United States Exosomes Market Size, Share, and COVID-19 Impact Analysis, By Product (Kits & Reagents, and Services), By Application (Cancer, CVD, Neurodegenerative Diseases, Infectious Diseases, and Others), and United States Exosomes Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Exosomes Market Insights Forecasts to 2035

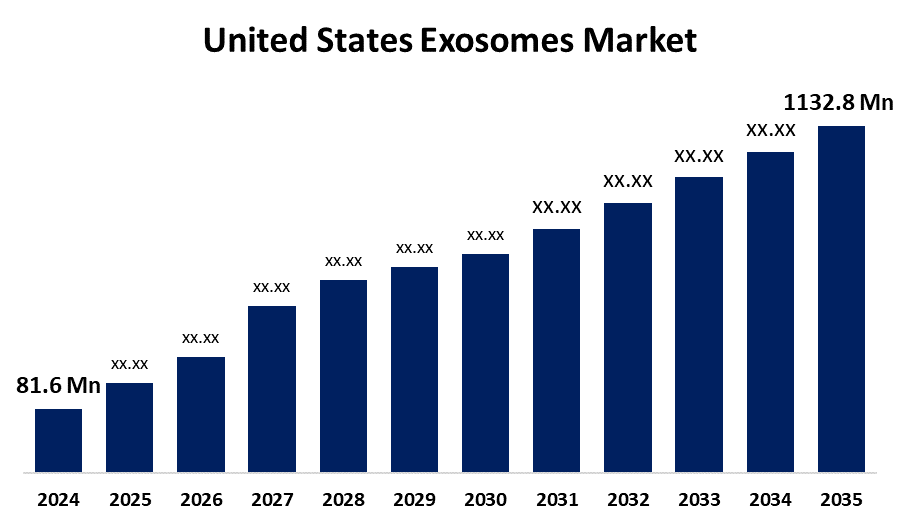

- The US Exosomes Market Size Was Estimated at USD 81.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 27.02% from 2025 to 2035

- The US Exosomes Market Size is Expected to Reach USD 1132.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Exosomes Market Size is anticipated to reach USD 1132.8 Million by 2035, growing at a CAGR of 27.02% from 2025 to 2035. The expansion of the United States exosomes market is propelled by the growing incidence of cancer and technological developments in exosome isolation and analytical techniques.

Market Overview

Exosomes are microscopic, membrane-bound vesicles that are discharged into physiological fluids like blood, saliva, and urine by nearly all cell types. They typically have a diameter of 30 to 150 nanometres. 52.0% of the exosome market share is held by the United States. Growth of the market is primarily due to the long-standing interest and commitment in the exosome industry to better characterize exosomes, which continues to grow in the pharmaceutical sector. Further, exosomes are useful biomarkers, allowing for disease detection and monitoring disease progression, as they mirror the cell state. The companies in the US market are focused on collaborating with universities and submitting patents on exosome-related projects. The way exosomes are being incorporated into diagnostics and therapies is influencing the growth of this market in the United States is contributing to the region's market growth driven by an increase in the prevalence rates of infectious disease, cancer, cardiovascular disease, and neurological disease.

In the United States, the National Institutes of Health (NIH) funds several major exosome research initiatives, including the Extracellular RNA Communication Program. It explores how exosomes containing RNA promote cell communication as well as their possible application in the management of disease. Additionally, the FDA, DOE, and NIH are part of the National Nanotechnology Initiative (NNI), which finances nanotechnology research, including the development of exosome-based medicines.

Report Coverage

This research report categorizes the market for the United States exosome market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States exosomes market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States exosomes market.

United States Exosomes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 81.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 27.02% |

| 2035 Value Projection: | USD 1132.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product and By Application |

| Companies covered:: | RoosterBio, Bio-Techne Corp, Hologic Inc, Danaher Corp, Thermo Fisher Scientific Inc, Aragen Bioscience, Capricor Therapeutics, Coya Therapeutics, Aegle Therapeutics Corporation, Aethlon Medical, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States exosomes market is boosted by the focus on accurate treatments and non-invasive diagnostics. As medicine shifts towards early detection and customised, less invasive care, exosomes offer a platform unlike any other that can transform the diagnosis and therapy. For example, studies have indicated the capability of exosomal RNA biomarkers in blood to detect cancers extremely early, and even before the development of visible symptoms. Furthermore, diagnostic companies are developing platforms for liquid biopsy that are based on the content of exosomes as alternatives to invasive tissue biopsies.

Restraining Factors

The United States exosomes market faces obstacles surrounding technology for isolation, scalability, and standardization. It is more difficult to complete regulatory approval procedures and even to compare studies because different laboratories use different separation techniques.

Market Segmentation

The United States exosomes market share is classified into product and application.

- The kits & reagents segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States exosomes market is segmented by product into kits & reagents, and services. Among these, the kits & reagents segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because it is vital for easy and reliable isolation, and the reagents facilitate analysis of exosome contents, particularly concerning disease studies, including cancer and regenerative medicine. For the next projected time period, usage in clinical research trials will be expanding significantly for exosome-based research.

- The cancer segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States exosomes market is segmented into cancer, CVD, neurodegenerative diseases, infectious diseases, and others. Among these, the cancer segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by governmental aid, an aging population, and improved health care. Moreover, the increasing number of people attending conferences and seminars is also improving awareness and boosting growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States exosomes market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- RoosterBio

- Bio-Techne Corp

- Hologic Inc

- Danaher Corp

- Thermo Fisher Scientific Inc

- Aragen Bioscience

- Capricor Therapeutics

- Coya Therapeutics

- Aegle Therapeutics Corporation

- Aethlon Medical

- Others

Recent Development

- In January 2024, In January 2024, Capricor Therapeutics revealed a collaboration with the National Institutes of Health to conduct a clinical trial on a new exosome-based multivalent vaccine for SARS-CoV-2. Capricor's exclusive StealthX exosome-based multivalent vaccine for preventing SARS-CoV-2 has been chosen to participate in Project NextGen.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States exosomes market based on the following segments:

United States Exosomes Market, By Product

- Kits & Reagents

- Services

United States Exosomes Market, By Application

- Cancer

- CVD

- Neurodegenerative Diseases

- Infectious Diseases

- Others

Need help to buy this report?