United States Distribution Transformer Market Size, Share, and COVID-19 Impact Analysis, By Voltage (Low Voltage, Medium Voltage, High Voltage), By Type (Oil-Filled and Dry-Type), By Phase (Single Phase and Triple Phase), By Type of Mounting (Pole-Mounted and Pad Mounted), and United States Distribution Transformer Market Insights Forecasts 2022 – 2032

Industry: Semiconductors & ElectronicsUnited States Distribution Transformer Market Insights Forecasts to 2032

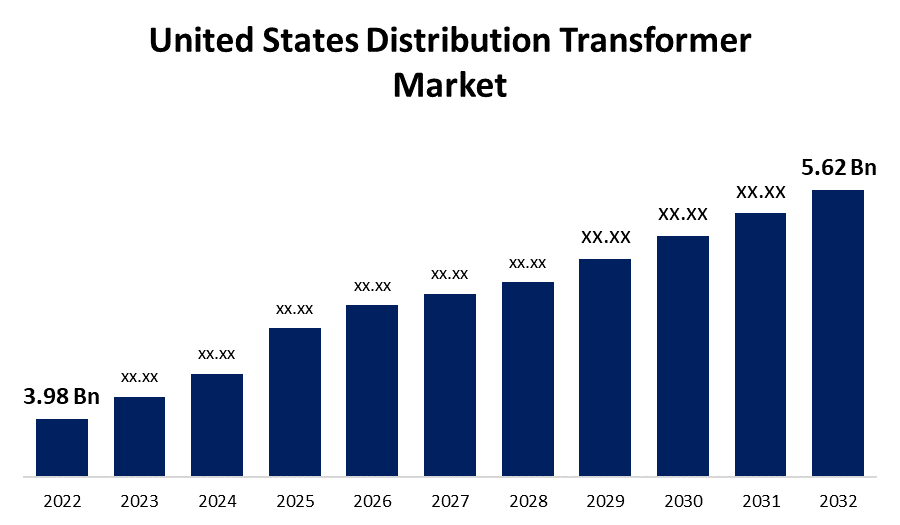

- The United States Distribution Transformer Market Size was valued at USD 3.98 Billion in 2022.

- The Market Size is Growing at a CAGR of 3.51% from 2022 to 2032.

- The United States Distribution Transformer Market Size is Expected to Reach USD 5.62 Billion by 2032.

Get more details on this report -

The United States Distribution Transformer Market Size is Expected to Reach USD 5.62 Billion by 2032, at a CAGR of 3.51% during the forecast period 2022 to 2032.

Market Overview

A distribution transformer is a transformer that transforms voltage in a power distribution system. It lowers the voltage in the distribution lines to the desired level for the customer. Distribution transformers are used in a variety of industries, including process and manufacturing plants, distribution transformer manufacturers, power distribution utilities, and government-owned enterprises. The rising population has significantly increased electricity demand, propelling the industry. To remotely monitor system parameters, smart grid installations require two-way, real-time communication and components with similar capabilities. It may increase demand for innovative products with interactive data transfer capabilities.

Report Coverage

This research report categorizes the market for the United States distribution transformer market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States distribution transformer market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States distribution transformer market.

United States Distribution Transformer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 3.98 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 3.51% |

| 2032 Value Projection: | USD 5.62 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Voltage, By Type, By Phase, By Type of Mounting and COVID-19 Impact Analysis. |

| Companies covered:: | Siemens AG, Kirloskar Electric Company Ltd., General Electric Company, Hyundai Electric & Energy Systems Co. Ltd., Schneider Electric SE, Southwest Electric Co., Hitachi Ltd., Emerson Electric Co., Eaton Corporation PLC, Toshiba Corp and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Demand for sustainable energy is expected to drive product demand over the forecast period. Infrastructure development in several states across the country may have a positive impact on growth prospects. The growing population has significantly increased electricity demand, driving the industry. To remotely monitor system parameters, smart grid installations require two-way, real-time communication and components with similar capabilities. It may increase demand for innovative products with interactive data transfer capabilities. Monitoring power consumption may encourage the use of alternative energy. The use of smart grids is required for the integration of backup conventional and alternative power sources, which is expected to drive industry growth over the forecast period.

