United States Energy Bar Market Size, Share, and COVID-19 Impact Analysis, By Type (Activity Bars, Endurance Bars, Oat Bars, Protein Bars), By Nature (Organic, Conventional), By Distribution Channel (Convenience Stores, Hypermarkets & Supermarkets, Specialty Stores, Online Sales Channel), and United States Energy Bar Market Insights Forecasts 2023 – 2033

Industry: Food & BeveragesUnited States Energy Bar Market Insights Forecasts to 2033

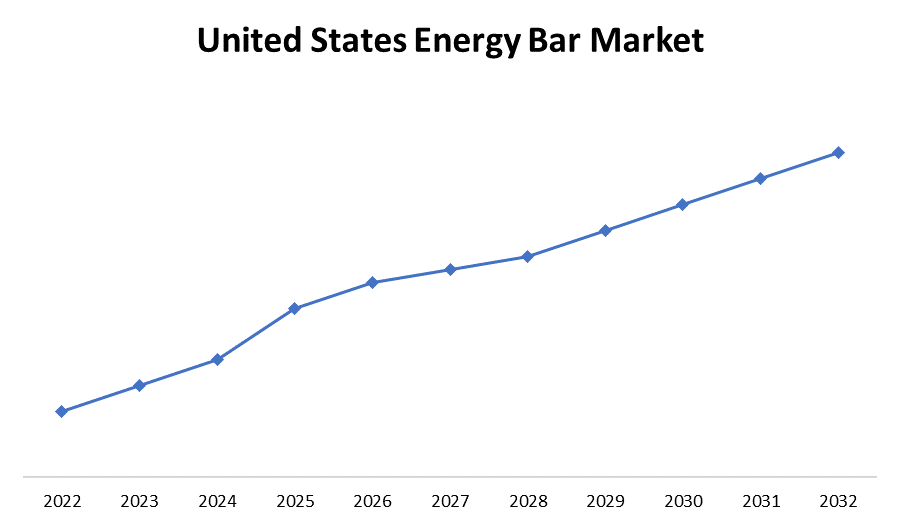

- The Market Size is Growing at a CAGR of 5.96% from 2023 to 2033.

- The United States Energy Bar Market Size is Expected to Hold a Significant Share by 2033.

Get more details on this report -

United States Energy Bar Market Size is Expected to Hold a Significant Share by 2033, at a CAGR of 5.96 % during the forecast period 2023 to 2033.

Market Overview

Energy Bar is a supplement bar that contains nutritive value and food benefits. The energy bar contains carbohydrates, fats, and proteins, which provide immediate energy and are frequently used as a meal replacement. It has several health benefits, including increasing metabolism, lowering cholesterol, and improving digestion. It is popular among millennials and the health-conscious population. The market is divided into activity bars, endurance bars, oat bars, protein bars, and others. The market is divided into convenience stores, hypermarkets, and supermarkets, online sales channels, specialty stores, and others based on the distribution channel. The increasing complexity of health care and the growing number of health-conscious people are expected to drive the energy bar market in the coming years. Furthermore, rising demand for energy foods, drinks, and other products is propelling market growth.

Report Coverage

This research report categorizes the market for the United States energy bar market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States energy bar market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States energy bar market.

United States Energy Bar Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.96 % |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Companies covered:: | The Kellogg Company, General Mills Inc., Clif Bar & Company, Abbott Nutrition Manufacturing Inc., GlaxoSmithKline Plc, Post Holdings, Inc., Nestle S.A., Quest Nutrition LLC, Kind LLC, Kate's Real Food, PepsiCo,and Others, |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising popularity of energy bars among athletes and young adults is expected to drive the growth of the energy bar market over the forecast period. Ingredient variations in snack products draw customers' attention, encouraging them to purchase such items based on their needs, thereby driving the energy bar market growth. Energy bar benefits, such as ease of consumption and disposable packaging, ensure the product's safety and increase demand for energy bars over the forecast period. The growing demand for diet foods has increased the consumption of low-carb and low-fat energy bars. Furthermore, as more people become aware of the health benefits of natural, chemical-free foods, the production of gluten-free and non-allergic nutrition foods has become more convenient. Furthermore, the rising prevalence of diabetes has increased the consumption of low-sugar foods, opening up new market opportunities.

