is coming from consumer-led models and value-based care. As consumers are putting more emphasis on wellness, self-care, and digital health, the importance of wearable technology is growing. Female users are demanding longer battery life, wireless connectivity, and seamless smartphone compatibility in their wearable devices.

- The pregnancy and nursing care segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States femtech market is segmented into pregnancy and nursing care, reproductive health & contraception, menstrual health, general health, pelvic & uterine health, sexual Health, women's wellness, menopause care, and longevity & mental health. Among these, the pregnancy and nursing care segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by industry in pregnancy and nursing care is going through tremendous growth and can be considered a critical area of women's health right now, for a number of reasons. Contributing factors to growth are advancements in technology, increased awareness, cultural changes, Direct-to-Consumer (DTC) models, and a sizable market opportunity. Companies are developing innovative solutions for health monitoring and support to help women during the pregnancy and postpartum stages.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States femtech market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Allara

- iSono Health

- Bloomlife

- Athena Feminine Technologies

- Apple Inc

- Alphabet Inc Class A

- Fitbit

- Kindbody

- Willow Innovations, Inc

- Others

Recent Development

- In April 2025, U.S.-based sexual wellness company Dame Products acquired Chakrubs. These acquisitions broaden Dame's product range and reinforce its commitment to de-stigmatizing female sexuality through innovative pleasure products.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States femtech market based on the following segments:

United States Femtech Market, By Type

- Devices

- Software

- Services

- Consumer Products

United States Femtech Market, By Application

- Pregnancy and Nursing Care

- Reproductive Health & Contraception

- Menstrual Health, General Health

- Pelvic & Uterine Health

- Sexual Health

- Womens Wellness

- Menopause Care

- Longevity & Mental Health

Need help to buy this report?