Restraining Factors

High installation and transportation costs, as well as the requirement for trained professionals, may put a strain on product demand. On the other hand, rising distributed energy generation is expected to stymie residential battery growth during the forecast period.

Market Segment

- In 2022, the high voltage segment accounted for the largest revenue share over the forecast period.

Based on the voltage, the United States distribution transformer market is segmented into low voltage, medium voltage, and high voltage. Among these, the high voltage segment has the largest revenue share over the forecast period. A high-voltage distribution transformer is an essential asset in the first and last steps of the grid. It transforms high-voltage transmission into low-voltage transmission for use by industries, infrastructure, and residential complexes. A high-voltage distribution transformer is also used to supply generated electricity to the grid as the amount of decentralized generated electricity from renewable energy sources grows. High-voltage distribution transformers can also receive voltage from high voltage levels and distribute it to lower voltage substations or industries with high energy demands.

- In 2022, the dry type segment accounted for a significant revenue share over the forecast period.

Based on the type, the United States distribution transformer market is segmented into oil-filled and dry-type. Among these, the dry-type segment accounted for a significant revenue share over the forecast period. Dry-type distribution transformers offer advantages such as lower energy losses, reduced environmental impact, and improved fire safety compared to their oil-filled counterparts, prompting governments and utilities in the United States to prioritize the adoption of dry-type transformers to achieve their energy efficiency and sustainability goals.

- In 2022, the triple-phase segment accounted for the largest revenue share over the forecast period.

Based on the phase, the United States distribution transformer market is segmented into a single phase and triple phase. Among these, the triple-phase segment has the largest revenue share over the forecast period. A variety of applications, including powering heavy loads, transferring power across electrical grids for power generation, and expanding use in the transmission and distribution industry. For supporting large loads and massive power distribution, triple-phase transformers are more cost-effective than single-phase transformers. As a result, all of these elements are expected to fuel segment growth.

- In 2022, the pad-mounted segment accounted for the significant revenue share over the forecast period.

Based on the type of mounting, the United States distribution transformer market is segmented into pole-mounted and pad-mounted. Among these, the pad-mounted segment accounted for the significant revenue share over the forecast period. Pad-mounted distribution transformer units have seen significant market penetration due to the need for effective base foundation and earthing arrangements, particularly for large-unit installations. These transformers are ground-mounted units that are housed in a secure steel cabinet and are placed on a concrete pad. They are commonly used in medium voltage distribution systems to power homes and small businesses. Pad-mounted transformers are becoming more popular due to a variety of factors, including reduced land requirements, improved safety features, improved aesthetics, and reasonable installation costs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States distribution transformer market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Siemens AG

- Kirloskar Electric Company Ltd.

- General Electric Company

- Hyundai Electric & Energy Systems Co. Ltd.

- Schneider Electric SE

- Southwest Electric Co.

- Hitachi Ltd.

- Emerson Electric Co.

- Eaton Corporation PLC

- Toshiba Corp

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2022, Hitachi Energy announced plans to invest more than USD 10 million in Jefferson City, Missouri, to expand and improve its distribution transformer facility. The investment was expected to increase capacity and improve manufacturing capabilities.

- In April 2022, Siemens Energy introduced a new dry-type single-phase transformer for pole applications. The transformers were created to meet the technological requirements of American grid standards, and the new cast-resin distribution transformer provides a more sustainable and reliable alternative to oil-filled transformers.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the United States Distribution Transformer Market based on the below-mentioned segments:

United States Distribution Transformer Market, By Voltage

- Low Voltage

- Medium Voltage

- High Voltage

United States Distribution Transformer Market, By Type

- Oil-Filled

- Dry-Type

United States Distribution Transformer Market, By Phase

- Single Phase

- Triple Phase

United States Distribution Transformer Market, By Type of Mounting

- Pole-Mounted

- Pad Mounted

Need help to buy this report?