United States Electronic Drug Delivery Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Implantable Drug Delivery Devices, Smart Infusion Pumps, Smart Transdermal Patches, Smart Metered Dose Inhalers, and Others), By Application (Oncology, Diabetes, Cardiology, and Respiratory Devices), and US Electronic Drug Delivery Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUSA Electronic Drug Delivery Devices Market Insights Forecasts to 2035

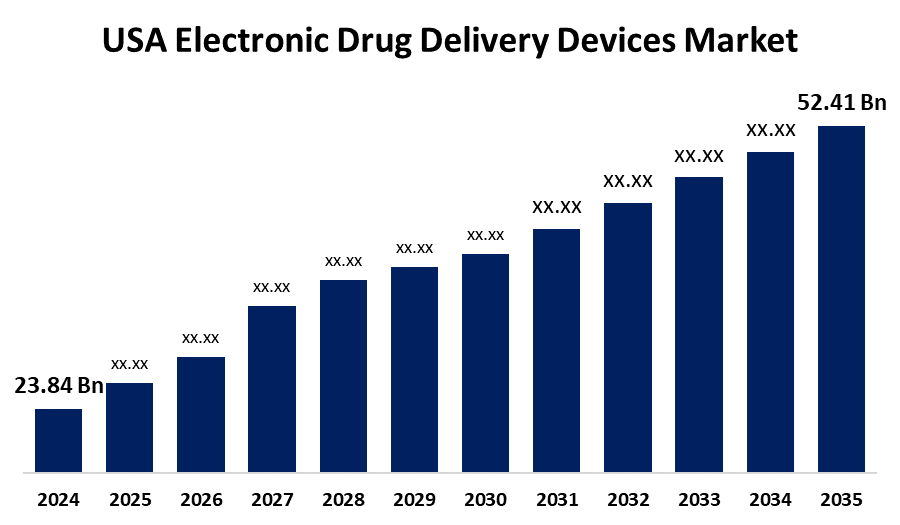

- The US Electronic Drug Delivery Devices Market Size Was Estimated at USD 23.84 Billion in 2024

- The Market Size is expected to grow at a CAGR of around 7.42% from 2025 to 2035

- The USA Electronic Drug Delivery Devices Market Size is expected to reach USD 52.41 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Electronic Drug Delivery Devices Market is anticipated to reach USD 52.41 billion by 2035, growing at a CAGR of 7.42% from 2025 to 2035. The market growth is attributed to the rising prevalence of chronic diseases, the increasing proportion of the geriatric population, and the growing trend of AI technologies and digitalization.

Market Overview

The market for electronic drug delivery devices in the US is centered on digitally enabled systems that enhance accuracy, convenience, and patient adherence through automated dosage, wireless connectivity, and real-time monitoring. Drugs can be delivered to the human body in a controlled, practical, and painless manner with the use of electronic drug delivery devices. Miniaturization and intelligence have been made possible by developments in microfabrication and microelectronics, which have integrated wireless communication modules and sensors. Commercialized on-demand drug delivery, improving patient adherence to dosages, enhancing caregivers' diagnosis accuracy, decreasing toxicity from dosage replication, and improving patient compliance through transdermal patches and edible electronic capsules all depend on these technologies. Transdermal patches or electronic micropumps can enhance transdermal drug delivery effectiveness, decrease injection pain, and boost drug bioavailability. Digestible capsules can deliver medications to precise places without damaging surrounding tissues, and microchips offer real-time data about patients' health. Patients with diabetes can also effectively manage their insulin dosage with the aid of electronic pumps. Examples of electronic drug delivery devices are insulin pumps, transdermal patches, microchips, electronic capsules, etc. Drug distribution has been transformed by digital technology, which increases safety and precision. Direct patient data gathering is made possible by developments in information technology, computing platforms, and electronic sensors. Smart medication delivery devices that are linked to digital monitoring systems, cloud platforms, and smartphone apps allow for real-time tracking and management, improving patient adherence, treatment effectiveness, and the number of in-person visits. Therefore, considering idealistic features of the electronic drug delivery devices and growing use by patients facilitates the growth of the market.

