United States Dermal Fillers Market Size, Share, and COVID-19 Impact Analysis, By Material Analysis (Calcium Hydroxylapatite, Poly-L-Lactic Acid, Hyaluronic Acid, Fat Fillers, PMMA (Polymethyl Methacrylate), and Others), By Product Analysis (Biodegradable and Non-biodegradable), By Application Analysis (Wrinkle Correction Treatment, Lip enhancement, Scar treatment, Restoration of Volume/Fullness, and Others), and By End-User (Specialty & Dermatology Clinics, Hospitals & Clinics, and Others), and United States Dermal Fillers Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsUnited States Dermal Fillers Market Insights Forecasts to 2033

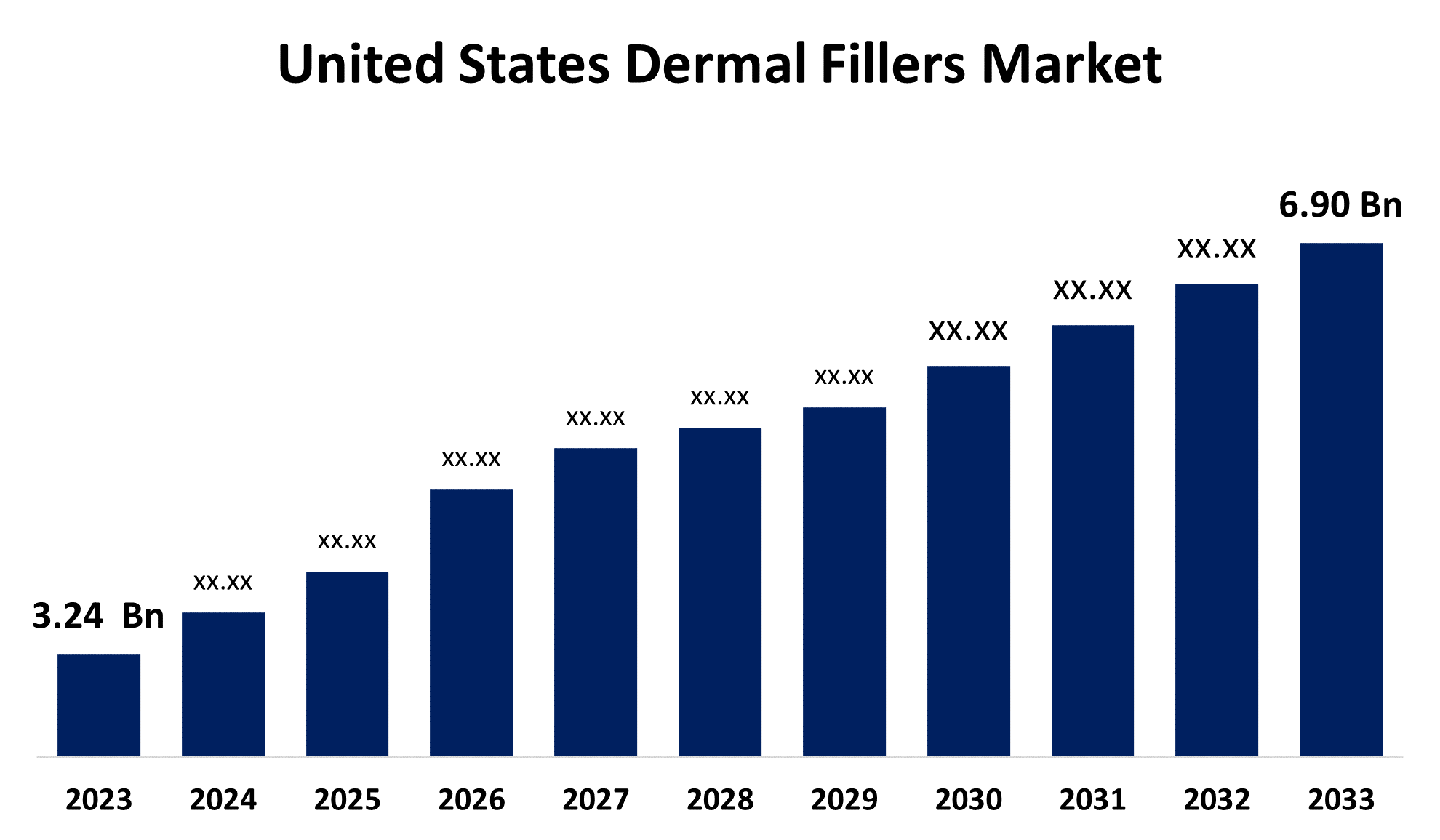

- The United States Dermal Fillers Market Size was valued at USD 3.24 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.85% from 2023 to 2033

- The U.S. Dermal Fillers Market Size is Expected to Reach USD 6.90 Billion by 2033

Get more details on this report -

The United States Dermal Fillers Market is anticipated to exceed USD 6.90 billion by 2033, growing at a CAGR of 7.85% from 2023 to 2033. The growing adoption of dermal filler injections, demand for minimally invasive cosmetic procedures, and R&D initiatives are driving the growth of the dermal fillers market in the United States.

Market Overview

Dermal fillers are injections that plump up wrinkles and smooth lines on the face. There are several types of dermal fillers out of which calcium hydroxylapatite, hyaluronic acid, polyalkylimide, polylactic acid, and PMMA (polymethyl-methacrylate microspheres) are the most common. The fillers are injected or deposited into the dermis usually in the areas around eyes, mouth and nose for skin augmentation that helps to diminish facial lines and restore volume and fullness in the face. This is also known as injectables" or "soft-tissue fillers. Fillers are made of polysaccharides (such as hyaluronic acids), collagens (which may come from pigs, cows, or cadavers, or may be generated in a laboratory), the person's own transplanted fat, and/or biosynthetic polymers. Hyaluronic acid is the gold standard in dermal filler materials. The advancement of cross-linking technique enhanced the longevity and stability of hyaluronic acid-based fillers. The introduction of modern techniques prioritizes precision and safety, utilizing advanced imaging technologies and refined