United States Electrical Naval Actuators Market Size, Share, and COVID-19 Impact Analysis, By Type (Linear, Rotary Actuators), By System (Electrical, Electro-Mechanical, Electrohydraulic Actuators), By Component (Cylinders, Drives, Servo Valves, Manifolds), and US Electrical Naval Actuators Market Insights Forecasts to 2032

Industry: Aerospace & DefenseUnited States Electrical Naval Actuators Market Insights Forecasts to 2032

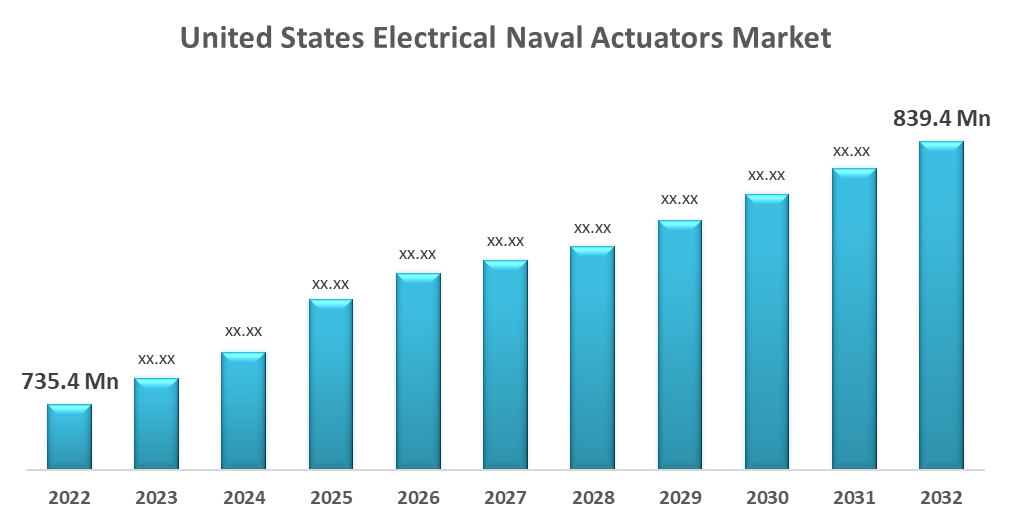

- The United States Electrical Naval Actuators Market Size was valued at USD 735.4 Million in 2022.

- The Market Size is Growing at a CAGR of 1.3% from 2022 to 2032.

- The United States Electrical Naval Actuators Market Size is expected to reach USD 839.4 Million by 2032.

Get more details on this report -

The United States Electrical Naval Actuators Market Size is expected to reach USD 839.4 Million by 2032, at a CAGR of 1.3% during the forecast period 2022 to 2032.

Market Overview

A naval ship actuator is a moving mechanical component of a machine that controls the ship's system. This mechanical part is externally powered by an energy source, which is converted into controlled motion by type linear and rotary actuators. The direction of control motion can be either linear to rotary or rotary to linear. Electric linear actuators provide numerous benefits to the marine industry because they are the most effective solution for handling passages, hatches, and watertight and fire doors. On the naval front, the emergence of new technologies such as high-power radars and long-range targeting systems is pushing nations to modernize and improve their naval capabilities. Because actuators and valves are critical components of all naval vessel subsystems, the introduction of new naval vessels places parallel demands on actuators and valves to ensure system performance as specified. The growing popularity of advanced naval joint combat systems is expected to create new opportunities for the expansion of the United States electrical naval actuators market share.

Report Coverage

This research report categorizes the market for the United States electrical naval actuators market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States electrical naval actuators market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States electrical naval actuators market. By the US Navy, Moog Inc. has been awarded a USD 33.8 million contract to supply over 1,000 electrical naval actuators for the next-generation Virginia Class submarines. The contract is part of General Dynamics Electric Boats' multi-year Block IV plan, which includes another Newport News Shipbuilding contract by 2023. During the forecast period, this development is expected to drive market growth.

