United States Eyewear Market Size, Share, and COVID-19 Impact Analysis, By Product (Contact Lenses, Spectacles, and Sunglasses), By Distribution Channel (E-Commerce and Brick & Mortar), and United States Eyewear Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited States Eyewear Market Insights Forecasts to 2035

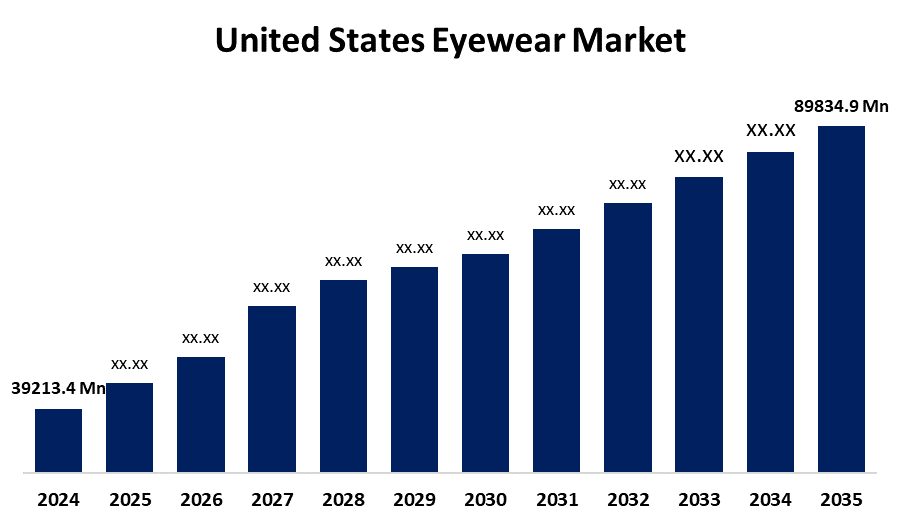

- The US Eyewear Market Size Was Estimated at USD 39213.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.83% from 2025 to 2035

- The US Eyewear Market Size is Expected to Reach USD 89834.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Eyewear Market is anticipated to reach USD 89834.9 million by 2035, growing at a CAGR of 7.83% from 2025 to 2035. The expansion of the United States eyewear market is propelled due to shifting lifestyle trends and rising demand for opulent accessories, particularly among millennials, the market is anticipated to expand.

Market Overview

The eyewear refers to items made to help or protect the eyes, most frequently contact lenses, sunglasses, and prescription eyeglasses. These products protect eyes from damaging UV rays, improve vision care, and add to personal style, among other practical and aesthetic uses. The eyewear market is ripe with possibilities, especially with the ability to incorporate digital technologies. Augmented reality smart eyewear with a health tracking function is growing in popularity and offers a new growth opportunity for the market. This technology-driven shift in eyewear is particularly attractive to younger customers, potential customers in professional settings, and potentially customers who embrace technology for its augmented capabilities that might eventually aid in health monitoring and work productively. In addition, the growing number of online sales only enhances the likelihood for growth and offers larger potential since e-commerce platforms enable customers to buy a wider variety of eyewear products at lower price points than traditional retailers. The eyewear industry is witnessing an increase in demand for personalised eyewear solutions as consumers move towards wanting goods that reflect their own needs and personal styles. This trend may open new areas of market share for retailers and manufacturers alike.

Report Coverage

This research report categorizes the market for the United States eyewear market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States eyewear market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States eyewear market.

United States Eyewear Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 39213.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.83% |

| 2035 Value Projection: | USD 89834.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Product, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Johnson & Johnson Vision Care, Inc., CooperVision, Bausch & Lomb Inc., CIBA VISION, De Rigo Vision S.p.A, Fielmann AG, HOYA Corporation, JINS, Inc., Marchon Eyewear, Inc., Others. |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The growth of the United States eyewear market is boosted by the awareness of eye health and the increase in visual impairment. The demand for prescription lenses and spectacles to correct visual abnormalities is increasing as the population ages. The fashion effect on eyewear has upended consumer attitudes, and consumers now often want to change eyewear due to fashion rather than functionality, expanding the marketplace. Moreover, technological advancements such as anti-glare glasses, blue-light filtering glasses, and lightweight materials have an appeal across all ages. Additionally, a major contributor to market growth is that eyewear has become so accessible and affordable through the internet, and increased availability means better access and reach to consumers.

Restraining Factors

The United States eyewear market faces obstacles like the eye surgery procedures, such as LASIK are becoming more prevalent, which may reduce the need for corrective eyewear. In addition to this, the high price point of luxury eyewear brands will discourage some potential buyers, particularly in the less affluent regions.

Market Segmentation

The United States eyewear market share is classified into product and distribution channel.

- The spectacles segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States eyewear market is segmented by product into contact lenses, spectacles, and sunglasses. Among these, the spectacles segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the growing demand for products due to an uptick in the prevalence of computer vision syndrome (CVS). The increase in the prevalence of CVS in children because of the rising online learning trend, particularly during the pandemic, has driven the use of anti-fatigue, anti-glare glasses.

- The brick & mortar segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the United States eyewear market is segmented into e-commerce and brick & mortar. Among these, the brick & mortar segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled as individuals become aware of the importance of regular eye examinations and the use of glasses. The growing number of companies is looking to expand their retail stores to gain a competitive advantage in the marketplace.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States eyewear market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Johnson & Johnson Vision Care, Inc.

- CooperVision

- Bausch & Lomb Inc.

- CIBA VISION

- De Rigo Vision S.p.A

- Fielmann AG

- HOYA Corporation

- JINS, Inc.

- Marchon Eyewear, Inc.

- Others

Recent Development

- In October 2023, Bausch & Lomb launched an ophthalmic diagnostic system, SeeNa, for refractive cataract patients. SeeNa captures key measurements necessary for evaluating patients’ eyes and determining the cataract intraocular lens (IOL) power calculation in one step. It also offers a user-friendly interface, allowing clinicians and staff to quickly master acquisition and operation and receive results in a short duration.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States eyewear market based on the following segments:

United States Eyewear Market, By Product

- Contact Lenses

- Spectacles

- Sunglasses

United States Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

Need help to buy this report?