injection techniques to avoid inconsistent results and a high risk of complications. The integration of imaging technologies like ultrasound and 3D imaging has improved the accuracy of both diagnosis and injectable treatment in dermal filler procedures by visualizing the placement and dispersion of fillers, leading to more precise and predictable outcomes. The application of advanced injection tools like cannulas, and flexible needles has allowed practitioners to minimize the risk of complications and deliver fillers with greater precision, control, and depth localization.

Report Coverage

This research report categorizes the market for the US dermal fillers market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the dermal fillers market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. dermal fillers market.

United States Dermal Fillers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 3.24 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.85% |

| 2033 Value Projection: | USD 6.90 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Material Analysis, By Product Analysis, By Application Analysis, By End-User |

| Companies covered:: | GALDERMA, Allergan Aesthetics (AbbVie Inc.), Bioxis pharmaceuticals, Sinclair, Revance Therapeutics, Inc., Merz Pharma, Suneva Medical, Prollenium Medical Technologies, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising demand for non-invasive cosmetic procedures among the population is due to a growing inclination towards hassle-free and pain-free methods for improving aesthetic appearance. As per the report of ASPS (American Society of Plastic Surgeons), after the pandemic, there has been around 200% growth in performing minimally invasive procedures. It also results in the launch of new products. These factors are anticipated to aid the market growth. The growing number of dermal filler procedures for treating conditions such as facial wrinkles, and cheek acne scars and also for increasing fullness of lips and restoration of volume in cheek and chin. According to the International Society of Aesthetic Plastic Surgery (ISAPS), a total of 807.870 hyaluronic acid procedures were performed in the US in 2020. Thus increasing the application of dermal fillers to enhance the US market of dermal fillers. R&D initiatives to launch products also contribute to the market growth of dermal fillers.

