United States Epigenetics Market Size, Share, and COVID-19 Impact Analysis, By Product (Reagents, Kits, Instruments, Enzymes, and Services), By Technology (DNA Methylation, Histone Methylation, Histone Acetylation, Large Non-coding RNA, MicroRNA Modification, Chromatin Structures), and United States Epigenetics Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Epigenetics Market Insights Forecasts to 2035

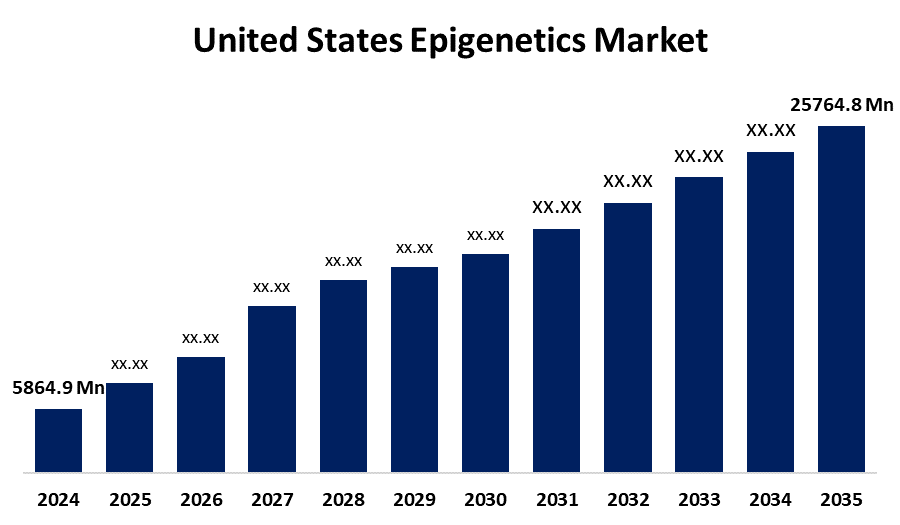

- The US Epigenetics Market Size Was Estimated at USD 5864.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 14.4% from 2025 to 2035

- The US Epigenetics Market Size is Expected to Reach USD 25764.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Epigenetics Market Size is anticipated to reach USD 25764.8 Million by 2035, growing at a CAGR of 14.4% from 2025 to 2035. The expansion of the United States epigenetics market is propelled by epigenetics' crucial function in enhancing personalised medicine, supporting disease research, and comprehending gene control beyond DNA sequencing.

Market Overview

Epigenetics is the study of differences in gene expression or activity that do not involve changes to the DNA sequence itself. With the increasing prevalence of disease, the call for early cancer screening continues to mount. Cancer incidents are about double those of non-communicable diseases, which motivates both public and private organizations in the US to increase awareness and screening efforts. For this reason, it is expected that within the projection period, the rising incidences of cancer would greatly enhance the demand for cancer diagnostic products. In the US area, major entities are collaborating to add epigenetics solutions to their portfolios. For example, in February 2024, Cardio Diagnostics Holdings, Inc., a precision cardiovascular (CVD) medicine company using artificial intelligence (AI), announced that the resTOR Longevity Clinic, a Houston concierge physician, will be incorporating Cardio Diagnostics' solutions into its suite of testing for new patients. As resTOR will be considered the first longevity clinic in the U.S. to adopt Cardio Diagnostics' state-of-the-art blood-based epigenetic tests for cardiovascular disease (Electronic Health Records CVD), Epi Gen CHD, and PrecisionCHD testing in its testing protocol for new patients, this collaboration is a huge achievement for the company.

The United States' National Institutes of Health (NIH) launched the historic Roadmap Epigenomics Program in the late 2000s through its Common fund, allocating more than $250 million to data coordination projects, epigenome mapping centres, and consortium efforts aimed at creating human reference epigenomes and novel analytical instruments.

Report Coverage

This research report categorizes the market for the United States epigenetics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States epigenetics market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States epigenetics market.

United States Epigenetics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5864.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 14.4% |

| 2035 Value Projection: | USD 25764.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product and By Technology |

| Companies covered:: | Element Biosciences, Thermo Fisher Scientific Inc, Danaher, Active Motif Inc, Agilent Technologies Inc, Hologic Inc, Zymo Research, Dovetail Genomics, Promega, Illumina Inc, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States epigenetics market is boosted by the increasing prevalence of chronic diseases such as cancer, cardiovascular disease, and neurological diseases. There is increased demand for new diagnostic methods and treatment techniques that are focused on epigenetic modifications, as traditional treatments are largely ineffective. Furthermore, there is a growing demand for these treatments with the ageing population, who are more likely to develop chronic diseases.

Restraining Factors

The United States epigenetics market faces obstacles like cost and availability of new instruments that are needed to conduct comprehensive epigenetic studies. The cost of advanced equipment also limits and decreases accessibility because of the skill level required to operate the equipment and analyze the data generated.

Market Segmentation

The United States epigenetics market share is classified into product and technology.

- The reagents segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States epigenetics market is segmented by product into reagents, kits, instruments, enzymes, and services. Among these, the reagents segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the application and study of epigenetic mechanisms of differentiation in gene expression that do not alter the base DNA sequence depends heavily on epigenetic reagents. These reagents are chemicals that are used in research and potential therapeutic applications and are fundamental to the study of epigenetic regulation. In addition, many companies are now selling epigenetic reagents that are specifically used in the study of epigenetics.

- The DNA methylation segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the technology, the United States epigenetics market is segmented into DNA methylation, histone methylation, histone acetylation, large non-coding RNA, microRNA modification, and chromatin structures. Among these, the DNA methylation segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because it is increasingly being used with sequencing techniques.The methylated areas to be sequenced are preferentially enriched by the innovative techniques of methylated DNA immunoprecipitation sequencing and methylation DNA binding domain sequencing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States epigenetics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Element Biosciences

- Thermo Fisher Scientific Inc

- Danaher

- Active Motif Inc

- Agilent Technologies Inc

- Hologic Inc

- Zymo Research

- Dovetail Genomics

- Promega

- Illumina Inc

- Others

Recent Development

- In November 2023, Element Biosciences, Inc. and QIAGEN partnered strategically to provide broad NGS workflows for the innovative Element AVITI System.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States epigenetics market based on the following segments:

United States Epigenetics Market, By Product

- Reagents

- Kits

- Instruments

- Enzymes

- Services

United States Epigenetics Market, By Technology

- DNA Methylation

- Histone Methylation

- Histone Acetylation

- Large Non-coding RNA

- MicroRNA Modification

- Chromatin Structures

Need help to buy this report?