United States Data Center Substation Market Size, Share, and COVID-19 Impact Analysis, By Power Rating (Below 500 kVA, 500-1000 kVA, 1000-1500 kVA, 1500-2000 kVA, and Above 2000 kVA), By Application (Data Centers, Colocation Facilities, Cloud Service Providers, and Enterprise IT Facilities), and United States Data Center Substation Market Insights, Industry Trend, Forecasts to 2033.

Industry: Information & TechnologyThe United States Data Center Substation Market Insights Forecasts to 2033

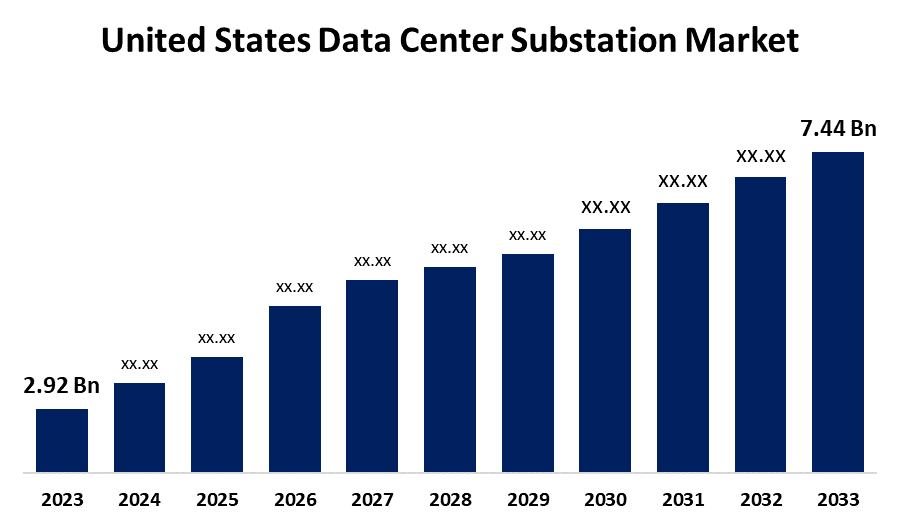

- The U.S. Data Center Substation Market Size was Valued at USD 2.92 Billion in 2023

- The United States Data Center Substation Market Size is Growing at a CAGR of 9.80% from 2023 to 2033

- The USA Data Center Substation Market Size is Expected to Reach USD 7.44 Billion by 2033

Get more details on this report -

The USA Data Center Substation Market Size is anticipated to exceed USD 7.44 Billion by 2033, growing at a CAGR of 9.80% from 2023 to 2033. Leading players in the U.S. data center substation market include ABB, GE Vernova, Schneider Electric, and others, driving innovation, reliability, and scalability to meet rising digital infrastructure demands.

Market Overview

The U.S. data center substation market includes the solutions, services, and products utilized in the distribution, transformation, and transmission of electrical power, particularly to data centers, which necessitate a high-capacity, uninterrupted, and reliable supply of electricity. Such substations often have devices like protection systems, control systems, circuit breakers, switchgear, transformers, and busbars, which guarantee a constant and secure supply of power. Moreover, the U.S. data center substation market is driven by surging data consumption, AI and cloud computing expansion, hyperscale data center development, rising demand for uninterrupted power, and government incentives for digital infrastructure. These factors collectively fuel the need for robust, scalable, and energy-efficient substations tailored to data center power demands. Furthermore, in March 2025, ABB invested in DG Matrix, a North Carolina-headquartered technology company to advance solid-state power electronics. The investment will drive the deployment of DG Matrix's ground-breaking Power Router platform for generative AI data centers and microgrids powered by renewables. This revolutionary solution consolidates multiple functionalities into a single system no larger than a few cabinet volumes, is up to five times smaller than the typical arrangement, and achieves up to 98% energy efficiency.

Report Coverage

This research report categorizes the market for the US data center substation market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US data center substation market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA data center substation market.

United States Data Center Substation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.92 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.80% |

| 2033 Value Projection: | USD 7.44 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Power Rating, By Application |

| Companies covered:: | ABB, Eaton, Emerson Electric Co., GE Vernova, Hitachi Energy Ltd., Discovery Energy, LLC (Rehlko), NEI Electric Power Engineering, Inc., Mitsubishi Electric Corporation, Schneider Electric, Schweitzer Engineering Laboratories, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The U.S. data center substation market benefits from unique growth drivers like rapid edge data center expansion in rural areas, energy transition incentives for renewable-ready substations, and private utility partnerships accelerating deployment. Additionally, ample land availability and the presence of high-security defense and intelligence data centers create demand for specialized, large-scale substations not commonly observed in other countries. Moreover, leading players such as ABB, Siemens, Schneider Electric, GE Vernova, and Eaton are propelling market growth with innovation in modular, digital, and gas-insulated substations. Their innovations revolve around quicker deployment, real-time monitoring, energy efficiency, and integration of renewables, addressing the changing power needs of hyperscale and edge data centers in the U.S.

Restraining Factors

High up-front costs, long permitting cycles, grid connection issues, and shortages of skilled labor are the major constraints preventing the growth of the U.S. Data Center Substation Market in the face of increasing demand.

Market Segmentation

The U.S. The United States data center substation market share is classified into power rating and application.

- The below 500 kVA segment accounted for the largest share of the US data center substation market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of power rating, the United States data center substation market is divided into below 500 kVA, 500-1000 kVA, 1000-1500 kVA, 1500-2000 kVA, and above 2000 kVA. Among these, the below 500 kVA segment accounted for the largest share of the United States data center substation market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This dominance is attributed to the increasing demand for localized data processing and storage, particularly in smaller data centers and edge computing deployments.

- The data centers segment accounted for a substantial share of the U.S. data center substation market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of application, the U.S. data center substation market is divided into data centers, colocation facilities, cloud service providers, and enterprise IT facilities. Among these, the data centers segment accounted for a substantial share of the U.S. data center substation market in 2023 and is anticipated to grow at a rapid pace during the projected period. This is driven by the surge in data storage, cloud computing, and AI, this segment is expected to dominate with strong growth, as data centers require scalable and reliable power infrastructure to support increasing digital demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the USA data center Substation market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ABB

- Eaton

- Emerson Electric Co.

- GE Vernova

- Hitachi Energy Ltd.

- Discovery Energy, LLC (Rehlko)

- NEI Electric Power Engineering, Inc.

- Mitsubishi Electric Corporation

- Schneider Electric

- Schweitzer Engineering Laboratories

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2025, Schneider Electric opened a new data center and microgrid innovation labs at its Global R&D Center in Andover, Massachusetts, USA. The Power Distribution Unit (PDU) laboratory has three testing bays and is capable of testing high-voltage systems developed for AI-enabled data centers. The facility is also capable of supporting the testing of fully commissioned microgrids, allowing customers to develop and deploy microgrid solutions more rapidly for customer use cases.

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US data center substation market based on the below-mentioned segments

United States Data Center Substation Market, By Power Rating

- Below 500 kVA

- 500-1000 kVA

- 1000-1500 kVA

- 1500-2000 kVA

- Above 2000 kVA

United States Data Center Substation Market, By Application

- Data Centers

- Colocation Facilities

- Cloud Service Providers

- Enterprise IT Facilities

Need help to buy this report?