United States Excipients Market Size, Share, and COVID-19 Impact Analysis, By Product (Polymers, Alcohols, Sugars, Minerals, and Gelatin), By Formulation (Oral, Topical, Parenteral, and Others), and United States Excipients Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Excipients Market Insights Forecasts to 2035

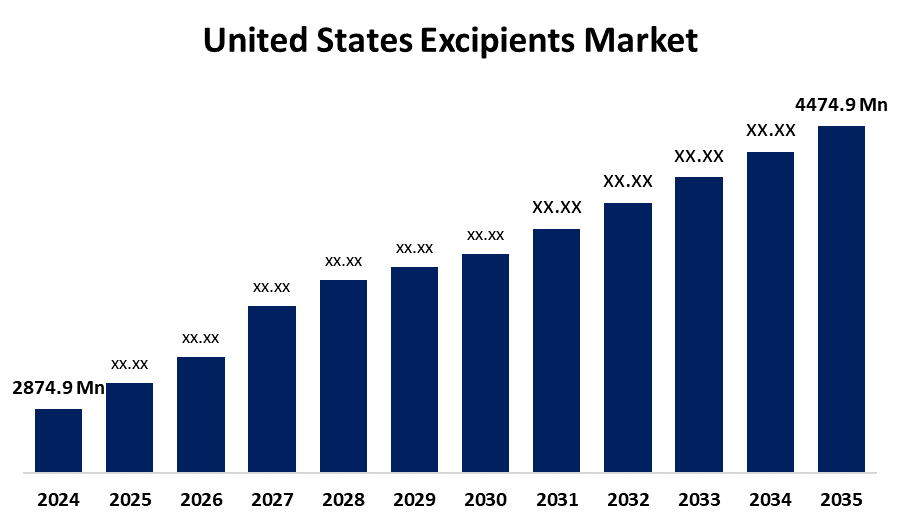

- The US Excipients Market Size Was Estimated at USD 2874.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.1% from 2025 to 2035

- The US Excipients Market Size is Expected to Reach USD 4474.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Excipients Market Size is anticipated to reach USD 4474.9 Million by 2035, growing at a CAGR of 4.1% from 2025 to 2035. The expansion of the United States' excipients market is propelled by growing demand for multifunctional excipients and the use of generic medications.

Market Overview

The term excipient refers to a material that is added to a pharmaceutical formulation in addition to the active pharmaceutical ingredient. In recent years, the use of excipients by pharmaceutical companies has increased because excipients have been documented to enhance functionality and increase competitive advantage in drug formulations. The market has undoubtedly supported the ongoing investigation and discovery of optimal or nearly ideal chemicals that can be used in therapeutic formulations and delivery applications. The bulk of the pharmaceutical companies have been developing more complex excipients with a developing aim of drug delivery, which is another factor fuelling the growth. The demand for new compounds supporting the drug delivery of nanoparticles in the enhancement of stability and uptake for cancer treatments will undoubtedly impact the growth of the market. Blockbuster medicine patent expiration is also expected to have meaningful growth in the market. Businesses are now working on developing these processes and optimising excipients for medicinal formulations and delivery devices.

The FDA in the United States has led major initiatives to promote the safe integration and development of new excipients. The FDA's Center for Drug Evaluation and Research launched the Novel Excipient Review Pilot Program (PRIME) in 2021 to give early-stage developers FDA input on novel excipients before they are incorporated into drug formulations. This makes it simpler to incorporate new materials that enhance patient outcomes, bioavailability, and solubility.

Report Coverage

This research report categorizes the market for the United States excipients market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States excipients market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States excipients market.

united-states-excipients-market

Driving Factors

The growth of the United States' excipients market is boosted by the increasing demand for pharmaceuticals and nutraceuticals, driven by chronic diseases and a growing population. However, the need for reasonably priced excipients is fuelled by the expiration of blockbuster medicine patents and the growing use of generics. At the same time, developments in drug delivery, including targeted, sustained release, and biologic formulations, are driving the demand for specialized multifunctional and high-purity excipients. The development of novel excipient technology is further accelerated by regulatory support of innovation, such as the FDA's early-stage excipient evaluation.

Restraining Factors

The United States Excipients market faces obstacles like stringent safety and regulatory scrutiny that often result in delays for new products. Also, the burden is high development and manufacturing costs associated with complex testing and compliance.

Market Segmentation

The United States excipients market share is classified into product and formulation.

- The polymers segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States excipients market is segmented by product into polymers, alcohols, sugars, minerals, and gelatin. Among these, the polymers segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by pregelatinized starch and microcrystalline cellulose, which is becoming the biggest product class with regard to both volume and revenue. Polymers accounted for approximately 40% of the total volume used in pharmaceutical formulations and greater than 45.69% of total revenue.

- The oral segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the formulation, the United States excipients market is segmented into oral, topical, parenteral, and others. Among these, the oral segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the large volume of its formulation usage corresponds to increased demand for excipients such as stabilisers, emulsifiers, polymers, and solubilising agents.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States excipients market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Colorcon

- Roquette America

- Actylis

- Ashland Inc

- The Lubrizol Corp

- Eastman Chemical Co

- Huntsman Corp

- FMC Corp

- Avantor Inc

- Procter & Gamble Co

- Others

Recent Development

- In August 2023, IFF Pharma Solutions partnered with BASF to integrate IFF excipient brands into BASF’s ZoomLab digital excipient recommendation platform.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States excipients market based on the following segments:

United States Excipients Market, By Product

- Polymers

- Alcohols

- Sugars

- Minerals

- Gelatin

United States Excipients Market, By Formulation

- Oral

- Topical

- Parenteral

- Others

Need help to buy this report?