Restraining Factors

The high cost of dermal filler products and procedures is majorly responsible for restraining the market. The lower adoption of procedures due to the growing economic strain on patients and the possible side effects such as swelling, redness, bruising at the injection site, pain, lumps and bumps, and infections are responsible for impeding the market growth of dermal fillers. The inadvertent injection of dermal fillers causes adverse effects and may lead to restrain the market.

Market Segmentation

The United States dermal fillers market share is classified into material analysis, product analysis, application analysis, and end-user.

- The hyaluronic acid segment is expected to hold a significant share of the United States dermal fillers market during the forecast period.

The United States dermal fillers market is segmented by material analysis into calcium hydroxylapatite, poly-l-lactic acid, hyaluronic acid, fat fillers, PMMA (polymethyl methacrylate), and others. Among these, the hyaluronic acid segment is expected to hold a significant share of the United States dermal fillers market during the forecast period. Hyaluronic acid possesses minimum risk, adverse reactions, and allergic responses as it is biocompatible and naturally present in the body. Thus it is a popular choice among patients and cosmetic professionals. The versatility of hyaluronic acid filler application further contributes to the market growth.

- The biodegradable segment dominates the market with the largest share of the United States dermal fillers market during the forecast period.

Based on the product analysis, the United States dermal fillers market is divided into biodegradable and non-biodegradable. Among these, the biodegradable segment dominates the market with the largest share of the United States dermal fillers market during the forecast period. There is a wide availability of biodegradable dermal fillers with associated benefits such as safety and efficacy. These are used for a maximum number of aesthetic applications.

- The wrinkle correction treatment segment is expected to grow at the highest CAGR in the United States dermal fillers market during the forecast period.

Based on the application analysis, the United States dermal fillers market is divided into wrinkle correction treatment, lip enhancement, scar treatment, restoration of volume/fullness, and others. Among these, the wrinkle correction treatment segment is expected to grow at the highest CAGR in the United States dermal fillers market during the forecast period. There is a growing investment in dermal filler products for wrinkle correction. For instance, Revance Therapeutics, Inc. launched the RHA dermal fillers line for the correction of facial wrinkles. It is the first and only FDA-approved dermal filler.

- The specialty & dermatology clinics segment is expected to hold the largest market share of United States dermal fillers market.

Based on the end-user, the United States dermal fillers market is divided into specialty & dermatology clinics, hospitals & clinics, and others. Among these, the specialty & dermatology clinics segment is expected to hold the largest market share of United States dermal fillers market. The growing number of scar and wrinkle correction treatments favors the expansion of the market as numerous dermal filler procedures are conducted in hospitals and clinics segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US dermal fillers market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GALDERMA

- Allergan Aesthetics (AbbVie Inc.)

- Bioxis pharmaceuticals

- Sinclair

- Revance Therapeutics, Inc.

- Merz Pharma

- Suneva Medical

- Prollenium Medical Technologies

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, Galderma announced the regulatory approval for Restylane SHAYPE, a new hyaluronic acid injectable designed for augmenting the chin region.

- In February 2022, Allergan Aesthetics, an AbbVie company (NYSE: ABBV), announced the FDA approval of JUVÉDERM VOLBELLA XC for improvement of infraorbital hollows in adults over the age of 21.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Dermal Fillers Market based on the below-mentioned segments:

United States Dermal Fillers Market, By Material Analysis

- Calcium Hydroxylapatite

- Poly-L-Lactic Acid

- Hyaluronic Acid

- Fat Fillers

- PMMA (Polymethyl Methacrylate)

- Others

United States Dermal Fillers Market, By Product Analysis

- Biodegradable

- Non-biodegradable

United States Dermal Fillers Market, By Application Analysis

- Wrinkle Correction Treatment

- Lip Enhancement

- Scar Treatment

- Restoration of Volume/Fullness

- Others

United States Dermal Fillers Market, By End-User

- Specialty & Dermatology Clinics

- Hospitals & Clinics

- Others

Need help to buy this report?