United States Draught Beer Market Size, Share, and COVID-19 Impact Analysis, By Type (Keg Beer and Cask Beer), By Category (Super Premium, Premium, and Regular), By End-use (Commercial Use and Home Use), and United States Draught Beer Market Insights, Industry Trend, Forecasts To 2035

Industry: Food & BeveragesUnited States Draught Beer Market Insights Forecasts to 2035

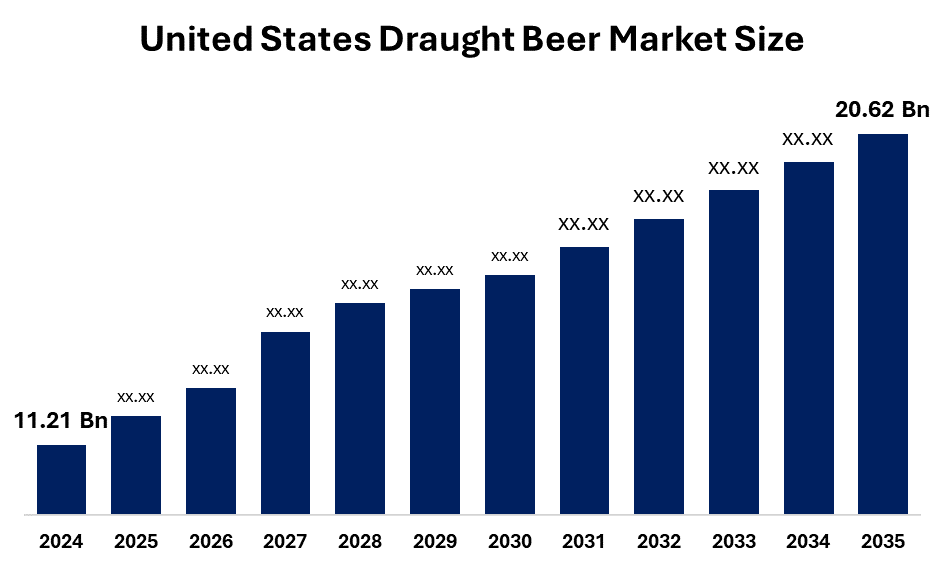

- The United States Draught Beer Market Size Was Estimated at USD 11.21 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.7% from 2025 to 2035

- The United States Draught Beer Market Size is Expected to Reach USD 20.62 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Draught Beer Market Size is Expected to Reach USD 20.62 Billion by 2035, Growing at a CAGR of 5.7% from 2025 to 2035. The market growth is driven by the increasing consumption of alcohol, the rising popularity of beer tourism among enthusiasts, and the growing trend of serving alcohol at parties, occasions, and celebrations.

Market Overview

Draught beer is referred to as beer that is served from kegs, casks, or pressure containers instead of bottles or compartments. It is usually dispensed using a tap system in bars, pubs, and restaurants, offering consumers a new and more fragrant beer experience than packaged options. The term draft originates from the traditional practice of pulling the beer directly into the term. Since it is usually unexpected and often processed minimally, it maintains its natural taste, aroma, and carbonation. Many beer enthusiasts consider beer superior for lubricating and freshness, as it is stored in a controlled environment and is consumed shortly after tapping. Beer plays an important role in the global alcoholic beverage industry. This especially contributes greatly to the sale of on-premises alcohol in restaurants, pubs, bars, and events. The format allows installations to offer unique brews, seasonal varieties, and craft beer that enhance customers experience and brand discrimination. The increasing popularity of craft breweries has further enhanced the demand for draft beer, as consumers rapidly prefer artisanal and locally produced beverages.

Report Coverage

This research report categorizes the United States draught beer market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States draught beer market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States draught beer market.

United States Draught Beer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 11.21 Billion |

| Forecast Period: | 2024-2035 |

| 2035 Value Projection: | USD 20.62 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Type, By Category and COVID-19 Impact Analysis. |

| Companies covered:: | Bunge Limited, Cargill Incorporated, J.M. Smucker Company, Ventura Foods, LLC, CARGILL INC and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factor

The United States draught beer market is driven by Consumers who are rapidly looking for fresh, delicious, and quality alcoholic beverages, especially in social and on-rich environments such as pubs and restaurants. The increasing popularity of craft breweries, rising disposable income, and urban nightlife culture all contribute to the increased demand. In addition, the cost savings in wholesale serving and low packaging waste appeal to draft beer to both consumers and companies.

Restraining Factor

The United States draught beer market has to face restrictions due to high storage and refrigeration expenditure, stringent hygiene rules, and a small shelf life than packaged beer. Changes in seasonal demand, dependence on on-premise consumption, and Competition from canned craft beer and off-premise alcohol sales also limit growth potential in certain regions.

The United States Draught Beer market share is classified into type, category, and end-use.

- The keg beer segment accounted for the largest revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The United States draught beer market is segmented by type into keg beer and cask beer, and others. Among these, the keg beer segment accounted for the largest revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. This is due to keg beer being distinguished in western, filtered, and small barrels to be served. It is due to its freshness, frequent quality, reducing packaging waste, and pubs, restaurants, and large-scale events, as well as its frequent taste and high demand from its long shelf life.

- The premium segment accounted for the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the projected timeframe.

The United States draught beer market is segmented by category into super premium, premium, and regular. Among these, the premium segment accounted for the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the projected timeframe. Premium draught beer provides a good balance of quality and price, making it a popular choice among a wide range of consumers. Premium beer often provides improvement in quality above standard beer without the high cost of super premium options, appealing to consumers in search of better-tasting beer at reasonable costs.

- The commercial use segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The United States draught beer market is segmented by end-use into commercial use and home use. Among these, the commercial use segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The sector is constantly expanding in reaction to beer sales in commercial establishments such as bars and clubs. Commercial sectors provide consumers with immediate and fresh produce. Furthermore, the commercial draught beer dispensing system supplies beer in large amounts to meet customer demand

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States draught beer market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bunge Limited

- Cargill Incorporated

- J.M. Smucker Company

- Ventura Foods, LLC

- CARGILL INC.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States draught beer market based on the below-mentioned segments:

United States Draught Beer Market, By Type

- Keg Beer

- Cask Beer

- Others

United States Draught Beer Market, By Category

- Super Premium

- Premium

- Regular

United States Draught Beer Market, By End-Use

- Commercial Use

- Home Use

Need help to buy this report?