United States Elastomers Market Size, Share, and COVID-19 Impact Analysis, By Type (Thermoplastics and Thermosets), By End Use (Automotive, Medical, Consumer Goods, Industrial, and Others), and United States Elastomers Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Elastomers Market Insights Forecasts to 2035

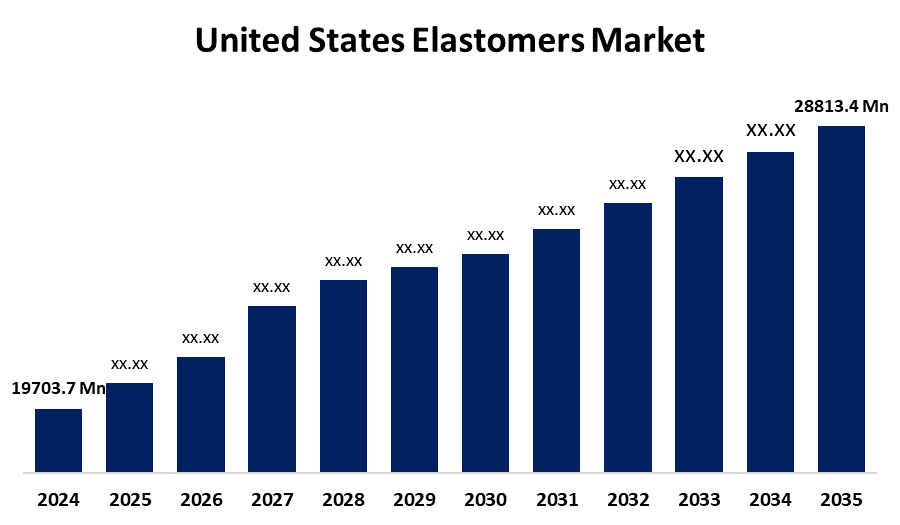

- The US Elastomers Market Size Was Estimated at USD 19703.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.52% from 2025 to 2035

- The US Elastomers Market Size is Expected to Reach USD 28813.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Elastomers Market is anticipated to reach USD 28813.4 million by 2035, growing at a CAGR of 3.52% from 2025 to 2035. The expansion of the United States elastomers market is propelled by the automotive industry's growing need for lightweight, high-performance materials because elastomers offer crucial qualities, including chemical resistance and durability.

Market Overview

An elastomer is a polymeric substance that possesses both elasticity and viscoelasticity, a property known as viscoelasticity. As these versatile polymers continue to be utilized across various industries, the demand for elastomers in the US has seen a significant rise. Rubber and other elastomers are known for their remarkable ability to bounce back to their original shape after being deformed. This unique trait makes elastomers crucial in many sectors, including consumer products, healthcare, construction, and automotive. In the automotive industry, elastomers play a vital role in tire production, providing the flexibility, durability, and traction necessary for safe and efficient vehicle operation. They are also commonly found in automotive hoses, gaskets, and seals, enhancing the overall performance and lifespan of vehicles. In construction, elastomers are widely used in adhesives, sealants, and roofing materials. Due to their elastic properties, they are ideal for creating durable, weather-resistant building materials that can withstand environmental challenges. Additionally, elastomers are incorporated into sealants and adhesives to boost the durability and structural integrity of buildings, ensuring the reliability of construction materials.

The U.S. government has supported the elastomers business through a number of strategic programs, primarily through the National Science Foundation, Department of Energy, and infrastructure legislation. DOE-supported research promotes elastomer-based innovations, such as Bridgestone’s pilot project financed by the Industrial Efficiency and Decarbonisation Office, which transforms ethanol into bio-based butadiene for synthetic rubber.

Report Coverage

This research report categorizes the market for the United States elastomers market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States elastomers market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States elastomers market.

United States Elastomers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 19703.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.52% |

| 2035 Value Projection: | USD 28813.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Type, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | ExxonMobil, DuPont de Nemours Inc, Huntsman Corp, Dow, Kraton Corporation, Eastman Chemical Company, 3M, RTP Company, PolymaxTPE, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States elastomers market is boosted by the automotive sector's demand. Over the years, automotive elastomers, especially thermoplastic elastomers (TPEs), styrene-butadiene rubbers (SBR), and nitrile butadiene rubbers (NBR), have gained immense popularity in the car industry. This is largely due to their remarkable flexibility, durability, and resistance to heat, wear, and chemicals. It finds these materials in a variety of automotive components, such as tires, tray panels, hoses, gaskets, seals, and weatherstripping. As vehicle technology advances and the push for lightweight materials to enhance fuel efficiency grows, especially with electric vehicles, the demand for elastomers is set to rise. These materials manage to maintain their strength and flexibility while helping to reduce the overall weight of devices.

Restraining Factors

The United States elastomers market faces obstacles like the unpredictable pricing of raw materials. Elastomers, particularly synthetic rubbers like SBR and NBR, rely heavily on oil-based raw materials. Various factors, including supply chain issues, conflicts, natural disasters, and global oil price fluctuations, can lead to sudden changes in these material costs.

Market Segmentation

The United States elastomers market share is classified into type and end use.

- The thermosets segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States elastomers market is segmented by type into thermoplastics and thermosets. Among these, the thermosets segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the impressive qualities of thermosets, such as their ability to withstand high temperatures, chemical stability, and overall durability, which fuel their growing popularity. These materials are ideal for tough applications in the automotive, aerospace, and construction industries due to these very traits. Moreover, their ability to maintain structural integrity under extreme conditions makes them particularly appealing for products like tires and seals.

- The automotive segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end use, the United States elastomers market is segmented into automotive, medical, consumer goods, industrial, and others. Among these, the automotive segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the need for strong, lightweight materials that enhance vehicle performance and efficiency. As automakers aim to reduce emissions and improve fuel economy, elastomers provide essential features like flexibility, heat resistance, and chemical stability.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States elastomers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ExxonMobil

- DuPont de Nemours Inc

- Huntsman Corp

- Dow

- Kraton Corporation

- Eastman Chemical Company

- 3M

- RTP Company

- PolymaxTPE

- Others

Recent Development

- In March 2024, Dow introduced a new polyolefin elastomer (POE) based alternative to leather, targeting the automotive industry’s shift toward animal-free products. This innovation, developed in partnership with HIUV Materials Technology, offers advantages such as enhanced softness, color stability, and resistance to aging and low temperatures. Furthermore, it is lighter than PVC leather and free from hazardous chemicals. Dow anticipates expanding this elastomer-based solution into various consumer sectors, including fashion and furniture.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States elastomers market based on the following segments:

United States Elastomers Market, By Type

- Thermoplastics

- Thermosets

United States Elastomers Market, By End Use

- Automotive

- Medical

- Consumer Goods

- Industrial

- Others

Need help to buy this report?