United States Cryptocurrency Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware and Software), By Process (Mining and Transaction), and United States Cryptocurrency Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialUnited States Cryptocurrency Market Insights Forecasts to 2035

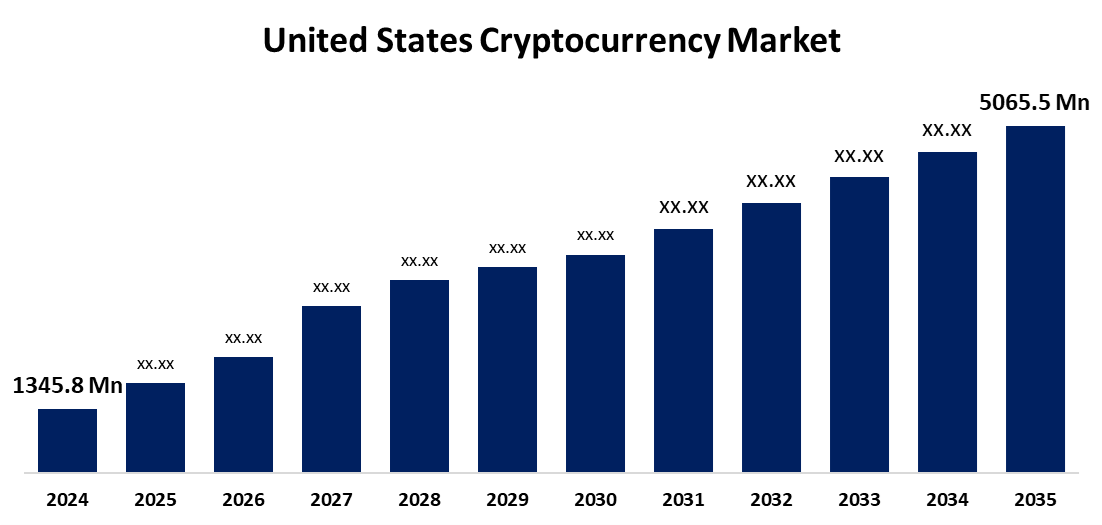

- The US Cryptocurrency Market Size Was Estimated at USD 1,345.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.81% from 2025 to 2035

- The US Cryptocurrency Market Size is Expected to Reach USD 5,065.5 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States Cryptocurrency Market Size is anticipated to Reach USD 5,065.5 Million by 2035, Growing at a CAGR of 12.81% from 2025 to 2035. The expansion of the United States cryptocurrency market is propelled by the growing use of distributed ledger technologies.

Market Overview

A Cryptocurrency is a type of digital or virtual currency that is protected and governed by encryption and functions on a decentralised network, typically built on blockchain technology. Furthermore, as customer fees and exchange fees drop, the increased use of cryptocurrencies is expected to provide fuel for industry growth. Recent developments in artificial intelligence (AI) will have a substantial impact on the industry. Many businesses have decided to focus on developing AI technologies due to the expanding popularity of cryptocurrency platforms that use AI. Major U.S. companies and financial institutions are starting to realise the potential of cryptocurrencies as an asset class. Consumers' growing demand and the desire to expand their product suite have led banks, asset managers, and investment firms to include bitcoin as an investment in their product portfolios. The bitcoin industry has been driven by this social acceptance in this nation, and institutions' growing acceptance of the bitcoin space. Many leading financial institutions and fintech companies include cryptocurrency in the portfolios of alternative investments and as a hedge against market volatility. Instantaneous, safe, and transparent value exchanges are made possible by cryptocurrency. In the United States, blockchain-based transactions are becoming more and more popular in a variety of sectors, including supply chain management and banking.

Report Coverage

This research report categorizes the market for the United States cryptocurrency market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States cryptocurrency market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States cryptocurrency market.

United States Cryptocurrency Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,345.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 12.81% |

| 2035 Value Projection: | USD 5,065.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | By Component, By Process |

| Companies covered:: | Xilinx, BitGo, Binance.US, Advanced Micro Devices Inc, NVIDIA Corp, Intel Corp, Ripple Labs, Inc., BitGo, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States cryptocurrency market is boosted by bitcoin, which is a commonly used and embraced digital currency. The substantial growth of the market is being facilitated by increased investor interest, growing awareness, and favourable legislation. The ability to incentivise usage and the evolving value proposition of Bitcoin Cash are also impacting the digital currency market's total value. There is proof that the US population's inclination for digital currency will support the future expansion of the cryptocurrency sector.

Restraining Factors

The United States cryptocurrency market faces obstacles as many policymakers are apprehensive about the ease with which criminals can exploit virtual currencies for nefarious purposes, given that they do not have state-approved regulatory or oversight restrictions, and they are decentralized exchange mechanisms. It has been noted that criminals have used digital currency to facilitate multiple unlawful acts such as money laundering, tax evasion, and maybe even terrorism financing.

Market Segmentation

The United States cryptocurrency market share is classified into component and process.

- The hardware segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States cryptocurrency market is segmented by component into hardware and software. Among these, the hardware segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by bitcoin miners' faster processing speeds and lower power use would motivate the hardware revenue business segment's development. Because of the shift in customer requirements, more manufacturers are developing bitcoin mining hardware. Mining devices require hardware, such as a graphics processing unit, which is fast, efficient, and dependable.

- The mining segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the process, the United States cryptocurrency market is segmented into mining and transaction. Among these, the mining segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the mining process, blockchain transactions are authorized and validated, while mining activities contribute new coins to the existing supply chain. Many companies are working to establish and build out crypto miner farms to provide greater mining experiences for cryptocurrency miners.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States cryptocurrency market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Xilinx

- BitGo

- Binance.US

- Advanced Micro Devices Inc

- NVIDIA Corp

- Intel Corp

- Ripple Labs, Inc.

- BitGo

- Others

Recent Development

- In February 2022, Intel Corporation announced plans to help the development of blockchain technology through a roadmap of energy-efficient accelerators. The business stated that its blockchain accelerator chip will ship later this year.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States cryptocurrency market based on the following segments:

United States Cryptocurrency Market, By Component

- Hardware

- Software

United States Cryptocurrency Market, By Process

- Mining

- Transaction

Need help to buy this report?