United States Electrical Naval Actuators Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Forecast Period: | 2022-2032 |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing use of electric actuators in industrial robots and automation is driving the market. With technological advances, rising labor costs, and increased competition, the use of automated solutions in the defense sector is increasing. In addition, the need for shorter product lifecycles and customization has created a demand for robotics in the defense industry. The increasing deployment of robots has increased demand for electric actuators, which is driving market growth.

Restraining Factors

The high initial setup cost for end-users of electric actuators is a major challenge impeding market growth. When compared to other alternatives such as pneumatic actuators and hydraulic actuators, the capital required to set up electric actuators in the marine and defense industries is high. As a result, businesses opt for substitute products, limiting market growth.

Market Segment

- In 2022, the rotary actuator segment is expected to hold the largest share of the United States electrical naval actuators market during the forecast period.

Based on the type, the United States electrical naval actuators market is classified into linear actuators and rotary actuators. Among these, the rotary actuator segment is expected to hold the largest share of the United States electrical naval actuators market during the forecast period. Depending on the type of actuation, different actuators are used in naval applications. Rotary actuators are simple to build and operate with little effort. They are used in a variety of applications, operate quickly, and are more reliable than other naval actuators. Rotary actuators are preferred over others in naval applications due to their ease of use. As a result, demand for rotary actuators is expected to rise further over the forecast period.

- In 2022, the electro-mechanical segment accounted for the largest revenue share over the forecast period.

Based on the system, the United States electrical naval actuators market is segmented into electrical, electro-mechanical, and electrohydraulic actuators. Among these, the electro-mechanical segment has the largest revenue share over the forecast period. Electro-mechanical actuators contribute the maximum share in the market owing to their high demand and their best-performing motions for different applications. For instance, VSSC (Indian Space Research Organization) awarded a contract to Hical in May 2022 for Electromechanical Actuators for thrust vector control applications of their PSLV, GSLV, and GSLVMk3 satellite launch vehicles. Electro-mechanical drives are mechanical drives in which an electric motor replaces the control knob or handle.

- In 2022, the manifold segment accounted for the largest revenue share over the forecast period.

Based on the components, the United States electrical naval actuators market is segmented into cylinders, drives, servo valves, and manifolds. Among these, the manifold segment has the largest revenue share over the forecast period. Heating in the floor manifolds controls the flow of liquid through the system, ensuring that the temperature is consistent across the entire floor. The Unfractionated Heparin underfloor heating system UFH system is built around manifolds. They serve as the link between the supply and return lines. Each manifold is made up of a flow and a return manifold. Each manifold has a flow meter that measures the flow rate. A valve opens and closes in each loop. The actuator valve controls the manifold valve, which controls the thermostat in smart room. As a result of its complex performance capability, the market demand for manifolds increased.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States electrical naval actuators market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Moog Inc.

- Honeywell International Inc.

- Emerson Electric Co.

- Curtiss Wright Corporation

- Rockwell Automation Inc.

- Woodward Inc.

- Flowserve Corporation

- Schlumberger Ltd.

- Huntington Ingalls Industries

- Watts

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2023, Austal USA announced that they had been awarded a USD 113.9 million contract to provide detailed design services for the US Navy's auxiliary general ocean surveillance ship (AGOS 25 class). Austal USA was awarded the contract under the Fixed-price Incentive (FTP) and Firm-Fixed-price Contract (FFP).

- In April 2022, Newport News Shipbuilding awarded Hunt Valve, a Fairbanks Morse Defense (FMD) subsidiary, a USD 2 million contract to supply valves and electro-mechanical actuators for Ford Class aircraft carriers for the United States Navy's next-generation aircraft carrier program.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the United States electrical naval actuators market based on the below-mentioned segments:

United States Electrical Naval Actuators Market, By Type

- Linear

- Rotary Actuators

United States Electrical Naval Actuators Market, By System

- Electrical

- Electro-Mechanical

- Electrohydraulic Actuators

United States Electrical Naval Actuators Market, By Component

- Cylinders

- Drives

- Servo Valves

- Manifolds

Need help to buy this report?