United States Electronic Contract Manufacturing and Design Services Market Size, Share, and COVID-19 Impact Analysis, By Type (Electronic Design & Engineering, Electronic Assembly, Electronic Manufacturing, Others), By Technology (Computers, Networking, Consumer Devices, Servers and Storage, Telecommunications, Peripherals, Others), By End-Use (Healthcare, Automotive, Industrial, Aerospace & Defense, IT & Telecom, Power & Energy, Consumer Electronics, Others), and US Electronic Contract Manufacturing and Design Services Market Insights Forecasts to 2032

Industry: Electronics, ICT & MediaUnited States Electronic Contract Manufacturing and Design Services Market Insights Forecasts to 2032

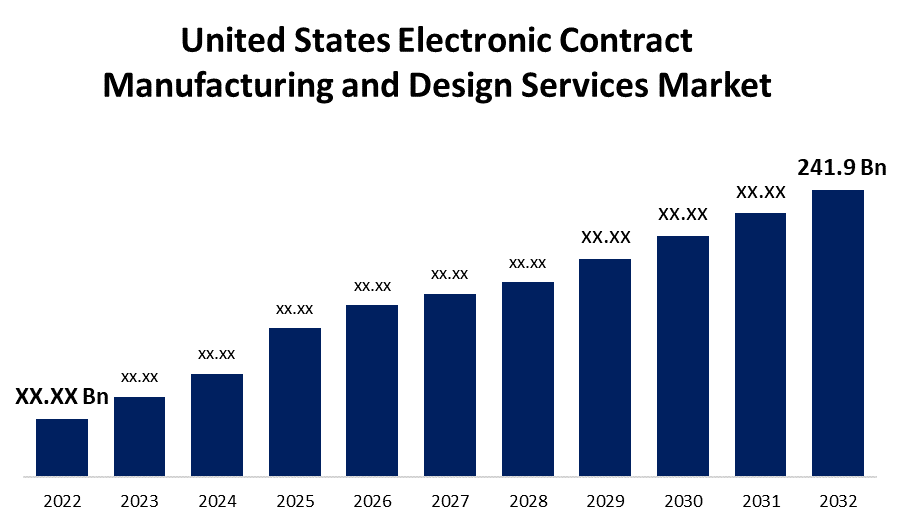

- The U.S. Electronic Contract Manufacturing and Design Services Market Size is expected to reach USD 241.9 billion by 2032.

- The market is growing at a CAGR of 8.7% from 2022 to 2032.

The United States Electronic Contract Manufacturing and Design Services Market Size is expected to reach USD 241.9 billion by 2032, at a CAGR of 8.7% during the forecast period 2022 to 2032.

Get more details on this report -

Market Overview

Engineering and manufacturing outsourcing (ECM) companies provide a wide range of important industrial capabilities. A contract manufacturer's facility determines the ECM & design facilities model by focusing on economies of scale in services, manufacturing design knowledge, material procurement & production, and regrouping resources, as well as providing value-added services such as warranty and maintenance. Furthermore, some businesses provide specialized services such as product design, prototype development, high-volume production, global shipping and distribution, electronics supply chain administration, and occasionally repair offerings. Outsourcing auxiliary duties also allows OEMs to concentrate on their core strengths, improving operational productivity and minimizing manufacturing costs while reducing fixed capital investment needs. The market for electronic contract manufacturing and design services in the United States is experiencing explosive growth as consumer electronics demand continues to grow. The healthcare and automotive industries are major sectors determining the development of the market in the United States, owing to a growing emphasis on research and development initiatives, the significant presence of major vendors, and the rapid utilization of cutting-edge technology along with the convenience of access to rapid internet access. In addition, a boom in demand for electric vehicles has culminated in an increased requirement for companies to outsource their electrical manufacturing in the country.

Report Coverage

This research report categorizes the market for the United States Electronic Contract Manufacturing and Design Services Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. Electronic Contract Manufacturing and Design Services Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States Electronic Contract Manufacturing and Design Services Market.

