United States Eubiotics Market Size, Share, and COVID-19 Impact Analysis, By Product (Probiotics, Prebiotics, Organic Acids, Phytogenic, and Enzymes), By Form (Liquid and Solid), and United States Eubiotics Market Insights, Industry Trend, Forecasts to 2035

Industry: Specialty & Fine ChemicalsUnited States Eubiotics Market Insights Forecasts to 2035

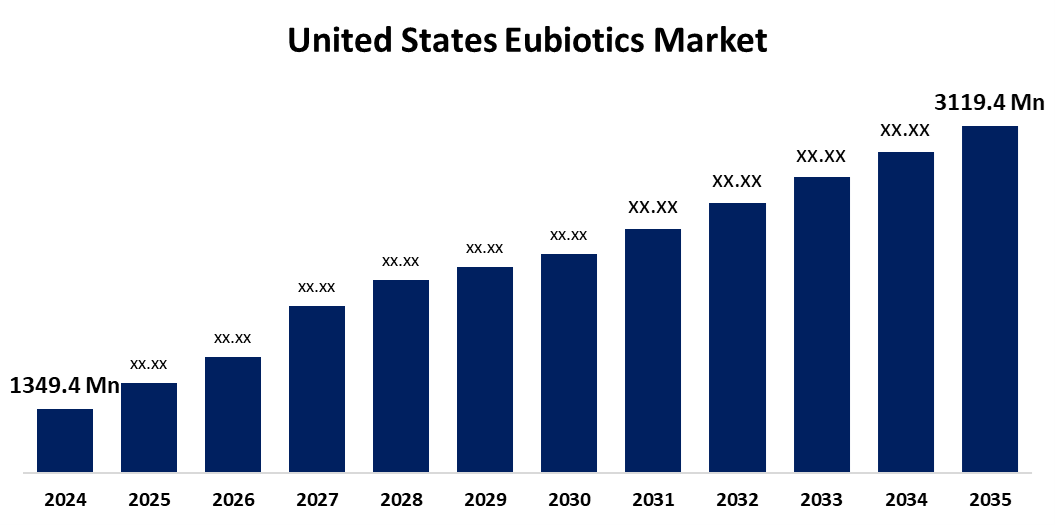

- The US Eubiotics Market Size Was Estimated at USD 1,349.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.92% from 2025 to 2035

- The US Eubiotics Market Size is Expected to Reach USD 3,119.4 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States Eubiotics Market Size is anticipated to reach USD 3,119.4 Million by 2035, Growing at a CAGR of 7.92% from 2025 to 2035. The expansion of the United States eubiotics market is propelled by an advantageous regulatory situation that prohibits the use of antibiotics and increases meat consumption.

Market Overview

A eubiotic is a kind of feed ingredient intended to support eubiosis, or a balanced, healthy gut microbial environment, in poultry and cattle. Distributors, pre-mixers, or feed mills generate and distribute eubiotics. Chemical synthesis and fermentation are the processes used to create eubiotics, such as organic acids. The chemical synthesis method is most often preferred for use as feed additives, such as in silage. Eubiotic products like probiotics and prebiotics are part of the value chain of the nutraceuticals industry. In the US, there is a strong position in the market, has better technology, cheaper labour, and an abundant lower-cost supply from high-end manufacturing. As a result, major US companies are creating an economic supply chain and the best possible manufacturing process so they can offer goods at a lower price point. Rising customer demand for sustainable and eco-friendly products is one of the key trends in the eubiotics sector, driven by rising customer demand for natural and organic ingredients. Significant interest is also growing in advancing bioavailability and efficacy in eubiotic formulations through innovative technologies, such as encapsulation and spore-forming probiotics. Demand is also factoring in the increasing collaboration between eubiotics producers and animal producers. Eubiotics are also seeing a rise in scope in the eubiotics market space to include use in aquaculture and pet nutrition.

Report Coverage

This research report categorizes the market for the United States eubiotics market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States eubiotics market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States eubiotics market.

United States Eubiotics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,349.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 7.92% |

| 2035 Value Projection: | USD 3,119.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Form |

| Companies covered:: | Kemin Industries, Cargill, DuPont de Nemours Inc, Archer-Daniels Midland Co, Novus International, Inc., UAS Laboratories, Advanced BioNutrition Corp, Chr. Hansen, Alltech, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States eubiotics market is boosted by the increased awareness of the importance of gut health in livestock, and the benefits of eubiotics for improving animal comfort and feed efficacy. The eubiotics market is expanding due to the increasing demand for naturally produced meats and dairy products. Since the use of antibiotics as growth promoters in animal feed is strictly regulated, the eubiotics industry has targeted eubiotics. The eubiotics market is growing due to new developments in product development, and its applications continue to grow in pet food and aquaculture.

Restraining Factors

The United States eubiotics market faces obstacles like the unavailability of raw materials is a significant concern for eubiotics producers because essential oils are derived from plant-derived material, which is subjected to stringent quality controls. The moisture, heat, and stability can all affect the shelf life of raw materials and can degrade probiotic quality, especially during unsuitable environmental conditions.

Market Segmentation

The United States eubiotics market share is classified into product and form.

- The probiotics segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States eubiotics market is segmented by product into probiotics, prebiotics, organic acids, phytogenic, and enzymes. Among these, the probiotics segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the increased consumer awareness of probiotics in animal feed, ongoing research and development for viable solutions, along with the product offering range from major players in the industry. The market demand is expected to be further enhanced by the numerous implementations of all range of animal applications, including immunity development and gut health maintenance.

- The solid segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the form, the United States eubiotics market is segmented into liquid and solid. Among these, the solid segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the potential benefits, such as reduced exposure to light and moisture. Solid forms include flakes, beadlets, and cross-linked beadlets. Beadlet technology consistently protects the active ingredients during feed milling from heat and mechanical stress, increasing their stability and bioavailability.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States eubiotics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kemin Industries

- Cargill

- DuPont de Nemours Inc

- Archer-Daniels Midland Co

- Novus International, Inc.

- UAS Laboratories

- Advanced BioNutrition Corp

- Chr. Hansen

- Alltech

- Others

Recent Development

- In January 2023, Cargill and BASF extended their cooperation in feed enzyme development and distribution in the U.S. Their joint R&D pipeline supports sustainable animal protein production, with enzyme protocols that interface with eubiotic strategies[AS1]

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States eubiotics market based on the following segments:

United States Eubiotics Market, By Product

- Probiotics

- Prebiotics

- Organic Acids

- Phytogenic

- Enzymes

United States Eubiotics Market, By Form

- Liquid

- Solid

Need help to buy this report?