Restraining Factors

Customer preferences and tastes for snack food products are constantly changing, which raises the cost of research, manufacturing, and distribution infrastructure for the major players, limiting the expansion of the energy bar market share. Furthermore, the widespread participation of local snack manufacturers has hampered the activities of United States industry participants.

Market Segment

- In 2023, the protein bars segment accounted for the largest revenue share over the forecast period.

Based on the type, the United States energy bar market is segmented into activity bars, endurance bars, oat bars, and protein bars. Among these, the protein bars segment has the largest revenue share over the forecast period. Protein bars are portable, high-protein snacks with a high carbohydrate content. It contains a lot of protein and other nutrients. Proteins in it promote protein synthesis, muscle growth, and fat loss. Increased health consciousness, shifting socioeconomic needs, and a lack of time to prepare nutritious food are driving a surge in demand for packaged and convenience foods. As a result, the protein bar market in the United States is projected to grow. To maintain a fit and healthy lifestyle, consumers choose weight management and energy goods such as protein bars. This lifestyle change is a major market driver for protein bars.

- In 2023, the organic segment accounted for a significant revenue share over the forecast period.

Based on nature, the United States energy bar market is segmented into organic, and conventional. Among these, the organic segment has a significant revenue share over the forecast period. Organic energy bars are high-nutritional-value snacks that are enriched with various vitamins and minerals to boost physical energy. Ingredients for organic energy bars are sourced from farms that do not use synthetic fertilizers or pesticides. Youth involvement in sports and physical activities is growing. The rising demand for healthy, organic, high-nutritional-value snacks, as well as the rising demand for sports nutrition, are expected to drive organic segment growth.

- In 2023, the specialty stores segment accounted for the largest revenue share over the forecast period.

Based on the distribution channel, the United States energy bar market is segmented into convenience stores, hypermarkets & supermarkets, specialty stores, and online sales channels. Among these, the specialty stores segment has the largest revenue share over the forecast period. A specialty store is a small retail establishment that specializes in a particular product line and related items. Consumers in the United States have made shopping a daily activity, and they typically prefer to analyze and evaluate a product before purchasing, increasing retail sales of energy bars through specialty stores. Specialty stores provide superior service, detailed product specifications, and expert advice to customers, resulting in increased product sales. Furthermore, these stores promote both international and private-label brands.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States energy bar market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Kellogg Company

- General Mills Inc.

- Clif Bar & Company

- Abbott Nutrition Manufacturing Inc.

- GlaxoSmithKline Plc

- Post Holdings, Inc.

- Nestle S.A.

- Quest Nutrition LLC

- Kind LLC

- Kate's Real Food

- PepsiCo

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2023, Jambar introduced a new energy bar line called "PowerBar." In 2023, the company plans to expand the footprint of category newcomer Jambar.

- In November 2022, CA Fortune, the company behind some of the world's largest health food brands, signed a distribution agreement with Lola Snacks. It also announced the launch of a crowdfunding campaign with StartEngine to raise USD 1 million in funds to support the brand's nationwide expansion over the next year.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States Energy Bar Market based on the below-mentioned segments:

United States Energy Bar Market, By Type

- Activity Bars

- Endurance Bars

- Oat Bars

- Protein Bars

United States Energy Bar Market, By Nature

- Organic

- Conventional

United States Energy Bar Market, By Distribution Channel

- Convenience Stores

- Hypermarkets & Supermarkets

- Specialty Stores

- Online Sales Channel

Need help to buy this report?