United States Feed Additives Market Size, Share, and COVID-19 Impact Analysis, By Additive (Antioxidants, Minerals, Prebiotics, Acidifiers, Amino Acids, Binders, and Enzymes), By Animal (Ruminants, Aquaculture, Swine, and Poultry), and US Feed Additives Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUSA Feed Additives Market Insights Forecasts to 2035

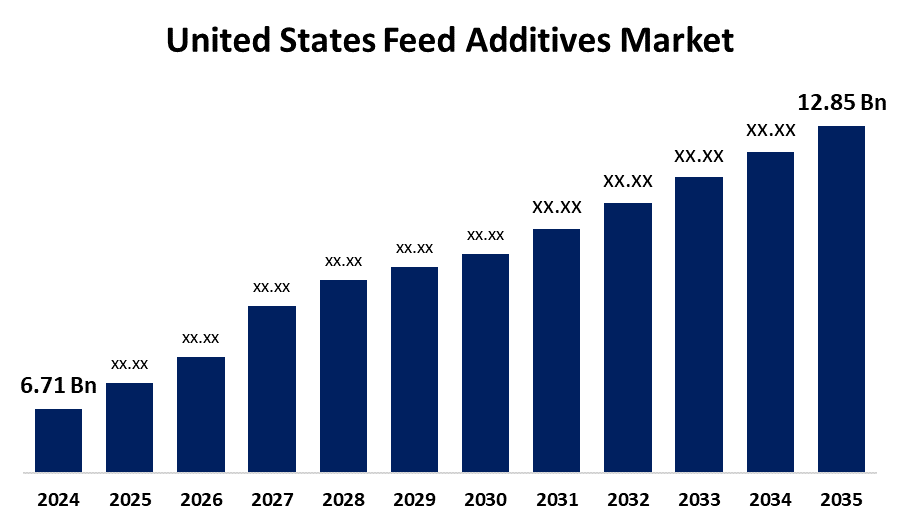

- The US Feed Additives Market Size was Estimated at USD 6.71 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.08% from 2025 to 2035

- The USA Feed Additives Market Size is Expected to reach USD 12.85 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Feed Additives Market Size is Anticipated to Reach USD 12.85 Billion by 2035, Growing at a CAGR of 6.08% from 2025 to 2035. The market growth is attributed to the increasing demand for feed additives, animal well-being, rising prevalence of disease, and acceleration in government initiatives.

Market Overview

Nutritional and functional additives for animal feed that improve growth, digestion, immunity, and general livestock health, maximize feed efficiency, and promote sustainable farming methods are the main focus of the US feed additives market. Products known as feed additives are used in animal nutrition to enhance the quality of feed, food, performance, and health. They consist of substances, molecules, or living things that support growth, health, and the absorption of nutrients. These additives have an impact on physiological functions such as reproduction, stress tolerance, and immune function. Prebiotics, probiotics, feeding attractants, immunostimulants, acidifiers, and essential oils are a few examples. These additives can improve feed quality, encourage growth, break down anti-nutritive factors, absorb toxins, alleviate nutrient deficiencies, affect animal performance, and cut down on energy-wasting processes. Feed additives are crucial to contemporary animal husbandry techniques because they enhance immune system performance, nutrient absorption, digestion, minimize disease risk, maximize feed utilization, and boost productivity in the production of meat, milk, or eggs. They also help animals and fight environmental stressors. The United States' expanding middle class, rising disposable incomes, and rising consumption of animal-based products are driving the market. The market is expanding as a result of government initiatives to encourage the use of feed additives and enhance animal health, as well as farmers' and producers' increased awareness of the productivity-boosting effects of animal nutrition.

Report Coverage

This research report categorizes the market for the US feed additives market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US feed additives market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US feed additives market.

United States Feed Additives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.71 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.08% |

| 2035 Value Projection: | USD 12.85 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 150 |

| Tables, Charts & Figures: | 136 |

| Segments covered: | By Additive, By Animal, and COVID-19 Impact Analysis. |

| Companies covered:: | A.D.M., Kemin Industries, Inc., DuPont, Cargill Inc., Adisseo, DSM Nutritional Products AG, Land O’ Lakes, Archer-Daniels-Midland Co., SHV (Nutreco NV), and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Innovations in the feed additives supplements:

The production and use of feed supplements is changing significantly in the livestock industry, with an emphasis on enhancing the performance, health, and nutrition of animals. Feed additives that promote gut health and improve immune function and performance have been developed as a result of developments in probiotics and prebiotics. Through enhancing the stability and bioavailability of sensitive additives and shielding them from deterioration during processing and storage, the microencapsulation technique guarantees improved nutrient delivery to the animal's digestive system. This results in increased market expansion and more effective feed utilization.

Rising need for functional foods:

For an animal's immunity, growth, and performance, nutrition is essential. Feed companies have created functional supplements and additive-fortified foods to enhance disease resistance, gut health, and animal immunity. Plant extracts, probiotics, prebiotics, enzymes, antioxidants, mycotoxin binders, and photobiotics are important additives. These additives enhance the physiological quality of animals and raise their market value when added to feed formulations and pellets. Many farms are adding functional additives to animal feed as the livestock industry in developing nations becomes more commercialized, which is driving market expansion.

Restraining Factors

The US feed additives market faces regulatory challenges, high production costs, consumer preferences, supply chain disruptions, and environmental concerns, limiting market expansion.

Market Segmentation

The USA feed additives market share is classified into additive and animal.

- The amino acids segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US feed additives market is segmented by additive into antioxidants, minerals, prebiotics, acidifiers, amino acids, binders, and enzymes. Among these, the amino acids segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the increasing demand for the poultry and ruminant sectors, lysine and methionine are the most significant amino acids due to their high efficiency in gut health and meat production. The increasing demand for meat and meat products, along with growing awareness about amino acids.

- The poultry segment accounted for the largest market share of 39.45% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US feed additives market is segmented by animal into ruminants, aquaculture, swine, and poultry. Among these, the poultry segment accounted for the largest market share of 39.45% in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by extensive commercial farming operations, particularly in broiler production, increasing adoption of feed additives. The high consumption of poultry meat, particularly broilers, further reinforces this dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US feed additives market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- A.D.M.

- Kemin Industries, Inc.

- DuPont

- Cargill Inc.

- Adisseo

- DSM Nutritional Products AG

- Land O’ Lakes

- Archer-Daniels-Midland Co.

- SHV (Nutreco NV)

- Others

Recent Developments:

- In January 2025, Axitan Limited, a biotech company, partnered with QualiTech, a global manufacturer of animal and plant nutrition products, to develop and distribute novel endolysin products for the replacement of antibiotics in animal feed.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US feed additives market based on the below-mentioned segments:

US Feed Additives Market, By Additive

- Antioxidants

- Minerals

- Prebiotics

- Acidifiers

- Amino Acids

- Binders

- Enzymes

US Feed Additives Market, By Animal

- Ruminants

- Aquaculture

- Swine

- Poultry

Need help to buy this report?