Driving Factors

Electronic contract manufacturing and design services are generally focused on innovations and auxiliary technologies such as computing devices, appliances, network connectivity, storage and server technology, internet access, and additional services. The primary driver of the electronic contract manufacturing and design services industry is the need for effective utilization of resources. In addition, increasing smartphone use and easy access to reliable and enhanced internet connections, notably in developed nations such as the United States, has led to higher utilization of these services recently and will probably keep increasing in the coming years. Additionally, the continued presence of significant market players and their increasing number of innovations in the United States is contributing to market evolution and development. Furthermore, increased adoption of electric vehicles, as well as investments made by the government and key manufacturing businesses to encourage electric vehicle sales, is also expected to provide a more favorable marketplace for this type of outsourcing service. The adoption of new connectivity technologies in automated automobiles or cars that use IoT is also expected to generate market growth prospects over the forecast period.

Market Segment

- In 2022, the electronic manufacturing segment accounted for the largest revenue share of more than 46.3% over the forecast period.

On the basis of type, the U.S. Electronic Contract Manufacturing and Design Services Market is segmented into electronic design & engineering, electronic assembly, electronic manufacturing, and others. Among these, the electronic manufacturing segment is dominating the market with the largest revenue share of 46.3% over the forecast period. Because of an increase in the proclivity of original equipment manufacturers to outsource design requirements. There is a greater emphasis on choosing services for numerous electronic devices, including tablets and mobile phones, which all contribute to market growth over the forecast period.

- In 2022, the telecommunications segment is witnessing a higher growth rate over the forecast period.

Based on the technology, the U.S Electronic Contract Manufacturing and Design Services Market is segmented into computers, networking, consumer devices, servers and storage, telecommunications, peripherals, and others. Among these, the telecommunications segment is witnessing a higher growth rate over the forecast period. With ever-increasing client needs, this market is continually adopting innovative technological solutions. Electronic contract manufacturing and design services boost the versatility and adaptability of technical products in response to market demands. The industry typically outsources these services to provide individualized and customized solutions while competently managing large-scale manufacturing and client variation demand.

- In 2022, the consumer electronics segment accounted for the largest revenue share of more than 27.4% over the forecast period.

On the basis of end-use, the U.S. Electronic Contract Manufacturing and Design Services Market is segmented into healthcare, automotive, industrial, aerospace & defense, IT & telecom, power & energy, consumer electronics, and others. Among these, the consumer electronics segment is dominating the market with the largest revenue share of 27.4% over the forecast period. Consumer electronics are in tremendous demand, necessitating the use of electronic component outsourcing from contract manufacturing companies. This reduces the expenditures of manufacturing, product assembly, and design services while increasing production operating efficiency. As a result, an upsurge in consumer electronics demand is driving a rise in the number of electronic contract manufacturing and design services.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States Electronic Contract Manufacturing and Design Services Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Flex Ltd.

- Jabil Inc.

- Sanmina Corporation

- Federal Electronics

- Benchmark Electronics Inc

- Key Tronic Corporation

- Kimball Electronics, Inc.

- Plexus Corp.

- Vexos Corporation

- TTM Technologies, Inc.

- Interconnect Solutions Company (ISC)

- Vergent Products

- SCI Systems

- Z-AXIS, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On September 2023, Vexos, a leading global provider of Electronic Manufacturing Services (EMS) and Custom Material Solutions (CMS), announced the successful purchase of ControlTek, a cutting-edge manufacturing facility situated in Vancouver. The acquisition of ControlTek expands Vexos' reach to the West Coast of North America, allowing the company to better fulfill the rising demands of its customers and support future expansion.

- On October 2023, Ark Electronics, a leading global contract manufacturer specializing in end-to-end electronic manufacturing solutions (EMS) and PCB Assembly, announced that it has received the International Organization for Standards (ISO) Medical Equipment Quality Management Certification. Earning this certification validates Ark Electronics' ability to provide medical devices and related services that consistently meet customer and applicable regulatory requirements, including design and development, production, storage and distribution, installation, or servicing of a medical device; and design and development or provision of associated activities (e.g. technical support).

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the U.S. Electronic Contract Manufacturing and Design Services Market based on the below-mentioned segments:

United States Electronic Contract Manufacturing and Design Services Market, By Type

- Electronic Design & Engineering

- Electronic Assembly

- Electronic Manufacturing

- Others

United States Electronic Contract Manufacturing and Design Services Market, By Technology

- Computers

- Networking

- Consumer Devices

- Servers and Storage

- Telecommunications

- Peripherals

- Others

United States Electronic Contract Manufacturing and Design Services Market, By End-Use

- Healthcare

- Automotive

- Industrial

- Aerospace & Defense

- IT & Telecom

- Power & Energy

- Consumer Electronics

- Others

Need help to buy this report?