United States Electronic Bill Presentment Payment Market Size, Share, and COVID-19 Impact Analysis, By Product (Electronic Bill Presentment, Electronic Bill Payment, Electronic Bill Posting), By Application (Billers, Consumers, Bill Consolidator, Banks & Financial Institutions), By Channel (Application Programming Interface (API), Mobile, Web, Email, IVR, POS, Kiosk), and United States Electronic Bill Presentment Payment Market Insights Forecasts to 2033

Industry: Electronics, ICT & MediaUnited States Electronic Bill Presentment Payment Market Insights Forecasts to 2033

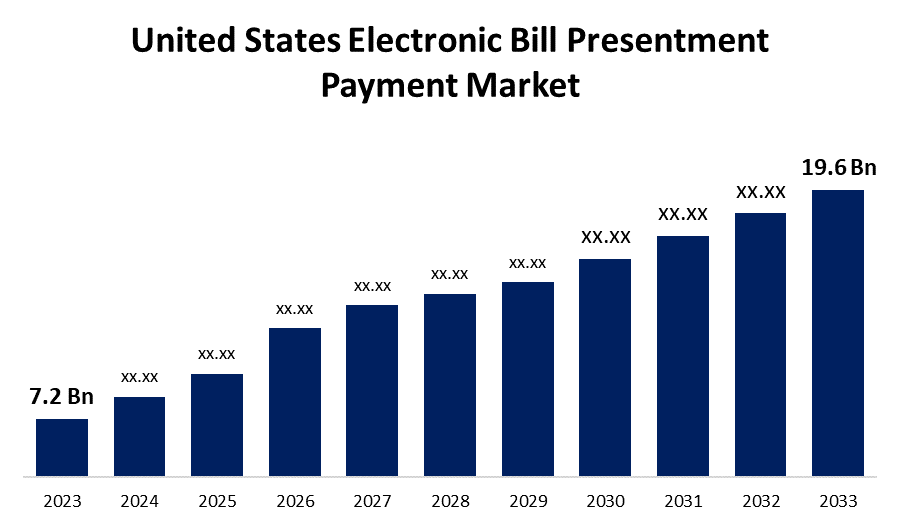

- The United States Electronic Bill Presentment Payment Market Size was valued at USD 7.2 Billion in 2023.

- The Market Size is Growing at a CAGR of 10.5% from 2023 to 2033.

- The United States Electronic Bill Presentment Payment Market Size is Expected to Reach USD 19.6 Billion by 2033.

Get more details on this report -

The United States Electronic Bill Presentment Payment Market Size is Expected to Reach USD 19.6 Billion by 2033, at a CAGR of 10.5% during the forecast period 2023 to 2033.

Market Overview

Electronic bill presentment and payment is a process that enables bills to be created, delivered, and paid online. One of the major trends driving demand for electronic bill presentment and payment solutions across various industry verticals is the changing global payment landscape, which has resulted in increased adoption of debit and credit cards. Banks and financial institutions have played a significant role in driving this transformation by providing debit cards to all account holders. Electronic bill presentment is also known as e-billing or e-invoicing. In the United Kingdom, the number of digital payment users increased to more than 600 million, which had a positive impact on the electronic bill presentation and payment market.

The United States electronic bill presentment payment (EBPP) market is expanding rapidly, owing to the convergence of technological advancements and changing consumer preferences. This billion-dollar market represents a significant shift toward digital payment methods. EBPP solutions provide businesses and consumers with a streamlined, secure, and efficient method of managing bills and payments electronically. The growing popularity of online and mobile platforms, combined with a desire for more convenient and immediate transactions, has fueled the growth of United States electronic bill presentment payment (EBPP) market.

Report Coverage

This research report categorizes the market for United States electronic bill presentment payment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States electronic bill presentment payment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States electronic bill presentment payment market.

