United States Enzymes Market Size, Share, and COVID-19 Impact Analysis, By Product (Carbohydrases, Proteases, Lipases, Polymerases & Nucleases, and Others), By Type (Industrial and Specialty), and United States Enzymes Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Enzymes Market Insights Forecasts to 2035

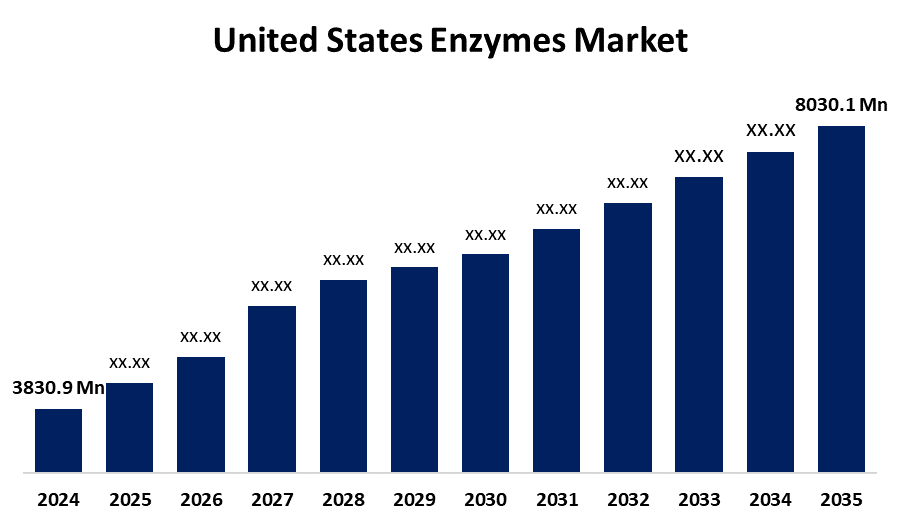

- The US Enzymes Market Size Was Estimated at USD 3830.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.96% from 2025 to 2035

- The US Enzymes Market Size is Expected to Reach USD 8030.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Enzymes Market is anticipated to reach USD 8030.1 million by 2035, growing at a CAGR of 6.96% from 2025 to 2035. The expansion of the United States enzymes market is propelled by the growing need for industrial and specialty enzymes across a range of industries, including wastewater treatment, food and beverage production, animal feed, biofuels, textiles, paper, pulp, and pharmaceuticals.

Market Overview

Enzymes are biological catalysts that greatly speed up chemical reactions in living things without being consumed in the process. They are primarily protein molecules. Enzyme-based nutritional supplements and functional foods are increasing in popularity across the country as a result of consumers' health-oriented goals and environmental concerns. The increase in convenience food consumption is a result of changing lifestyle habits from increased urbanization and disposable income. The food processing business has been awakened by this, and new demand has surfaced. The US enzyme sector, which currently holds a 29% market share, is growing rapidly as a result of consumers' and businesses' growing emphasis on sustainable practices, high-quality products, and effective operations. Enzymes are increasingly being employed as catalysts due to the wariness of businesses to develop environmentally friendly and sustainable industrial pathways. Furthermore, businesses are looking for enzymatic substitutes due to a growing awareness of the deleterious environmental impacts posed by traditional chemical methods, which has driven market growth.

The U.S. has launched a comprehensive strategy to promote enzyme-related biotechnology by establishing the National Biotechnology and Biomanufacturing Initiative in compliance with Executive Order 14081 (September 2022). Enzymes are a key technological area in biomanufacturing, and this whole-of-government approach seeks to promote sustainable innovation in fields including health, agriculture, renewable energy, and sustainability.

Report Coverage

This research report categorizes the market for the United States enzymes market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States enzymes market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States enzymes market.

United States Enzymes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3830.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.96% |

| 2035 Value Projection: | USD 8030.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Product, By Type and COVID-19 Impact Analysis |

| Companies covered:: | DuPont de Nemours Inc, Engrain LLC, AG Scientific, Novozymes, DSM, Chr. Hansen, BASF SE, AB Enzyme, Amano Enzymes Inc., Others. |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The growth of the United States enzymes market is boosted by the advances in molecular biology, protein engineering, and bioprocess optimisation. The effective creation and modification of enzymes can take place with the desired engineered features for the demands of many industrial purposes. The primary strategy in enzyme engineering is rationally designing enzymes, which is to deliberately alter enzyme structure and function through understanding both the catalytic mechanisms and the enzyme-substrate interactions. With the advancements in molecular dynamics simulations, protein structure prediction, and computational modelling, recent improvements in rational design have been made.

Restraining Factors

The United States' enzymes market faces obstacles like the strict regulatory requirements and safety concerns. Enzyme products used in industrial applications require strict regulatory requirements and thorough safety assessments to ensure their effectiveness, quality, and safety for employees and final consumers.

Market Segmentation

The United States enzymes market share is classified into product and type.

- The carbohydrases segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States enzymes market is segmented by product into carbohydrases, proteases, lipases, polymerases & nucleases, and others. Among these, the carbohydrases segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the protease, which converts proteins into free amino acids, and is in second place to carbohydrase, which converts carbohydrates into simple sugars. The great demand for them relates to their widespread application in the food and drink industries, especially the processing of dairy products.

- The industrial segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the United States enzymes market is segmented into industrial and specialty. Among these, the industrial segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because it is used in many industries, including biofuels, animal feed, detergents, food, and drink. Industrial enzymes have several benefits, such as enhanced product quality, faster processing times, and being eco-friendly.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States enzymes market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DuPont de Nemours Inc

- Engrain LLC

- AG Scientific

- Novozymes

- DSM

- Chr. Hansen

- BASF SE

- AB Enzyme

- Amano Enzymes Inc.

- Others

Recent Development

- In March 2023, Creative Enzymes (New York) launched a food-grade enzyme blend designed to boost processing efficiency in food production.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States enzymes market based on the following segments:

United States Enzymes Market, By Product

- Carbohydrases

- Proteases

- Lipases

- Polymerases & Nucleases

- Others

United States Enzymes Market, By Type

- Industrial

- Specialty

Need help to buy this report?