United States Defoamers Market Size, Share, and COVID-19 Impact Analysis, By Product (Water-Based, Oil-Based, Silicone-Based, and Others), By End-use (Paints, Coatings, & Inks, Adhesives & Sealants, Personal Care & Cosmetics, Agriculture, Food & Beverages, Household & Industrial/Institutional Cleaning, Water Treatment, and Others), and United States Defoamers Market Insights, Industry Trend, Forecasts to 2035

Industry: Specialty & Fine ChemicalsUnited States Defoamers Market Size Insights Forecasts to 2035

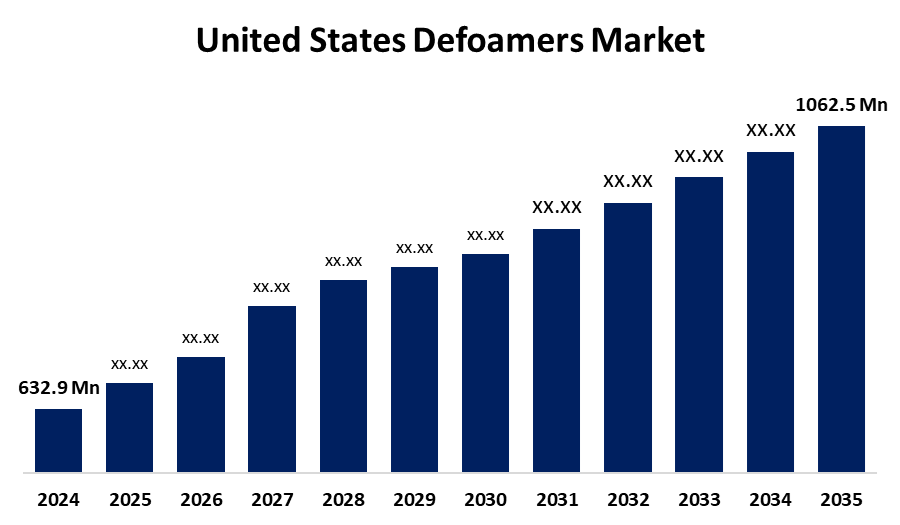

- The US Defoamers Market Size Was Estimated at USD 632.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.82% from 2025 to 2035

- The US Defoamers Market Size is Expected to Reach USD 1062.5 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Defoamers Market Size is anticipated to reach USD 1062.5 million by 2035, growing at a CAGR of 4.82% from 2025 to 2035. The expansion of the United States defoamers market is propelled by the requirement for water purification and wastewater treatment systems, as well as the growing need for agrochemicals.

Market Overview

Defoamers, referred to as anti-foaming agents, are chemical additives used in industrial liquids to lessen or completely eradicate foam. Defoamers are a critical component in the treatment of wastewater. Defoamers enhance overall water quality by limiting foam formation during treatment processes. As industrialization and urbanization progress, demand for better agrochemical substances and efficient water purification systems is predicted to increase along with this. It is anticipated that demand will rise across a range of businesses, resulting in an expansion in the defoamer sector. There are many different things created by the growth of industrialized sectors in the US, including food, clothing, cars, and other manufacturing sectors.

The U.S. government supports the defoamer industry through the Environmental Protection Agency's (EPA) Safer Choice program, which promotes the use of safer chemical components in consumer and industrial products. This voluntary program ensures that only the safest ingredients are used in products with the safer choice logo by evaluating defoamers based on their impact on the environment and human health.

Report Coverage

This research report categorizes the market for the United States defoamers market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States defoamers market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States defoamers market.

United States Defoamers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 632.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.82% |

| 2035 Value Projection: | USD 1062.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 196 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Product, By End-use and COVID-19 Impact Analysis |

| Companies covered:: | Ashland Inc, Eastman Chemical Co, Silicon Laboratories Inc, Dow Inc, Kemira Oyj, Air Products and Chemicals, Inc., Bluestar Silicones International, Evonik Industries AG, Wacker Chemie AG, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States defoamers market is boosted by the growing demand for defoamers across industries, which demonstrates the importance of these chemicals in both improved product quality and greater operational efficiencies across a range of industries. In order to meet the need for foam management solutions, industries such as chemicals, pharmaceuticals, textiles, and pulp and paper are growing. For Instance, in October 2023, Dow Chemicals developed and offered a customized defoamer compound for the pulp and paper sector that directly addresses common foam issues in the papermaking process that can impact the quality of paper produced and reduce efficiency.

Restraining Factors

The United States defoamer market faces a barrier to entry for manufacturers and end users is the expense of the production and quality assurance of defoamers. Also, high-quality ingredients combined with strict quality assurance protocols affect a defoamer's effectiveness and compatibility for numerous uses.

Market Segmentation

The United States defoamers market share is classified into product and end-use.

- The silicone-based segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States defoamers market is segmented by product into water-based, oil-based, silicone-based, and others. Among these, the silicone-based segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because it is the most effective and versatile agent in the marketplace. Silicone defoamers offer the best performance, stability, and long-term performance, and are recognized across all applications, from textiles to paints, coatings, and industrial applications. They are at the forefront of most sectors because they can perform better than any other agent in demanding environments.

- The paints segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-use, the United States defoamers market is segmented into paints, coatings, & inks, adhesives & sealants, personal care & cosmetics, agriculture, food & beverages, household & industrial/institutional cleaning, water treatment, and others. Among these, the paints segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because foam has a detrimental effect on product quality, consistency, and sheen; defoamers are legally mandated in those sectors. Demand for defoamers is driven by the demand for high-performance coatings and inks, and the more efficient application associated with them, and is also reinforced by the need for greater management of foam issues, such as environmental metrics and legislative requirements.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States defoamers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ashland Inc

- Eastman Chemical Co

- Silicon Laboratories Inc

- Dow Inc

- Kemira Oyj

- Air Products and Chemicals, Inc.

- Bluestar Silicones International

- Evonik Industries AG

- Wacker Chemie AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States defoamers market based on the following segments:

United States Defoamers Market, By Product

- Water-Based

- Oil-Based

- Silicone-Based

- Others

United States Defoamers Market, By End-use

- Paints, Coatings, & Inks

- Adhesives & Sealants

- Personal Care & Cosmetics

- Agriculture

- Food & Beverages

- Household & Industrial/Institutional Cleaning

- Water Treatment

- Others

Need help to buy this report?