United States Death Care Market Size, Share, and COVID-19 Impact Analysis, By Operations (Funeral Homes, Cemeteries), By Ownership (Corporate, Family-Owned Business), By Arrangement (Preneed, Atneed), and US Death Care Market Insights Forecasts to 2032

Industry: Consumer GoodsUnited States Death Care Market Insights Forecasts to 2032

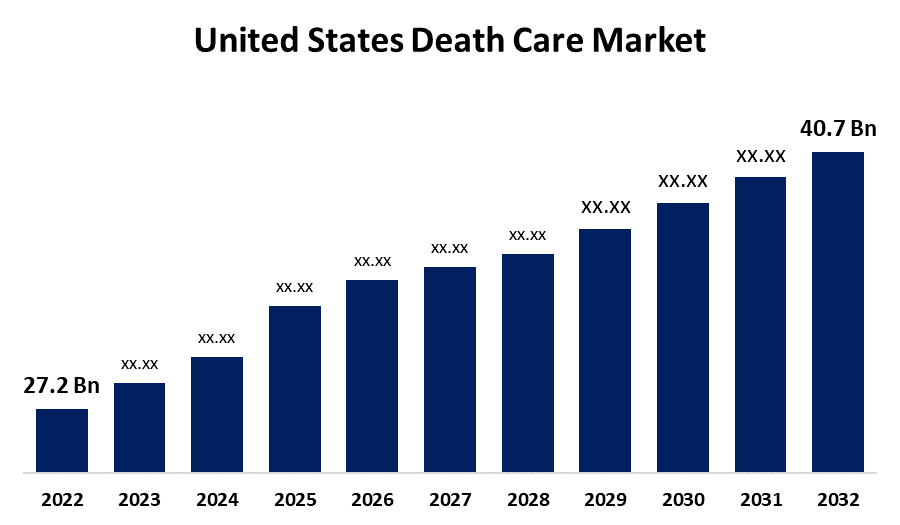

- The United States Death Care Market Size was valued at USD 27.2 Billion in 2022

- The Market Size is Growing at a CAGR of 4.1% from 2022 to 2032

- The United States Death Care Market Size is Expected to Reach USD 40.7 Billion by 2032

Get more details on this report -

The United States Death Care Market Size is Expected to Reach USD 40.7 Billion by 2032, at a CAGR of 4.1% during the forecast period 2022 to 2032.

Market Overview

The United States death care market refers to the industry involved in providing funeral and burial services, cremation services, memorial products, and related services. Funeral homes, crematoria, cemeteries, mortuaries, and other establishments that provide funeral and memorialization services are included. During times of loss, the death care market serves as a support system for individuals and families, ensuring respectful and dignified arrangements for the deceased. The death care market in the United States has grown significantly during the forecast period. As a result of various factors such as an aging population, increased awareness about pre-planning funeral arrangements, and an increase in the number of deaths. This market includes funeral homes, cemeteries, crematoria, and other related services that help individuals and families cope with the loss of a loved one. The death care industry is critical in providing end-of-life services and assisting bereaved families.

Report Coverage

This research report categorizes the market for the United States death care market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States death care market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States death care market.

United States Death Care Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 27.2 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.1% |

| 2032 Value Projection: | USD 40.7 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Operations, By Ownership, By Arrangement |

| Companies covered:: | McCollister’s Transportation Group, StoneMor, Carriage Services, NorthStar Memorial Group, McMahon, Lyon & Hartnett Funeral Home, Musgrove Mortuaries and Cemeteries, Natural Legacy USA, Newton Cemetery, The Northern Craft Advantage, Nosek-McCreery Funeral, Cremation & Green services, Park Lawn Cemetery, Rock of Ages, Sauder Funeral Products, Sich, Sunset Memorial Park, Hillenbrand control, Service Corporation International (SCI), Matthews International Corporation, StoneMor Partners L.P., Foundation Partners Group, Aurora Casket Company, Bogati Urn Company and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

United States death care market is growing as increasing employment opportunities for funeral service workers. Since the COVID-19 pandemic in the United States, the employment of funeral morticians and directors has increased significantly. As the country's population ages, so will the demand for funeral service workers. Efforts are also being made to legalize the composting of deceased human bodies. Terramation is another term for composting human bodies. The required energy for the terramation process is far less than that required for the cremation process. The stimulation of microbes in human bodies takes sixty days to transform into fertile, usable soil. Terramation is quickly gaining traction in the death care market in the United States. Furthermore, there is a growing demand for green alternatives. In the United States, the number of green cremation and burial options is growing. As a result, there is a preference for environmentally friendly burial and cremation methods.

Restraining Factors

Traditional burial services have faced challenges as cremation has grown in popularity. Cremation is frequently viewed as a more cost-effective and environmentally friendly alternative, resulting in a decrease in demand for burial-related services. Alternative funeral service providers such as direct cremation companies, green burial options, and online memorialization platforms compete in the death care market. These alternatives offer convenience and cost-effectiveness, luring a market segment away from traditional funeral homes.

Market Segment

- In 2022, the funeral homes segment is expected to hold the largest share of the United States death care market during the forecast period.

Based on the operations, the United States death care market is classified into funeral homes and cemeteries. Among these, the funeral homes segment is expected to hold the largest share of the United States death care market during the forecast period. The market is expanding rapidly as a result of rising demand for professional funeral services, an aging population, and an increase in the number of deaths. In the United States, funeral homes provide professional services to the deceased and their families. These businesses provide complete funeral services based on the needs of the customer. Funeral homes frequently provide high-value services in accordance with family reputation and tradition.

- In 2022, the corporate segment accounted for the largest revenue share over the forecast period.

Based on the ownership, the United States death care market is segmented into corporate and family-owned business. Among these, the corporate segment has the largest revenue share over the forecast period. As large corporations continue to acquire family-owned/individual businesses, and as consumer preferences for professionalism and the availability of a diverse range of services grow, the corporate/large company ownership segment is growing significantly in the United States.

- In 2022, the preneed segment accounted for the largest revenue share over the forecast period.

Based on the arrangement, the United States death care market is segmented into preneed and atneed. Among these, the preneed segment has the largest revenue share over the forecast period. The growth can be attributed as it reduces the stress of funeral arrangements and financial burden. Preneed services are available at the majority of funeral homes and cemeteries. Companies that provide such services also provide attractive discounts, which is a major factor driving the United States death care market. One of the major factors driving the growth of the preneed arrangements market is the growing geriatric population. Furthermore, the rising number of deaths from injuries caused by accidents, suicides, and other causes drives the atneed arrangement segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States death care market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- McCollister’s Transportation Group

- StoneMor

- Carriage Services

- NorthStar Memorial Group

- McMahon

- Lyon & Hartnett Funeral Home

- Musgrove Mortuaries and Cemeteries

- Natural Legacy USA

- Newton Cemetery

- The Northern Craft Advantage

- Nosek-McCreery Funeral

- Cremation & Green services

- Park Lawn Cemetery

- Rock of Ages

- Sauder Funeral Products

- Sich

- Sunset Memorial Park

- Hillenbrand control

- Service Corporation International (SCI)

- Matthews International Corporation

- StoneMor Partners L.P.

- Foundation Partners Group

- Aurora Casket Company

- Bogati Urn Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the United States death care market based on the below-mentioned segments:

United States Death Care Market, By Operations

- Funeral Homes

- Cemeteries

United States Death Care Market, By Ownership

- Corporate

- Family-Owned Business

United States Death Care Market, By Arrangement

- Preneed

- Atneed

Need help to buy this report?