United States Factory Automation and Industrial Controls Market Size, Share, and COVID-19 Impact Analysis, By Product (Programmable Logic Controller (PLC), Distributed Control System (DCS), Supervisory Control and Data Acquisition System (SCADA), Human Machine Interface (HMI), Process Safety Systems, Sensors & Transmitters, Industrial Robotics, Others), By End-user Industry (Automotive, Chemical & Petrochemical, Semiconductor & Electronics, Oil & Gas, Power Generation, Water & Wastewater, Others), and Others and United States Factory Automation and Industrial Controls Market Insights Forecasts to 2033

Industry: Information & TechnologyUnited States Factory Automation and Industrial Controls Market Insights Forecasts to 2033

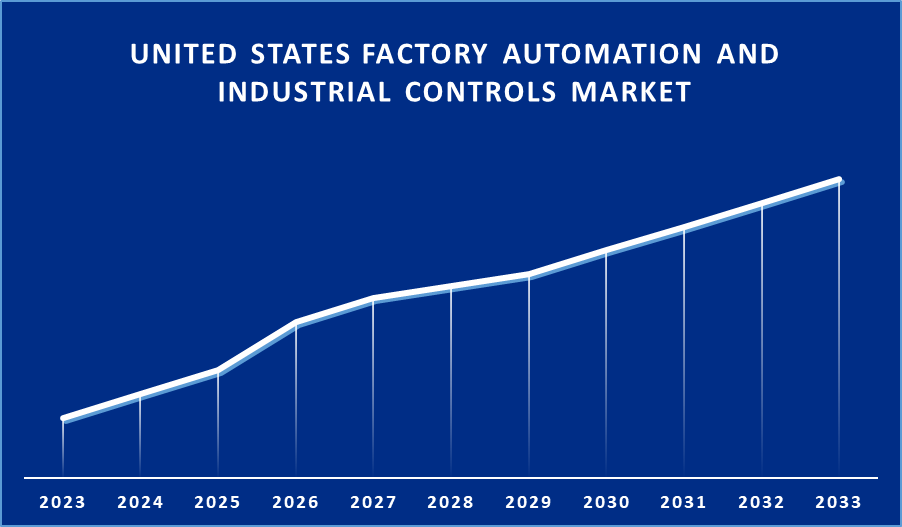

- The Market Size is Growing at a CAGR of 7.5% from 2023 to 2033.

- The United States Factory Automation and Industrial Controls Market Size is Expected to Hold a Significant Share by 2033.

Get more details on this report -

The United States Factory Automation and Industrial Controls Market Size is expected to Hold a Significant Share by 2033, at a CAGR of 7.5% during the forecast period 2023 to 2033.

Market Overview

The use of machines to reduce human labor has come to be known as automation. Mechanization innovations and control gadgets, which are conveyed in computerizing machines, are included in industrial robotization. PC programming and modern robots are increasingly being used in businesses to deal with various cycles in order to improve efficiency and productivity. Several current areas, including oil and gas businesses, synthetic substances, materials, clinical sites, and other critical enterprises, are gradually introducing computerization procedures. The essential characteristic of production line computerization innovation, which is considered the invigorating development variable for the factory automation industry, is increasing efficiency with low assembly costs. Several countries are increasingly investing in carbon-free strategies that include environmentally friendly procedures. Automobile companies, in particular, are focusing on such procedures. These variables are regarded as significant driving variables in the factory automation industry.

Report Coverage

This research report categorizes the market for United States factory automation and industrial controls market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States factory automation and industrial controls market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States factory automation and industrial controls market.

United States Factory Automation and Industrial Controls Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.5% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By End-User Industry |

| Companies covered:: | Rockwell Automation Inc., Honeywell International Inc., ABB Ltd, Schneider Electric SE, Emerson Electric Company and Other key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Industrial IoT solutions, such as factory robotics and automated manufacturing equipment, evaluate machine data and gain insightful knowledge that can be used to maximize asset availability and productivity by utilizing sophisticated analytics, edge computing. Siemens' IndustrialEdge, MindSphere, and Mendix. Schmalz, a manufacturer of vacuum automation and ergonomic handling solutions, uses the capabilities of Siemens Industrial IoT to enhance its extended analytics and customer maintenance offerings. As a result, the continued expansion of Industrial IoT across industries is expected to drive market growth during the forecast period. Rising demand for automation for quality and dependability is expected to drive market growth. The United States factory automation and industrial controls market is expected to expand significantly during the forecast period, owing to increased demand for automation for high-quality and dependable manufacturing. Furthermore, industry players are focusing on increasing manufacturing process efficiency in order to achieve low-cost and high-quality production results, which is driving the factory automation market.

Restraining Factors

One of the primary factors limiting the growth of the factory automation and industrial controls market is the scarcity of professionals and security awareness, as well as the high costs of implementing factory automation systems. During the forecast period, an increase in automation demand in United States is expected to provide a lucrative opportunity to expand the factory automation and industrial controls market.

Market Segment

- In 2023, the distributed control system (DCS) segment accounted for the largest revenue share over the forecast period.

Based on the product, the United States factory automation and industrial controls market is segmented into programmable logic controller (PLC), distributed control system (DCS), supervisory control and data acquisition system (SCADA), human machine interface (HMI), process safety systems, sensors & transmitters, industrial robotics, and others. Among these, the distributed control system (DCS) segment has the largest revenue share over the forecast period. DCS are process-oriented platforms that rely on a network of interconnected sensors, controllers, terminals, and actuators to act as a centralized master controller for all production operations at a facility. As a result, a distributed control system (DCS) focuses on controlling and monitoring processes, as well as providing facility operators with a centralized view of all facility operations.

- In 2022, the automotive segment accounted for the largest revenue share over the forecast period.

Based on the end user, the United States factory automation and industrial controls market is segmented into automotive, chemical & petrochemical, semiconductor & electronics, oil & gas, power generation, water & wastewater, and others. Among these, the automotive segment has the largest revenue share over the forecast period. The automotive industry is one of the most prominent sectors with a significant presence in U.S. automated manufacturing facilities. It has been observed that various automakers' production facilities are automated in order to maintain accuracy and efficiency. Furthermore, the growing trend of replacing conventional vehicles with EVs is expected to increase demand in the automotive industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States factory automation and industrial controls market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Rockwell Automation Inc.

- Honeywell International Inc.

- ABB Ltd

- Schneider Electric SE

- Emerson Electric Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2022, At Hannover Messe 2022, Critical Manufacturing unveiled the latest version of its Manufacturing Execution System (MES). Critical Manufacturing MES (V9) advancements help high-tech manufacturers thrive in changing market conditions.

- In September 2022, Rockwell Automation, Inc., a digital transformation and industrial automation company, completed the acquisition of Plex Systems. Rockwell may be able to strengthen their cloud-delivered intelligent manufacturing solutions and provide smart manufacturing in customer operations as a result of this acquisition.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States factory automation and industrial controls market based on the below-mentioned segments:

United States Factory Automation and Industrial Controls Market, By Product

- Programmable Logic Controller (PLC)

- Distributed Control System (DCS)

- Supervisory Control and Data Acquisition System (SCADA)

- Human Machine Interface (HMI)

- Process Safety Systems

- Sensors & Transmitters

- Industrial Robotics

- Others

United States Factory Automation and Industrial Controls Market, By End User

- Automotive

- Chemical & Petrochemical

- Semiconductor & Electronics

- Oil & Gas

- Power Generation

- Water & Wastewater

- Others

Need help to buy this report?