United States Crop Protection Chemicals Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Herbicides, Fungicides, Insecticides, and Others), By Form (Liquid, Solid), By Crop Type (Cereal & Grains, Fruits & Vegetables, Oilseed & Pulses, Others), By Mode of Application (Foliar Spray, Seed Treatment, Soil Treatment, and Others), and United States Crop Protection Chemicals Market Insights Forecast to 2033

Industry: AgricultureUnited States Crop Protection Chemicals Market Insights Forecasts to 2033

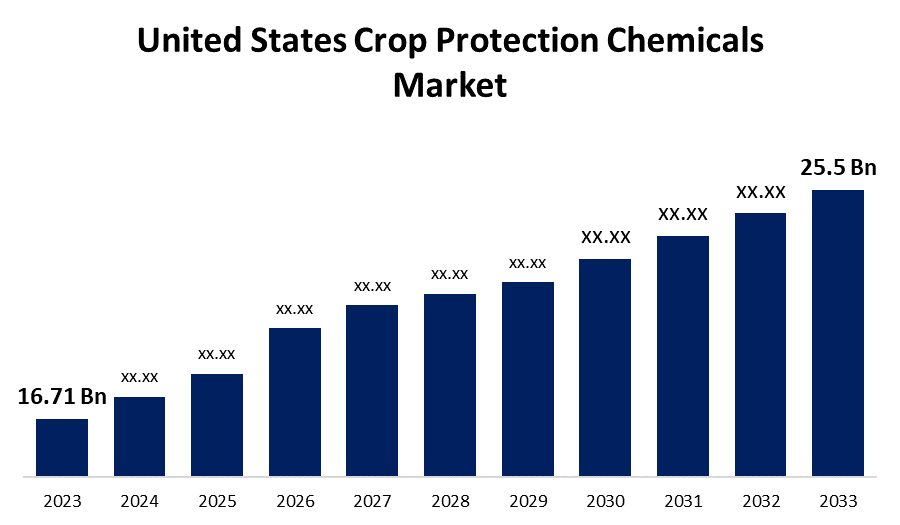

- The United States Crop Protection Chemicals Market Size was valued at USD 16.71 Billion in 2023

- The Market Size is Growing at a CAGR of 4.32% from 2023 to 2033.

- The United States Crop Protection Chemicals Market Size is Expected to Reach USD 25.5 Billion by 2033.

Get more details on this report -

The United States Crop Protection Chemicals Market Size is Expected to Reach USD 25.5 Billion by 2033, at a CAGR of 4.32% during the forecast period 2023 to 2033.

Market Overview

Crop protection chemicals, also known as agricultural pesticides, are chemical substances used in farming to keep crops safe from pests, diseases, and weeds. These chemicals are critical to maintaining agricultural productivity and profitability. Crop protection chemicals include a variety of products such as insecticides, herbicides, fungicides, and rodenticides, all of which are designed to target specific pests or plant diseases. Insecticides are used to control and eradicate insects that can harm crops by feeding on their leaves, stems, or fruits. Herbicides are used to control or eliminate unwanted plants, also known as weeds, that compete with crops for resources like water, sunlight, and nutrients. In contrast, fungicides are designed to prevent and control fungal infections, which can have a significant impact on crop yield and quality. Furthermore, rodenticides are used to control rodent populations, which can cause significant crop damage during feeding activities. Crop protection chemicals help to preserve crop quality, reduce post-harvest losses, and ensure the availability of safe and nutritious food options. Aside from that, ongoing advancements in agricultural technologies and crop protection formulations continue to boost the market. Furthermore, the development of innovative pesticides with increased efficacy, lower environmental impact, and lower application rates helps to grow the crop protection chemicals industry.

Report Coverage

This research report categorizes the market for the United States crop protection chemicals market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States crop protection chemicals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States crop protection chemicals market.

