United States Digestive Health Products Market Size, Share, and COVID-19 Impact Analysis, By Product (Dairy Products, Bakery & Cereals, Non-Alcoholic Beverages, Supplements, and Others), By Ingredient (Prebiotics, Probiotics, and Food Enzymes), and United States Digestive Health Products Market Insights, Industry Trend, Forecasts To 2035

Industry: HealthcareUnited States Digestive Health Products Market Insights Forecasts to 2035

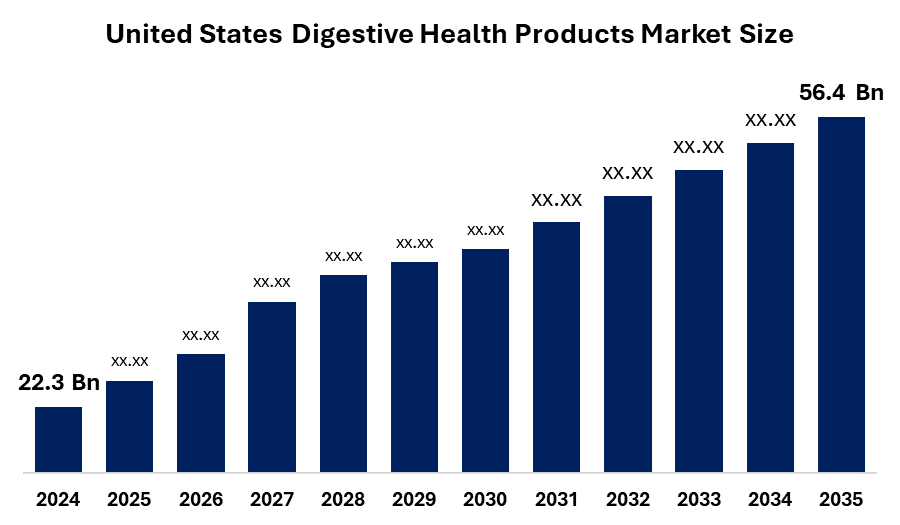

- The United States Digestive Health Products Market Size Was Estimated at USD 22.3 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.8% from 2025 to 2035

- The United States Digestive Health Products Market Size is Expected to Reach USD 56.4 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Digestive Health Products Market is Expected to Grow from USD 22.3 Billion in 2024 to USD 56.4 Billion by 2035, growing at a CAGR of 8.8% during the forecast period 2025-2035.The U.S. digestive health products market is being driven by rising demand for food additives that are fortifying and nutritious. The strong national leadership, government backing for the creation of new products, and developments in probiotic and prebiotic technology.

Market Overview

Digestive health products have been classified as functional foods, dietary supplements, and medicines that support and enhance the general health of the gastrointestinal (GI) system. These products improve food absorption, reduce gastrointestinal discomfort, prevent gastrointestinal diseases, and maintain a balanced intestinal microbiome. Probiotics, prebiotics, digestive enzymes, fiber, laxatives, antacids, and herbal supplements are some of the many products that they cover. This category also includes stronghold foods and functional beverages that are enriched with intestinal-friendly substances. The main purpose of digestive health products is to keep the intestinal microbiota in a healthy balance, which is necessary for immunity, digestive, and metabolic activities. Probiotics are living beneficial bacteria that support intestinal health, while prebiotics are foods for bacteria, which create a healthy intestinal environment. Additionally, antacids and enzymes help in breaking down food and control acidity, while fiber supplements promote bowel regularity and reduce constipation risks. Because consumers are more interested in natural, plant-based, and probiotic-rich products, digestive health products are becoming more popular in both developed and emerging economies. Furthermore, individual nutrition, functional snacks, and stronghold food are examples of how businesses are innovating, making digestive health an important component of the large welfare and preventive healthcare sector.

Report Coverage

This research report categorizes the USA digestive health products market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US digestive health products market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. digestive health products market.

United States Digestive Health Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 22.3 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.8% |

| 2035 Value Projection: | USD 56.4 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 242 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Product, By Ingredient |

| Companies covered:: | International Flavors & Fragrances Inc DuPont de Nemours, Inc. Nestle SA Cargill, Incorporated Sanofi Danone Arla Foods amba Herbalife Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United States digestive health products market is driven by preventive healthcare, the increasing prevalence of gastrointestinal diseases, and increased inclination for increasing consumer knowledge of intestinal health. Due to the digestive problems brought by a changing lifestyle, there is an increasing demand for probiotics, prebiotics, and fiber-rich supplements.

Restraining Factor

The United States digestive health products market has to face restrictions due to high product costs, low awareness in developing countries, and international regulatory criteria. Adoption of adoption is incorrectly influenced by consumer doubts about the lack of clinical data for some supplements, and the effectiveness of the products, especially in areas where obstacles to education and strength are still present.

The United States digestive health products market share is classified into products and ingredients.

- The dairy products segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the projected timeframe.

The United States digestive health Products market is segmented by products into dairy products, bakery & cereals, non-alcoholic beverages, supplements, and others. Among these, the dairy products segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the projected timeframe. This is due to digestive health components found in probiotics and dairy products are abundant and can increase intestinal health and promote normal good. Many reasons, such as an increase in per capita income, expanding consumer knowledge of nutritious food, and more government intervention in controlling dairy products, are contributing to the increasing demand for dairy products.

- The prebiotics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States digestive health products market is segmented by ingredient into prebiotics, probiotics, and food enzymes. Among these, the prebiotics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to probiotics are live microorganisms that are beneficial for the host when consumed in adequate amounts. They are often referred to as "good bacteria" because they help maintain a healthy balance of microorganisms in the gut and support overall health

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States digestive health products market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- International Elavors Fragrances inc

- DuPont de Nemours, Inc.

- Nestle SA

- Cargill, Incorporated

- Sanofi

- Danone

- Arla Foods amba

- Herbalife

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segments

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States digestive health products market based on the below mentioned segments:

United States Digestive Health Products Market, By Product

- Dairy Products

- Bakery & Cereals

- Non Alcoholic Beverages

- Supplements

- Others

United States Digestive Health Products Market, By Ingredient

- Prebiotics

- Probiotics

- Food Enzymes

Need help to buy this report?