United States Exoskeleton Market Size, Share, and COVID-19 Impact Analysis, By Mobility (Mobile and Fixed/Stationary), By Technology (Powered and Non-powered), and United States Exoskeleton Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Exoskeleton Market Insights Forecasts to 2035

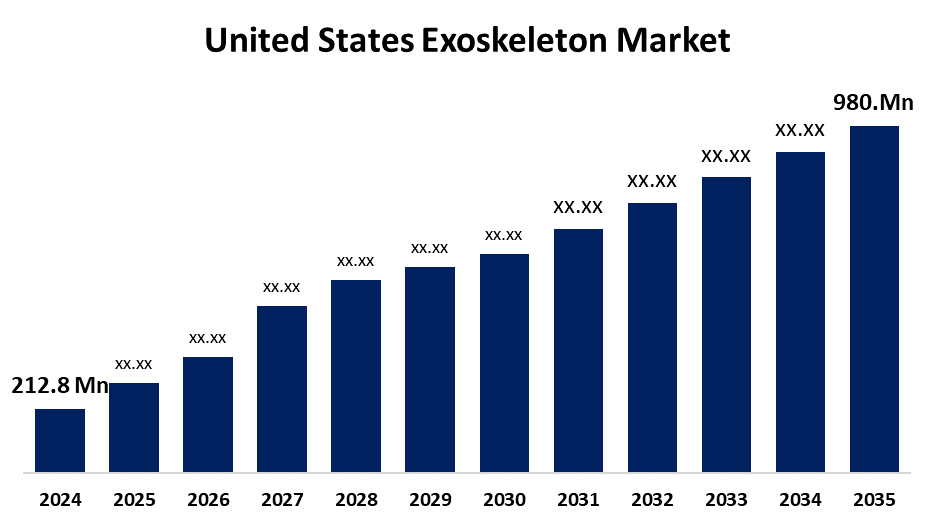

- The US Exoskeleton Market Size Was Estimated at USD 212.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 14.90% from 2025 to 2035

- The US Exoskeleton Market Size is Expected to Reach USD 980.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Exoskeleton Market Size is Anticipated to Reach USD 980.9 Million by 2035, Growing at a CAGR of 14.90% from 2025 to 2035. The expansion of the United States exoskeleton market is propelled by a rapidly ageing population, the increasing use of medical devices across a range of industries, including the automotive, military, defence, and construction sectors, as well as the increased prevalence of stroke.

Market Overview

An exoskeleton is referred to as a hard outer covering that serves as a protective mechanism for an organism's body. It is considered a special feature distinguishing an exoskeleton from an endoskeleton. A traditional example of an exoskeleton is an insect or crustacean, and even a vertebrate like a turtle can have an exoskeleton. With SCI representing an increasing burden of health problems, it is anticipated that there will be growth in international markets. Multiple sectors have used exoskeleton technologies to improve worker wellness and increase efficiency. Numerous businesses specialising in exoskeleton technology and rehabilitation solutions have formed as a result of the growing demand for these products. Additionally, the dynamic progress of the exoskeleton industry may cause players to shop for new methods of product development relative to the adoption coming out of the prediction period. For instance, in June 2022, Ekso Bionics received 510k approval from the FDA to market the EksoNR, a robotic exoskeleton, which would be used where patients present with multiple sclerosis. According to the U.S. Bureau of Labor Statistics, there were an estimated 502,380 cases of workers suffering from musculoskeletal disorders in 2022, caused by their job. Many of the drivers of exoskeleton technology adoption include the benefits exoskeletons offer, such as improving or augmenting users' physical performance or abilities, improving users' health and productivity, and reducing fatigue of industrial workers.

Report Coverage

This research report categorizes the market for the United States exoskeleton market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States exoskeleton market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States exoskeleton market.

United States Exoskeleton Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 212.8 Million |

| Forecast Period: | 2024-2035 |

| 2035 Value Projection: | USD 980.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Mobility, By Technology and COVID-19 Impact Analysis. |

| Companies covered:: | Ekso Bionics, Myomo, Inc., Levitate Technologies Inc., Lockheed Martin Corp, ReWalk Robotics, Raytheon Company, Bionik Laboratories Corp., Suit X and Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States exoskeleton market is fueled by the recommendation that patients with spinal cord injuries utilise exoskeletons to enhance their condition. The market for these devices is expanding as a result of the rising incidence of spinal cord injuries. This is now a key factor in both patients' and healthcare professionals' acceptance of exoskeletons. Exoskeleton demand is predicted to increase as a result of the market's rapid technical improvements. The industry is anticipated to expand due to exoskeletons' rising acceptance and popularity among businesses. Additionally, the growing use of exoskeletons in the construction, automotive, logistics, and industrial sectors is increasing their penetration, which is driving the market's expansion.

Restraining Factors

The U.S. exoskeleton market is hindered in several ways, such as devices being expensive, which limits small to medium-sized businesses and users from entering the market. Exoskeletons often cost much more due to requiring advanced materials, and hardware or software design to a certain degree, regardless of the use of it being for industrial or medical use.

Market Segmentation

The United States exoskeleton market share is classified into mobility and technology.

- The mobile segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States exoskeleton market is segmented by mobility into mobile and fixed/stationary. Among these, the mobile segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. Increased R&D efforts and a growing need for robots with motors that help in human body mechanics are some of the factors propelling this market. For instance, in October 2022, a Stanford University research team supported by the NIH developed an exoskeleton that facilitates walking.

- The powered segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the technology, the United States exoskeleton market is segmented into powered and non-powered. Among these, the powered segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growing adoption of powered exoskeleton technologies to boost personal safety and productivity across many industries is driving the segment's growth. Higher strength, force multiplier, smoother lifting action, less physical strain on employees, and better productivity are some advantages of powered technology products. Additionally, the launch of new products has increased. For instance, in August 2024, Arc'teryx and Skip worked together to introduce the first powered trousers, a wearable exoskeleton that improves human mobility through powered support.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States exoskeleton market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ekso Bionics

- Myomo, Inc.

- Levitate Technologies Inc.

- Lockheed Martin Corp

- ReWalk Robotics

- Raytheon Company

- Bionik Laboratories Corp.

- Suit X

- Others

Recent Development

- In February 2024, DIH Holding US, Inc. secured money to expand its market presence in robotic and VR-enabled rehabilitation technology through a merger with Aurora Technology Acquisition Corp.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States exoskeleton market based on the following segments:

United States Exoskeleton Market, By Mobility

- Mobile

- Fixed/Stationary

United States Exoskeleton Market, By Technology

- Powered

- Non-powered

Need help to buy this report?