United States Electronic Bill Presentment Payment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.2 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 10.5% |

| 2033 Value Projection: | USD 19.6 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application, By Channel, and COVID-19 Impact Analysis. |

| Companies covered:: | Fiserv, Inc., ACI Worldwide, Bottomline Technologies, Jack Henry & Associates, Doxo, Paymentus, Visa, Inc., Mastercard, PayPal, CheckFree, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The pervasive digital transformation across industries has had a significant impact on the Electronic Bill Presentment and Payment (EBPP) market. Technological advancements have fundamentally altered the dynamics of business-to-consumer interactions and the orchestration of financial transactions. Corporations are enthusiastically embracing sophisticated billing and payment systems, leveraging cutting-edge innovations such as AI, machine learning, and data analytics to infuse a personalized element into the billing experience. The combination of these technological innovations seamlessly integrates into the billing infrastructure, resulting in a streamlined process, automated invoicing, and increased customer engagement. Furthermore, the widespread availability of mobile devices and the internet's ubiquitous reach have created a world of instant access to billing data, allowing for quick payments and easy bill management. This seamless integration of technology has not only increased operational efficiency, but has also catalyzed an increase in customer satisfaction, propelling the market forward. This shift toward a more technologically advanced, consumer-centric landscape represents a significant evolution in the EBPP realm, fundamentally altering how transactions are orchestrated and experienced in today's business ecosystem.

Restraining Factors

One of the most significant constraints confronting the EBPP market is the ongoing concern about security and data privacy. As electronic transactions become more common, the risk of cyber-attacks and data breaches rises. Both businesses and consumers are concerned about potential vulnerabilities in online payment systems. Security breaches not only jeopardize sensitive financial information, but they also undermine trust in the entire billing and payment system.

Market Segment

- In 2023, the electronic bill payment segment accounted for the largest revenue share over the forecast period.

Based on the product, the United States electronic bill presentment payment market is segmented into electronic bill presentment, electronic bill payment, and electronic bill posting. Among these, the electronic bill payment segment has the largest revenue share over the forecast period. The Electronic Bill Payment segment experienced significant growth due to its critical role in allowing consumers and businesses to conveniently pay their bills electronically. This dominance is due to consumers' growing preference for streamlined, hassle-free payment methods. The ease of managing various bills through online platforms, coupled with the increasing adoption of mobile payment applications, has pushed the electronic bill payment segment to the forefront.

- In 2023, the consumers segment accounted for the largest revenue share over the forecast period.

Based on the application, the United States electronic bill presentment payment market is segmented into billers, consumers, bill consolidator, and banks & financial institutions. Among these, the consumers segment has the largest revenue share over the forecast period. The consumer-centric segment rose to prominence as individuals became more reliant on electronic billing and payment solutions. The evolution of consumer behavior toward digital preferences, combined with the convenience and flexibility provided by these systems, contributed to this segment's dominance. Consumers' preference for managing their bills online, using mobile applications, and seeking secure, instantaneous payment methods has been a driving force behind this dominance.

- In 2023, the mobile segment accounted for the largest revenue share over the forecast period.

Based on the channel, the United States electronic bill presentment payment market is segmented into application programming interface (API), mobile, web, email, IVR, POS, and kiosk. Among these, the mobile segment has the largest revenue share over the forecast period. The rise in mobile channel dominance can be attributed to the widespread use of smartphones and the growing reliance on mobile applications for bill management and payment processing. Mobile platforms' convenience and accessibility have resonated strongly with consumers, allowing them to view bills, schedule payments, and receive notifications on handheld devices. Furthermore, the growing preference for contactless and on-the-go payment methods, fueled by the global pandemic, has strengthened the mobile channel's dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States electronic bill presentment payment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fiserv, Inc.

- ACI Worldwide

- Bottomline Technologies

- Jack Henry & Associates

- Doxo

- Paymentus

- Visa, Inc.

- Mastercard

- PayPal

- CheckFree

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2023, SecurePay, a leading financial technology company, has implemented an enhanced security framework within its EBPP platform, demonstrating its commitment to protecting sensitive financial information and maintaining consumer trust. To protect against potential security threats, the upgraded system includes strong encryption protocols, multi-factor authentication, and real-time monitoring. SecurePay's proactive approach to security demonstrates the growing importance of data protection and compliance with stringent regulations in the US EBPP market.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States electronic bill presentment payment market based on the below-mentioned segments:

United States Electronic Bill Presentment Payment Market, By Product

- Electronic Bill Presentment

- Electronic Bill Payment

- Electronic Bill Posting

United States Electronic Bill Presentment Payment Market, By Application

- Billers

- Consumers

- Bill Consolidator

- Banks & Financial Institutions

United States Electronic Bill Presentment Payment Market, By Channel

- Application Programming Interface (API)

- Mobile

- Web

- IVR

- POS

- Kiosk

Need help to buy this report?