United States Drone Services Market Size, Share, and COVID-19 Impact Analysis, By Type (Drone Platform Services, Drone Training & Education Services), By Application (Aerial Photography, Remote Sensing, Data Acquisition and analytics, Mapping and surveying), By Industry Vertical (Agriculture, Utility, Oil and Gas, Mining, Defense, and Logistics), and United States Drone Services Market Insights Forecasts 2022 – 2032

Industry: Semiconductors & ElectronicsUnited States Drone Services Market Insights Forecasts to 2032

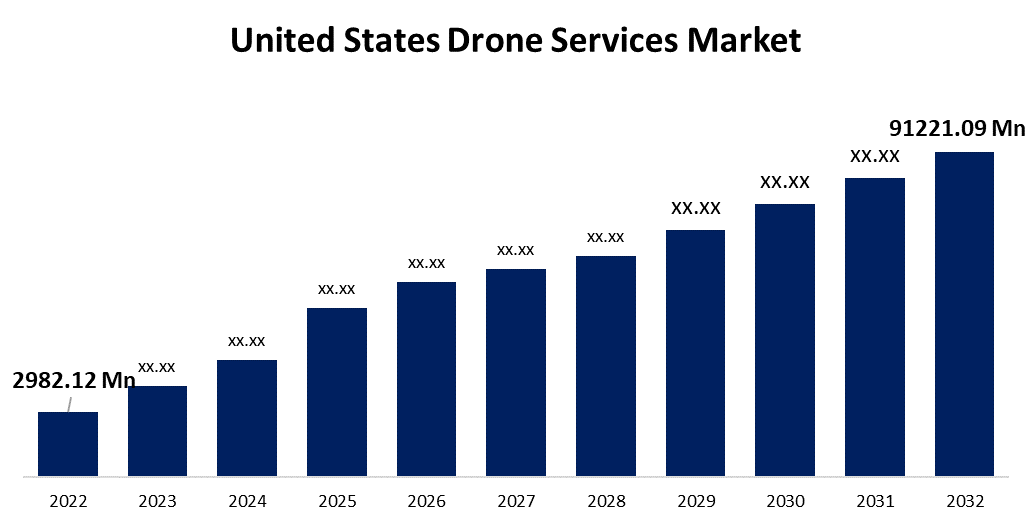

- The United States Drone Services Market Size was valued at USD 2982.12 Million in 2022.

- The Market Size is Growing at a CAGR of 40.91% from 2022 to 2032.

- The United States Drone Services Market Size is Expected to Reach USD 91221.09 Million by 2032.

Get more details on this report -

The United States Drone Services Market Size is Expected to Reach USD 91221.09 Million by 2032, at a CAGR of 40.91% during the forecast period 2022 to 2032.

Market Overview

Drones are unmanned aerial vehicles that are used for a variety of purposes, including inspection and monitoring, mapping and surveying, and filming and photography. Drones come in a variety of sizes, including large, medium, small, and micro. Drones benefit from automatic take-off and landing, as well as semi-automatic control with automatic stabilization when using large drones. A large-scale drone may require more than 100 kg of take-off weight. However, it has a weight limit of up to 850 kg and a dimension of 8,800*2,700 mm. DRONE with a small size has an approximate flight time of 1.5 hours and can fly at a maximum speed of about 100 km per hour and a cruising speed of 45 km per hour. A micro-drone may have a take-off weight of less than 20 kg. A micro-drone is 875 mm x 347 mm in size. It has a flight time of about 5 hours and a maximum speed of about 30 minutes per second. For control operations, it has a range of 430 km. Drone services are becoming increasingly popular in a variety of industry verticals because they provide high-quality services with real-time data. These provide a variety of potential benefits, such as maintaining a safe environment, cost savings, aerial imaging quality, precision, easily controllable or deployable technology, security, minimal obvious danger and health risks, and flexibility for quick inspections, among others.

Report Coverage

This research report categorizes the market for the United States drone services market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States drone services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States drone services market.

United States Drone Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 2982.12 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 40.91% |

| 2032 Value Projection: | USD 91221.09 Million |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Application and By Industry Vertical |

| Companies covered:: | Cyberhawk, Unmanned Experts, Deveron UAS, ABJ Renewables, AgEagle Aerial Systems Inc., Precision Hawk, Identified Technologies Corp., and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The 'United States Drone Services Market' is expanding rapidly as a result of various driving factors such as technological advancement, regulatory support, cost-effectiveness, and so on. Increased demand for time-efficient delivery services, increased demand for industry-specific solutions, and cyber security concerns about drones are all expected to accelerate the United States drone services market's growth. Drone applications have grown in popularity as drone technology has advanced, including improved flight capabilities, longer battery life, better sensors, and AI integration. Furthermore, the development of smart drones is expected to significantly boost the growth of the United States drone services market in the coming years.

Market Segment

- In 2022, the drone platform services segment accounted for the largest revenue share over the forecast period.

Based on the type, the United States drone services market is segmented into drone platform services, drone training & education services. Among these, the drone platform services segment has the largest revenue share over the forecast period. Drone platforms are used to collect, manage, and interpret raw drone data, which improves business workflows through scalable image processing, data storage, and sharable drone maps and 3D models in real-time. The increasing adoption of drone services by industries such as power & utility, logistics, and wind. These industries have a high demand for high-quality data and analytics, which will drive up demand for drone platform services over the next few years.

- In 2022, the aerial photography segment accounted for the largest revenue share over the forecast period.

Based on application, the United States drone services market is segmented into aerial photography, remote sensing, data acquisition & analytics, mapping & surveying. Among these, the aerial photography segment has the largest revenue share over the forecast period. Aerial photography is one of the most widely used and cost-effective remote sensing techniques. It is commonly used in topographic mapping and interpretation. Drones, unlike manned aircraft, are smaller in size and thus capable of flying into previously inaccessible areas. Drones can also capture videos with 360-degree rotation, time-lapse cameras, and aerial views, which manned aircraft cannot do. Drones are frequently used to capture stunning aerial photography and video.

- In 2022, the oil and gas segment accounted for the largest revenue share over the forecast period.

Based on industry vertical, the United States drone services market is segmented into agriculture, utility, oil and gas, mining, defense, and logistics. Among these, the oil and gas segment has the largest revenue share over the forecast period. The oil and gas industry is concerned with the complete production and supply of petroleum products. It is one of the world's largest industries and the most important contributor to the global economy. Drones are changing the way assets such as healthy sites, storage tanks, pipelines, and offshore platforms are inspected and maintained. Drone technology saves time and money at every stage of the petroleum production process, from accurate surveys to inspection of hard-to-reach areas.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States drone services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cyberhawk

- Unmanned Experts

- Deveron UAS

- ABJ Renewables

- AgEagle Aerial Systems Inc.

- Precision Hawk

- Identified Technologies Corp.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2022, Prime Air, Amazon's drone delivery service, plans to launch its drone services by the end of this year. The first drone deliveries will take place in Lockeford, California. Prime Air is working with the Federal Aviation Administration and Lockeford's local officials to obtain permission to begin drone delivery operations from the appropriate authorities.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the United States Drone Services Market based on the below-mentioned segments:

United States Drone Services Market, By Type

- Drone Platform Services

- Drone Training & Education Services

United States Drone Services Market, By Application

- Aerial Photography

- Remote Sensing

- Data Acquisition & Analytics

- Mapping & Surveying

United States Drone Services Market, By Industry Vertical

- Agriculture

- Utility

- Oil and Gas

- Mining

- Defense

- Logistics

Need help to buy this report?