United States Fast Food and Quick Services Restaurants Market Size, Share, and COVID-19 Impact Analysis, By Product (Sandwich, Mexican, Hamburgers, Pizza, and Others), By Service Type (Offline and Online), and US Fast Food and Quick Services Restaurants Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUSA Fast Food and Quick Services Restaurants Market Insights Forecasts to 2035

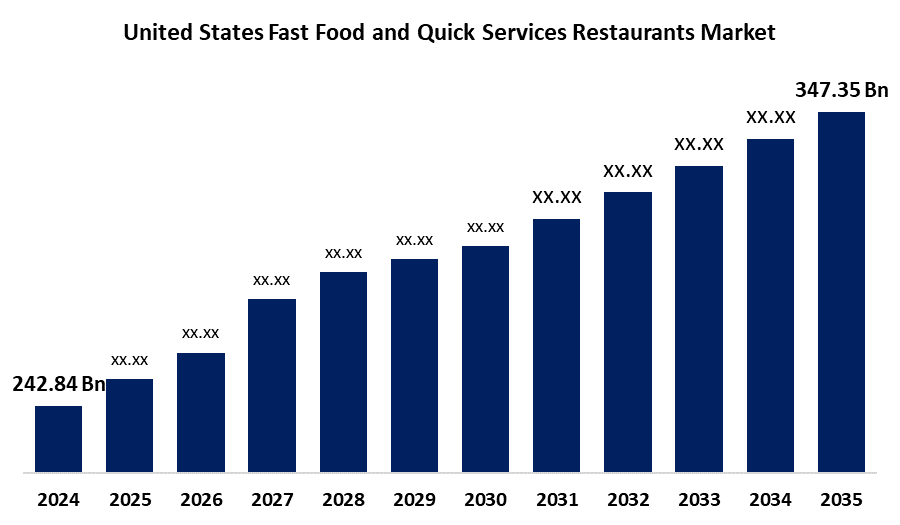

- The US Fast Food and Quick Services Restaurants Market Size was Estimated at USD 242.84 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.31% from 2025 to 2035

- The USA Fast Food and Quick Services Restaurants Market Size is Expected to reach USD 347.35 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The US Fast Food and Quick Services Restaurants Market Size is anticipated to reach USD 347.35 Billion by 2035, growing at a CAGR of 3.31% from 2025 to 2035. The market is fueled by a large urban population, a variety of menus, quick service, incentive pricing, creative food formats, loyalty programs, and improved customer experiences.

Market Overview

The US fast food and quick service restaurants (QSR) market focuses on quick, convenient, affordable, and standardized meals, including chains, drive-thru outlets, and self-service kiosks, catering to consumers seeking quick, ready-to-eat meals. The demand for quick-service restaurants (QSRs) and fast food is rising as a result of urbanization. Convenience food consumption has increased in cities due to longer workdays and quicker cooking times. Quick, inexpensive, and easily consumable meals are provided by QSRs. Cities are growing quickly, especially in emerging nations, and this is fueling the rise of QSR as people want quick meals without compromising flavor. As the world grows more urbanized, there is a growing need for ready-to-eat (RTE) food. QSRs are becoming gradually more essential in urban settings since they are convenient for picking up meals between work shifts or commutes, which fits with their fast-paced, efficient culture and leading to market growth.

Report Coverage

This research report categorizes the market for the US fast food and quick service restaurants market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US fast food and quick services restaurants market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US fast food and quick services restaurants market.

United States Fast Food and Quick Services Restaurants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 242.84 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 3.31% |

| 2035 Value Projection: | USD 347.35 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 269 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | By Product and By Service Type |

| Companies covered:: | Domino’s Pizza, Inc., McDonald’s, Subway IP LLC, KFC Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing number of people in the workforce and shifting consumer habits, which call for quick, easily accessible meals, are the primary factors of the market growth. In accordance with these demands, the food industry has produced a wide range of fast-food items. The sector is being impacted by consumers who are becoming more health-conscious, as well as those who are choosing healthier foods. Cafe culture is becoming more and more popular as eateries embrace healthier options like organic and plant-based menus. Touchscreen kiosks, smartphone apps, and digital order systems are all examples of how the restaurant industry is digitizing and improving customer convenience. The industry is expanding due to the increased desire for healthier foods and creative flavors. Growing consumer spending, more delivery options, and more discretionary income are driving the market. Additional factors that contribute to customer retention include consistent quality, effective marketing, and brand loyalty.

Restraining Factors

The US fast food and quick service restaurant (QSR) market faces challenges such as health concerns, regulatory challenges, rising operational costs, market saturation, and changing consumer preferences.

Market Segmentation

The USA Fast Food and Quick Services Restaurants Market share is classified into product and service type.

- The hamburgers segment held the largest market share of 38.96% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US fast food and quick services restaurants market is segmented by product into sandwich, Mexican, hamburgers, pizza, and others. Among these, the hamburgers segment held the largest market share of 38.96% in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by major chains like McDonald's, Burger King, and Wendy's, offering a variety of classic, premium, and plant-based burgers.

- The offline segment accounted for a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US fast food and quick services restaurants market is segmented by service type into offline and online. Among these, the offline segment accounted for a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. The offline component of the US fast food and QSR market, which includes convenience stores, dine-ins, and takeaway counters, continues to dominate because of convenience, social dining experiences, and impulsive purchases.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US fast food and quick services restaurants market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Domino's Pizza, Inc.

- McDonald’s

- Subway IP LLC

- KFC Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US fast food and quick services restaurants market based on the below-mentioned segments:

US Fast Food and Quick Services Restaurants Market, By Product

- Sandwich

- Mexican

- Hamburgers

- Pizza

- Others

US Fast Food and Quick Services Restaurants Market, By Service Type

- Offline

- Online

Need help to buy this report?