United States Environmental Testing Market Size, Share, and COVID-19 Impact Analysis, By Technology (Conventional, and Rapid Method), By Contaminant (Microbial Contamination, Organic Compounds, Heavy Metals, Residues, Solids), and United States Environmental Testing Market Insights Forecasts 2023 – 2033

Industry: AgricultureUnited States Environmental Testing Market Insights Forecasts to 2033

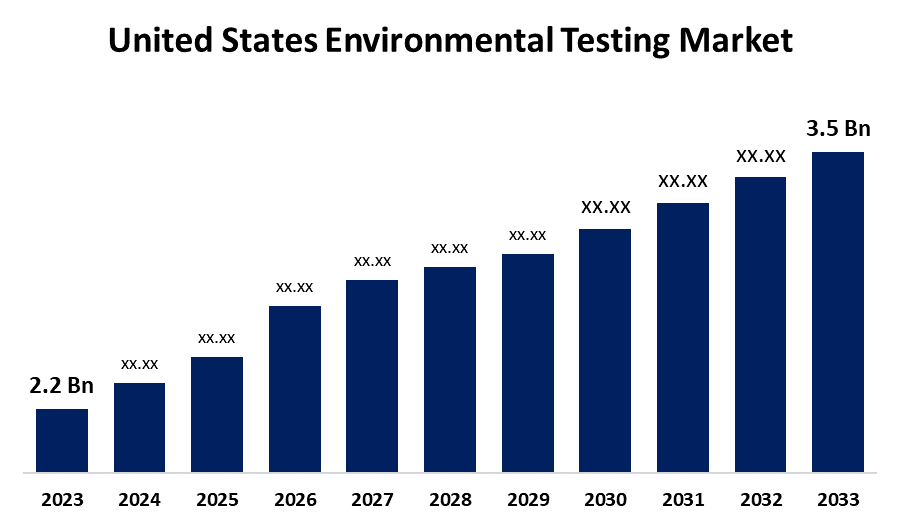

- The United States Environmental Testing Market Size was valued at USD 2.2 Billion in 2023

- The Market Size is Growing at a CAGR of 4.75% from 2023 to 2033.

- The United States Environmental Testing Market Size is Expected to Reach USD 3.5 Billion by 2033.

Get more details on this report -

The United States Environmental Testing Market size is expected to reach USD 3.5 Billion by 2033, at a CAGR of 4.75% during the forecast period 2023 to 2033.

Market Overview

Environmental testing is the process of observing and analyzing the performance of environmental conditions and their impact on living organisms. The parameters measured include temperature sensitivity, humidity, solar radiations, vibrations, fungus, acoustic measurements, and many others. It enables forecasting bodies to maintain the appropriate quantities of components in the environment. It is used to reduce the spread of waterborne and airborne diseases, as well as other health issues. It is widely used for testing microbial contaminants, heavy metals, residues, solids, and organic compounds. moreover, the environmental testing market is expanding and evolving at a rapid pace. Technological advancements play an important role in this evolution because they enable the development of more sophisticated testing techniques. These advancements lead to more accurate and comprehensive data, which provides useful insights into environmental conditions. Furthermore, the market is expected to benefit from the current trend of 'green' and sustainable business practices. As more businesses recognize the value of reducing their environmental footprint, the demand for environmental testing services to monitor and validate these efforts is expected to rise.

Report Coverage

This research report categorizes the market for the United States environmental testing market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States environmental testing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States environmental testing market.

United States Environmental Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.2 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.75% |

| 2033 Value Projection: | USD 3.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Contaminant |

| Companies covered:: | Eurofins Scientific Inc., SGS S.A., Bureau Veritas SA, Intertek Group Plc., ALS Limited, Microbac Laboratories, Inc. and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the primary drivers of the remarkable growth of the United States Environmental Testing Market is rising public awareness of environmental health. Another significant driver of the environmental testing market is the pressure exerted by regulatory bodies, which require regular testing and inspection of samples, and the environmental testing market has undergone a remarkable transformation with the introduction of advanced technologies. Remote sensing technology is another game changer in the environmental testing industry. This technology collects valuable data on air quality, water pollution, and deforestation by allowing for the monitoring of large and remote areas.

Restraining Factors

One of the primary obstacles these businesses face is the high cost of regulatory compliance. In addition to financial challenges, regulatory compliance raises the possibility of greenwashing, and the environmental testing market faces the difficult task of navigating an intricate regulatory landscape.

Market Segment

- In 2023, the rapid method segment accounted for the largest revenue share over the forecast period.

Based on technology, the United States environmental testing market is segmented into the conventional, and rapid method. Among these, the rapid method segment has the largest revenue share over the forecast period. The commercial sector's need for stable and time-efficient analytical equipment is an important factor behind the development of a rapid method for environmental testing. Contaminants in the environment, such as water, air, and soil, are becoming more prevalent as cities and industries grow. As a consequence, governments are launching initiatives and enacting regulations to limit the spread of contaminants from various industries. As such, the demand for rapid environmental testing methods has increased significantly. Furthermore, to promote the commercialization of testing equipment, governments, and private institutions are investing heavily in treatment and detection methods. These investments are intended to improve the efficiency and effectiveness of environmental testing, thereby creating profitable opportunities for market growth.

- In 2023, the organic compounds segment is witnessing significant growth over the forecast period.

Based on the contaminant, the United States environmental testing market is segmented into microbial contamination, organic compounds, heavy metals, residues, and solids. Among these, the organic compounds segment is witnessing significant growth over the forecast period. Organic contaminants contain carbon-based chemicals like organic solvents, pesticides, petroleum-based waste, timber, and volatile compounds in gas or liquid phases. These organic compounds are widely used in the manufacture of various products across industries. Unfortunately, some industries dispose of organic waste by land dumping or adding untreated industrial waste into septic systems, storm drains, sewer pipes, or natural bodies of water. However, as industries grow, there are also organic compound contaminants in the environment, driving demand for organic compounds in the United States environmental testing market over the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States environmental testing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Eurofins Scientific Inc.

- SGS S.A.

- Bureau Veritas SA

- Intertek Group Plc.

- ALS Limited

- Microbac Laboratories, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States Environmental Testing Market based on the below-mentioned segments:

United States Environmental Testing Market, By Technology

- Conventional

- Rapid Method

United States Environmental Testing Market, By Contaminant

- Microbial Contamination

- Organic Compounds

- Heavy Metals

- Residues

- Solids

Need help to buy this report?