United States Express Delivery Market Size, Share, and COVID-19 Impact Analysis, By Business (B2B, B2C), By Destination (Domestic and International), and United States Express Delivery Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited States Express Delivery Market Insights Forecasts to 2035

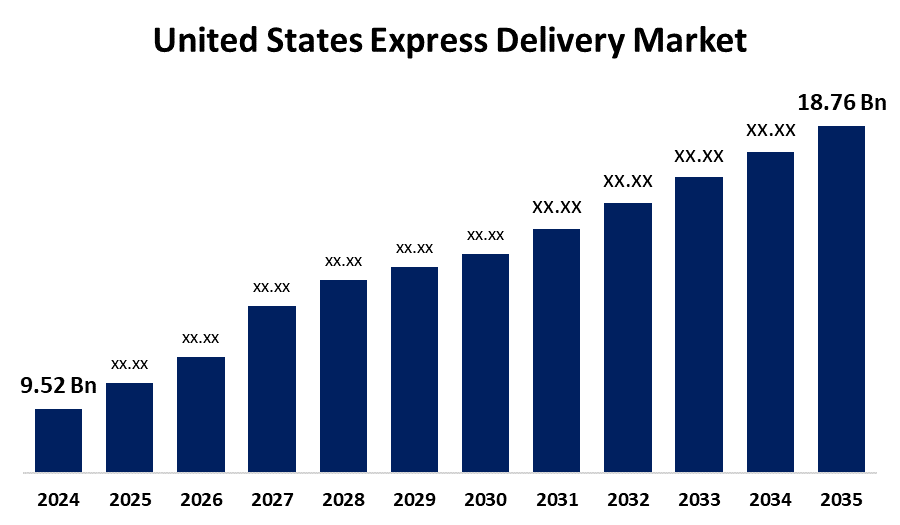

- The U.S. Express Delivery Market Size was estimated at USD 9.52 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.36% from 2025 to 2035a

- The USA Express Delivery Market Size is Expected to Reach USD 18.76 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The US Express Delivery Market is anticipated to reach USD 18.76 Billion by 2035, growing at a CAGR of 6.36% from 2025 to 2035. The U.S. express delivery market is expanding rapidly due to e-commerce growth, demand for faster shipping, and advanced logistics technologies, with domestic and B2C segments leading in volume and value.

Market Overview

The United States express delivery market involves expedited shipping services that provide quicker delivery times for documents and parcels, both locally and globally. These services are provided by different carriers, such as the United States Postal Service (USPS), FedEx, and United Parcel Service (UPS), among others. Express delivery services serve a variety of customers, ranging from individual consumers to corporate businesses, ensuring the timely and secure transportation of products across different industries. Moreover, growth in the U.S. express delivery market is driven by subscription box services, time-sensitive deliveries in healthcare, rising demand for reverse logistics in online retail, expanding micro-fulfillment centers in urban areas, and partnerships with drone and autonomous vehicle firms that aim to revolutionize last-mile delivery efficiency and speed. Furthermore, Key players like FedEx, UPS, Amazon Logistics, and DHL boost the U.S. express delivery market through innovations such as autonomous delivery vehicles, drone-based shipping, AI-powered route optimization, and smart lockers, enhancing speed, efficiency, and customer convenience in last-mile logistics.

Report Coverage

This research report categorizes the market for the U.S. express delivery market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States Express Delivery market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA express delivery market.

United States Express Delivery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9.52 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.36% |

| 2035 Value Projection: | USD 18.76 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 261 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Business and By Destination |

| Companies covered:: | FedEx Corporation, Aramex PJSC, YRC Worldwide, Deutsche Post DHL Group, Courier Express, SF Express (Group) Co. Ltd, A-1 Express Delivery Service Inc, Spee Dee Delivery Service Inc., United Parcel Service Inc., OnTrac Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The U.S. express delivery industry is driven by expanding demand among small and medium-sized businesses for national coverage, expansion in perishable and time-sensitive product segments, and growth of omnichannel retail initiatives. Improved consumer expectations of flexible delivery time and the adoption of sophisticated analytics to forecast demand also drive it. Strategic investments in regional hubs and growing cross-border e-commerce are also continuing to accelerate the growth of the industry.

Restraining Factors

Restraining factors include high operational costs, last-mile delivery challenges in rural areas, labor shortages, traffic congestion, and environmental concerns, which hinder scalability and affect profitability in the U.S. express delivery market.

Market Segmentation

The United States Express Delivery market share is classified into business and destination.

- The B2C segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States express delivery market is segmented by business into B2B, B2C. Among these, the B2C segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is primarily driven by the rapid expansion of e-commerce platforms and the increasing consumer preference for online shopping. B2C companies leverage express delivery services to meet customer expectations for fast and reliable shipping, offering same-day or next-day delivery options to enhance customer satisfaction and loyalty.

- The domestic segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States express delivery market is segmented by destination into domestic and international. Among these, domestic segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is driven by the robust growth of e-commerce within the country, increasing consumer demand for rapid deliveries, and the extensive logistics infrastructure maintained by major players like UPS, FedEx, and Amazon Logistics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US express delivery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- FedEx Corporation

- Aramex PJSC

- YRC Worldwide

- Deutsche Post DHL Group

- Courier Express

- SF Express (Group) Co. Ltd

- A-1 Express Delivery Service Inc

- Spee Dee Delivery Service Inc.

- United Parcel Service Inc.

- OnTrac Inc.

- Others

Recent Developments:

- In October 2024, DHL Express has commenced construction on a cutting-edge 305,000 sq. ft. aviation maintenance facility at its Global Hub located at the Cincinnati/Northern Kentucky International Airport (CVG). This USD 292 million investment aims to streamline aircraft repairs, minimize downtime, and bolster service reliability for prompt customer deliveries. Additionally, the expanded aircraft apron will enable the hub to accommodate a greater number of aircraft, thereby enhancing its shipment handling capacity.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the USA express delivery market based on the below-mentioned segments:

United States Express Delivery Market, By Business

- B2B

- B2C

United States Express Delivery Market, By Destination

- Domestic

- International

Need help to buy this report?