United States Dolomite Market Size, Share, and COVID-19 Impact Analysis, By Product (Calcined, Sintered, and Agglomerated), By End-use (Iron & Steel, Construction, Glass & Ceramics, Water Treatment, Agriculture, and Others), and United States Dolomite Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Dolomite Market Insights Forecasts to 2035

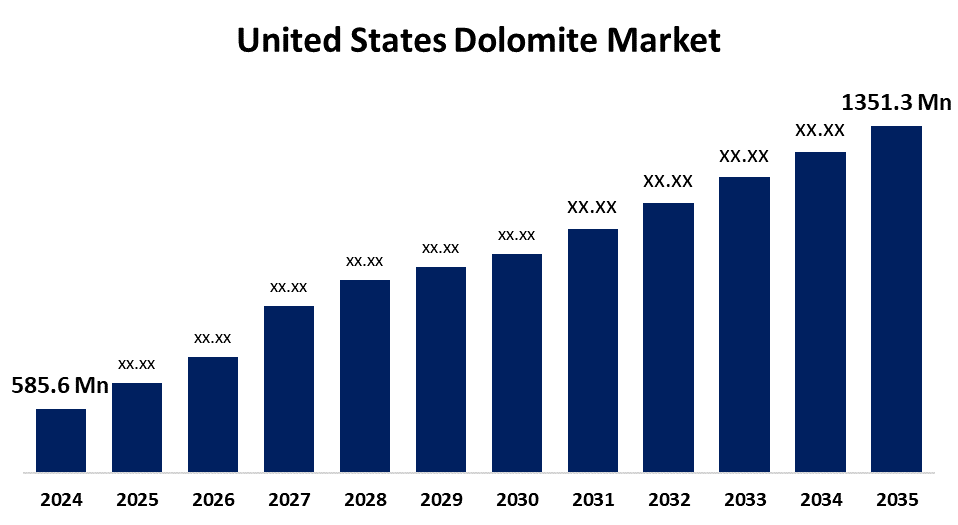

- The US Dolomite Market Size Was Estimated at USD 585.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.9% from 2025 to 2035

- The US Dolomite Market Size is Expected to Reach USD 1351.3 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Dolomite Market Size is anticipated to reach USD 1351.3 Million by 2035, growing at a CAGR of 7.9% from 2025 to 2035. The expansion of the United States dolomite market is propelled by the growing use of steel products in sectors including energy, automotive, and construction.

Market Overview

Dolomite, known as dolostone when it occurs in rock form, is a carbonate mineral. In terms of chemistry, it is calcium carbonate. The main reasons this sector succeeds are due to its applications in agriculture, steel, and construction, as dolomite is an inexpensive way to improve soil health, and is a flux in steel production. Increases in infrastructure and building demand are increasing dolomite consumption. Rising demand for construction materials, in part due to investments in sustainable infrastructure, can be seen with Lhoist Group's planned expansion of premium dolomite production in 2024 to meet their increasing needs. Dolomite is a source of two important minerals, calcium and magnesium, which exist in nature. It is consumed as a dietary supplement to maintain bone health and metabolism and to address deficiencies of these minerals. The presence of magnesium is important in pharmaceutical preparations containing dolomite, since magnesium is essential for enzyme activity, muscle contraction, and nerve impulses. Also, because of its ability to be opaque and absorb, dolomite is used most frequently in cosmetic applications, e.g., face lotions, creams, and powders. Further, the melting point and hardness of dolomite extend its uses to the manufacture of glass and ceramics, indirectly benefiting companies that provide bulk sources for pharmaceutical and medical instruments.

Report Coverage

This research report categorizes the market for the United States dolomite market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States dolomite market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States dolomite market.

United States Dolomite Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 585.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.9% |

| 2035 Value Projection: | USD 1351.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 178 |

| Tables, Charts & Figures: | 97 |

| Segments covered: | By Product and By End-use |

| Companies covered:: | Calcinor, CARMEUSE, Imersys S.A., Lhoist, Omya AG, RHI Magnesita, Sibelco, Lhoist Group, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States dolomite market is boosted because it adds durability and develops strength to construction materials, and is a major component for infrastructure. Additionally, dolomite is also used in asphalt and bitumen blends to create road construction or maintenance. Due to the properties of dolomite, those surfaces will perform better and last longer. Dolomitic products are sometimes treated in agricultural use as a conditioner or soil amendments to increase fertility or pH balance, in terms of the additional application that supports landscaping and agricultural construction.

Restraining Factors

The United States dolomite market faces obstacles like the dust from dolomite deposits inhaled can cause respiratory diseases such as asthma, coughing, and dyspnoea. Long-term exposure can cause diseases, including pneumoconiosis or silicosis, mainly based on the silica content of the dust.

Market Segmentation

The United States dolomite market share is classified into product and end-use.

- The calcined segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States dolomite market is segmented by product into calcined, sintered, and agglomerated. Among these, the calcined segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because it is often used as a refractory during the construction of simple refractories. The calcined material survives high temperatures required for processes demanding durability and thermal stability due to its resistance to corrosion and erosion.

- The iron & steel segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-use, the United States dolomite market is segmented into iron & steel, construction, glass & ceramics, water treatment, agriculture, and others. Among these, the iron & steel segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by steelmaking processes such as electric furnace walls, open hearth furnace lining, and converter linings. Besides its fluxing and sintering abilities, dolomite is a natural source of magnesium oxide (MgO). Magnesium oxide is an essential constituent in producing refractory bricks that line high-temperature furnaces.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States dolomite market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Calcinor

- CARMEUSE

- Imersys S.A.

- Lhoist

- Omya AG

- RHI Magnesita

- Sibelco

- Lhoist Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States dolomite market based on the following segments:

United States Dolomite Market, By Product

- Calcined,

- Sintered

- Agglomerated

United States Dolomite Market, By End-use

- Iron & Steel

- Construction

- Glass & Ceramics

- Water Treatment

- Agriculture

- Others

Need help to buy this report?