United States Esports Market Size, Share, and COVID-19 Impact Analysis, By Revenue Source (Sponsorships, Advertising, Merchandise & Tickets, Publisher Fees, and Media Rights), By Streaming Outlook (On-demand and Live Streaming), and United States Esports Market Insights, Industry Trend, Forecasts to 2035

Industry: Electronics, ICT & MediaUnited States Esports Market Insights Forecasts to 2035

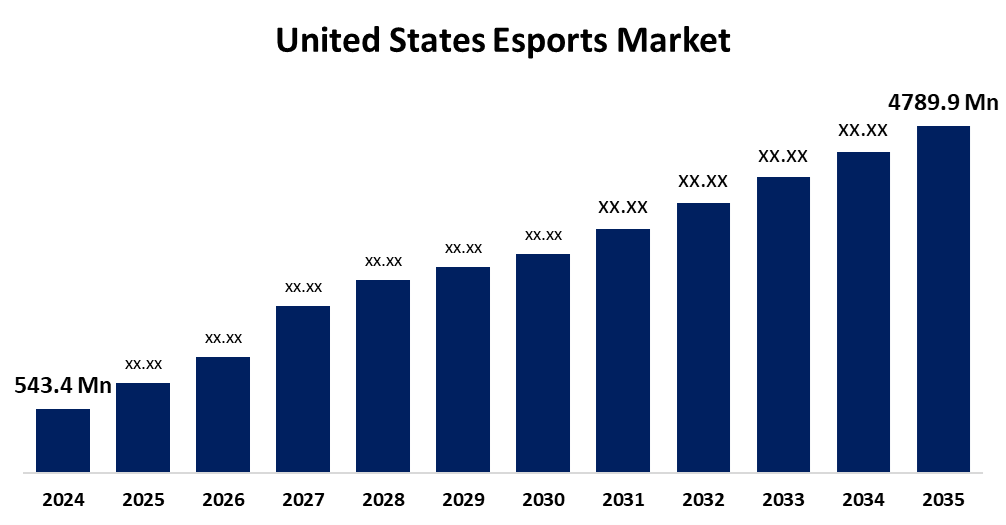

- The US Esports Market Size Was Estimated at USD 543.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 21.88% from 2025 to 2035

- The US Esports Market Size is Expected to Reach USD 4789.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States Esports Market Size is anticipated to Reach USD 4789.9 Million by 2035, Growing at a CAGR of 21.88% from 2025 to 2035. The expansion of the United States esports market is propelled by factors such as increasing audience reach, engagement activities, league tournament infrastructure, and the expansion of live streaming of games.

Market Overview

Professional teams or players are the main participants in organised, multiplayer video game competitions known as esports. Tournaments can range across several categories of games, including multiplayer online battle arena games, real-time strategy games, and first-person shooters. Tournaments can occur during in-person events and online tournaments, as well. The root of the increase in the number of people who play esports or watch esports has stemmed from the increasing growth of mobile gaming and the relative ease and affordability of high-speed internet. Cloud gaming platforms and potential multi-media collaborations between gaming companies and esports organizations will likely further spur growth in esports in the future. There has been increasing development from sponsors and investors in the U.S. esports industry. Large corporations ranging from Coca-Cola to the U.S. Army value esports as a vehicle to connect and engage with tech-savvy younger audiences. This investment furthers the overall engagement with esports content and improves production value by helping to establish and grow professional teams, popular events as brand activations, and professional leagues. This investment attracts a larger audience in addition to enhancing the viewing experience. Esports are becoming a more popular entertainment industry with the potential for long-term, steady growth as more brands enter the market, offering it legitimacy and visibility. A key component of esports is gradually being artificial intelligence. AI tools are being used by teams for evaluating gameplay, identifying strengths and weaknesses, and enhancing methods. AI also improves the way fans experience matches and streams by personalising content for them. To reduce toxicity and provide more welcoming gaming environments, it is being used to manage online communities. Game developers are using AI to create more clever opponents and more dynamic gameplay. Players perform better and audiences have more fun as a result of these advancements. As AI develops, it will play an increasingly important role in esports training, broadcasting, and community involvement, strengthening the expansion of the US esports business.

Report Coverage

This research report categorizes the market for the United States esports market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States esports market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States esports market.

United States Esports Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 543.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 21.88% |

| 2035 Value Projection: | USD 4789.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Revenue Source, By Streaming Outlook |

| Companies covered:: | Take-Two Interactive, Riot Games, Discord, Envy Gaming, Valve Corporation, NVIDIA, Twitch, Activision Blizzard, Electronic Arts, Microsoft, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States esports market is fueled by the emergence of websites like Twitch, YouTube Gaming, and Facebook Gaming. By allowing viewers and streamers to communicate in real time, these systems boost fan engagement. Sponsors and advertising have also been attracted by the high viewership, which has increased esports' earnings. Due to a change in the way that gaming appears, esports is becoming more acceptable among parents and educators in the United States. It is now widely accepted that esports can aid in the development of practical life skills in youth, such as teamwork, communication, and fast decision-making.

Restraining Factors

The United States esports market faces obstacles because many esports games are free-to-play, making it difficult for creators to make money straight from their games. Revenue is mostly derived from outside sources, including media rights, sponsorships, and in-game sales. If these sources perform poorly or get saturated, profitability may be constrained.

Market Segmentation

The United States esports market share is classified into revenue source and streaming outlook.

- The sponsorships segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States esports market is segmented by revenue source into sponsorships, advertising, merchandise & tickets, publisher fees, and media rights. Among these, the sponsorships segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by a larger audience, more brand investments, and key collaborations. The brand can target potential buyers through booths, interactive advertising, posters, giveaways, video displays, and other innovative techniques. Brands are looking for uniqueness and authenticity in gaming and esports collaborations as a result of the heightened competition in the sponsorship sector. Through a digital extension of traditional sponsorship partnerships, several non-endemic corporations made their foray into esports, strengthening the industry's dominance.

- The live streaming segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the streaming outlook, the United States esports market is segmented into on-demand and live streaming. Among these, the live streaming segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is fueled by considerable expenditures in streaming infrastructure, improved viewer interactivity, and rising demand for live esports programming. The segment's position is further supported by the broad use of platforms like Twitch and YouTube, as well as by growing audience involvement and accessibility.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States esports market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Take-Two Interactive

- Riot Games

- Discord

- Envy Gaming

- Valve Corporation

- NVIDIA

- Twitch

- Activision Blizzard

- Electronic Arts

- Microsoft

- Others

Recent Development

- In February 2023, Microsoft and Nvidia announced their collaboration to add Xbox PC titles on the NVIDIA GeForce Now cloud gaming platform. Through this collaboration, Microsoft will be able to access more Activision Blizzard cloud games that will be streamed on NVIDIA GeForce.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States esports market based on the following segments:

United States Esports Market, By Revenue Source

- Sponsorships

- Advertising

- Merchandise & Tickets

- Publisher Fees

- Media Rights

United States Esports Market, By Streaming Outlook

- On-demand

- Live Streaming

Need help to buy this report?