Report Coverage

This research report categorizes the market for the US electronic drug delivery devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US electronic drug delivery devices market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US electronic drug delivery devices market.

United States Electronic Drug Delivery Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 23.84 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.42% |

| 2035 Value Projection: | USD 52.41 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 185 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Insulet Corporation, United Therapeutics Corporation, Abbott, Johnson and Johnson, BD, Medtronic, Tandem Diabetes Care, Inc. and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for electronic medicine delivery systems is expanding as a result of rising chronic disease rates and consumer preference for at-home treatment. Home healthcare lowers healthcare costs and improves patient outcomes while providing patients with convenience, comfort, and privacy. In home healthcare, devices such as insulin pumps, auto-injectors, wearable infusion pumps, and pre-filled syringes are becoming essential tools that enable patients to self-administer medications with little help. With developments in materials science, biotechnology, and microelectronics propelling the creation of complex gadgets like implanted medication delivery systems, patch pumps, and smart inhalers, the sector is known for its high level of innovation. Trends in personalized medicine also encourage the use of gadgets that are specially made to meet the demands of each patient. The market is being driven by factors such as the expanding geriatric population, wearable and implantable devices, minimally invasive drug delivery, the integration of AI and machine learning, and the growth of telemedicine and remote monitoring. These elements support the market expansion for electronic drug delivery devices.

Restraining Factors

High development and manufacturing costs, regulatory obstacles, product recalls and safety concerns, low patient knowledge and uptake, data security and privacy difficulties, affordability high production costs which hinders the growth of the market.

Market Segmentation

The USA electronic drug delivery devices market share is classified into product and application.

- The implantable drug delivery devices segment held the largest market share of 31.83% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US electronic drug delivery devices market is segmented by product into implantable drug delivery devices, smart infusion pumps, smart transdermal patches, smart metered dose inhalers, and others. Among these, the implantable drug delivery devices segment held the largest market share of 31.83% in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the need for frequent injections is decreased by drug administration devices, which are implanted beneath the skin and provide continuous, regulated delivery of medication straight into the bloodstream. In addition to treating a variety of medical diseases like cancer, chronic pain, hormonal imbalances, and neurological disorders, these devices are perfect for people with hectic schedules. They offer direct medication delivery, localized treatment, fewer side effects, and better therapeutic results.

- The diabetes segment accounted for the largest share in 2024 and is predicted to grow at a significant CAGR during the forecast period.

The US electronic drug delivery devices market is segmented by application into oncology, diabetes, cardiology, and respiratory devices. Among these, the diabetes segment accounted for the largest share in 2024 and is predicted to grow at a significant CAGR during the forecast period. The sector growth is driven by the increasing prevalence of diabetes in the US, poor diet, physical inactivity, and genetic predisposition. Insulin pens and pumps offer convenience, accuracy, comfort, treatment adherence, and may reduce healthcare costs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US electronic drug delivery devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Insulet Corporation

- United Therapeutics Corporation

- Abbott

- Johnson and Johnson

- BD

- Medtronic

- Tandem Diabetes Care, Inc.

- Others

Recent Developments:

- In September 2023, ARPA-H, a U.S. Department of Health and Human Services agency, has launched a program to develop new technologies that will automatically deliver treatments and monitor disease within an individual's body, aiming to improve patient self-care and reduce the need for invasive and expensive long-term treatments.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US electronic drug delivery devices market based on the below-mentioned segments:

US Electronic Drug Delivery Devices Market, By Product

- Implantable Drug Delivery Devices

- Smart Infusion Pumps

- Smart Transdermal Patches

- Smart Metered Dose Inhalers

- Others

US Electronic Drug Delivery Devices Market, By Application

- Oncology

- Diabetes

- Cardiology

- Respiratory Devices

Need help to buy this report?