United States Edge Computing Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, Software/Solutions, and Services), By Deployment (On-Premise and On-Cloud), By Industry Vertical (BFSI, IT & Telecommunication, Retail, Manufacturing, and Others), and United States Edge Computing Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited States Edge Computing Market Insights Forecasts to 2035

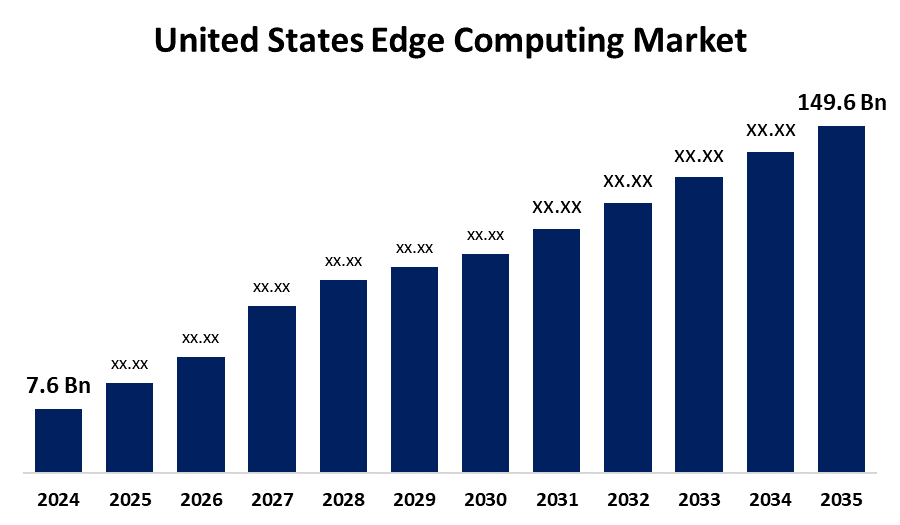

- The United States Edge Computing Market Size was Estimated at USD 7.6 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 31.11% from 2025 to 2035

- The United States Edge Computing Market Size is Expected to Reach USD 149.6 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United States edge computing market Size is anticipated to reach USD 149.6 Billion by 2035, growing at a CAGR of 31.11% from 2025 to 2035. The United States edge computing market is growing due to increased demand for real-time data processing, rising adoption of IoT devices, and the need for reduced latency in applications like autonomous vehicles and smart cities. Enhanced data security, cloud integration, and advancements in 5G technology further drive market expansion across industries.

Market Overview

The United States edge computing market refers to the deployment of computing resources closer to data sources, such as IoT devices, sensors, and local servers, to enable real-time data processing, reduce latency, and optimize bandwidth usage. This market is witnessing robust growth driven by the rapid expansion of IoT devices, the need for real-time analytics, and the proliferation of applications requiring low-latency responses, including autonomous vehicles, industrial automation, smart cities, and remote healthcare. A major strength of edge computing lies in its ability to support decentralized processing, reduce network congestion, and enhance data privacy by minimizing reliance on centralized cloud infrastructure. Additionally, advancements in AI, 5G connectivity, and edge hardware and software are fueling innovation and expanding use cases across sectors such as manufacturing, healthcare, retail, and telecommunications. The market presents significant opportunities in rural connectivity, predictive maintenance, and smart infrastructure. U.S. government initiatives, such as funding for broadband expansion and support for AI and smart city projects, are helping drive adoption.

Report Coverage

This research report categorizes the market for the United States edge computing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States' edge computing market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States edge computing market.

United States Edge Computing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7.6 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 31.11% |

| 2035 Value Projection: | USD 149.6 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 277 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Component, By Deployment and By Industry Vertical |

| Companies covered:: | Amazon Web Services, Microsoft Corporation, Google LLC, IBM Corporation, Dell Technologies, Hewlett-Packard Enterprise, Cisco Systems, Inc., Intel Corporation, EdgeConneX, Vapor IO, Fastly, Inc., Akamai Technologies, ClearBlade, Inc., Section.io, Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing demand for real-time data processing, reduced latency, and improved bandwidth efficiency across industries. The rapid growth of IoT devices, autonomous systems, and smart infrastructure has made edge computing essential for handling large volumes of data near the source. Advancements in 5G networks have further accelerated adoption by enabling faster and more reliable data transmission. Industries such as manufacturing, healthcare, and retail rely on edge computing to support automation, predictive maintenance, and personalized services. Government initiatives promoting digital transformation and broadband expansion also contribute to market growth. Additionally, increased focus on data privacy, reduced cloud dependency, and the need for resilient decentralized systems further drive the market.

Restraining Factors

The high initial infrastructure costs and complexity in integrating with existing systems. Limited skilled workforce and concerns over data security and privacy also slow adoption. Additionally, a lack of standardized frameworks and challenges in managing distributed networks hinder seamless deployment, restricting rapid market growth despite increasing demand for edge solutions.

Market Segmentation

The United States' Edge Computing Market share is classified into component, deployment, and industry vertical.

- The hardware segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States edge computing market is segmented by component into hardware, software/solutions, and services. Among these, the hardware segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the growing need for edge servers, gateways, and networking devices that enable real-time data processing closer to the source. Increased investments in infrastructure to support IoT, AI applications, and low-latency requirements have driven strong demand for robust and scalable edge hardware solutions.

- The on-premise segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States edge computing market is segmented by deployment into on-premise and on-cloud. Among these, the on-premise segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to organizations prioritizing data security, privacy, and low latency. Many industries prefer on-premise deployment to maintain control over sensitive data and ensure faster processing, especially in sectors like healthcare, manufacturing, and government, where compliance and real-time response are critical.

- The manufacturing segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States edge computing market is segmented by industry vertical into BFSI, IT & telecommunication, retail, manufacturing, and others. Among these, the manufacturing segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of its need for real-time data processing to optimize operations, improve automation, and enhance predictive maintenance. Edge computing helps manufacturers reduce latency, increase operational efficiency, and support Industry 4.0 initiatives, driving strong adoption across the sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States edge computing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amazon Web Services

- Microsoft Corporation

- Google LLC

- IBM Corporation

- Dell Technologies

- Hewlett-Packard Enterprise

- Cisco Systems, Inc.

- Intel Corporation

- EdgeConneX

- Vapor IO

- Fastly, Inc.

- Akamai Technologies

- ClearBlade, Inc.

- Section.io, Inc.

- Others

Recent Developments:

- In November 2024, Dell Technologies announced advancements to its Dell NativeEdge edge operations software platform to simplify how organizations could deploy, scale, and use AI at the edge.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S., regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States edge computing market based on the below-mentioned segments:

USA Edge Computing Market, By Component

- Hardware

- Software/Solutions

- Services

USA Edge Computing Market, By Deployment

- On-Premise

- On-Cloud

USA Edge Computing Market, By Industry Vertical

- BFSI

- IT & Telecommunication

- Retail

- Manufacturing

- Others

Need help to buy this report?