United States Crop Protection Chemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 16.71 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.32% |

| 2033 Value Projection: | USD 25.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Form, By Crop Type, By Mode of Application and COVID-19 Impact Analysis. |

| Companies covered:: | BASF Corporation, Syngenta Corporation, Bayer CropScience, FMC Corporation, Monsanto Company, Nufarm Americas, Valent Biosciences Corporation, The Dow Chemical Company, E.I. du Pont de Nemours and Company, Sumitomo Chemical America Inc. and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

As the population grows, the demand for food increases. Crop protection chemicals play an important role in increasing agricultural productivity by protecting crops from pests, diseases, and weeds, and the growth of agricultural practices such as commercial farming and intensive cropping systems is driving up demand for crop protection chemicals. Higher crop yields benefit farmers economically while also contributing to food security by providing an adequate supply of food for the growing population. The most minor risk to human and animal health is driving the United States crop protection chemicals market growth. The agricultural industry is undergoing a remarkable transformation, fueled by technological advancements. Rising demand for organic food items is also driving revenue growth in the crop protection chemicals market. Organic farmers use crop protection agents approved for use in organic farming.

Restraining Factors

Increasing regulations and restrictions on the use of these chemicals are major factors that may hamper revenue growth in the United States crop protection chemicals market. Furthermore, the rising emphasis on sustainable agriculture and the requirement to reduce the environmental impact of crop protection chemicals is another factor that could hamper revenue growth in the United States crop protection chemicals market.

Market Segment

- In 2023, the herbicides segment is witnessing significant growth over the forecast period.

Based on product type, the United States crop protection chemicals market is segmented into herbicides, fungicides, insecticides, and others. Among these, the herbicides segment is witnessing significant growth over the forecast period. Weeds are a common and persistent problem in agriculture, competing with crops for vital resources like sunlight, water, and nutrients. Herbicides provide an effective solution for weed control, making them an essential tool for farmers. Herbicides help farmers maintain crop productivity and quality by selectively targeting, suppressing, or eliminating weeds. In addition, herbicides make weed management easier and more efficient. Herbicides are a faster and less expensive option for weed removal than manual or mechanical methods. They can be applied over large areas, allowing for effective weed control in large farming operations. These crops are engineered to withstand specific herbicides, allowing farmers to apply them without harming their crops. The adoption of herbicide-resistant crops has resulted in a significant increase in herbicide usage, boosting the growth of the herbicides segment.

- In 2023, the liquid segment accounted for the largest revenue share over the forecast period.

Based on form, the United States crop protection chemicals market is segmented into liquid, and solid. Among these, the liquid segment has the largest revenue share over the forecast period. Liquid formulations provide convenience and ease of application. They are easily mixed, sprayed, and distributed over large areas, allowing for effective crop coverage. Liquid formulations can be applied with a variety of equipment, including sprayers and irrigation systems, making them appropriate for a wide range of farming practices and crop types. Many farmers prefer liquid formulations due to their versatility and convenience. Furthermore, liquid formulations have better penetration and absorption into plant tissues than other forms, such as granules or powder. Furthermore, liquid formulations often have better storage stability than other forms. They are less likely to degrade or lose effectiveness over time, resulting in a longer shelf life and a lower risk of product waste. This stability is especially important in large-scale agricultural operations, where storage and inventory management are vital factors.

- In 2023, the cereal and grains segment accounted for the largest revenue share over the forecast period.

Based on crop type, the United States crop protection chemicals market is segmented into cereal and grains, fruits and vegetables, oilseed and pulses, and others. Among these, the cereal and grains segment has the largest revenue share over the forecast period. Cereals and grains are staple food crops that are consumed around the world and serve as the foundation for many diets. Population growth, changing dietary preferences, and increased urbanization all contribute to a consistent high demand for these crops. As a consequence, farmers pay close attention to the production and protection of cereals and grains, resulting in increased demand for crop protection chemicals. Cereals and grains are also susceptible to a variety of pests, diseases, and weeds, all of which can have a significant impact on yield and quality.

- In 2023, the foliar spray segment accounted for the largest revenue share over the forecast period.

Based on the mode of application, the United States crop protection chemicals market is segmented into foliar spray, seed treatment, soil treatment, and others. Among these, the foliar spray segment has the largest revenue share over the forecast period. The foliar spray provides a direct and targeted application to plant leaves. This method of application enables the efficient and effective delivery of crop protection chemicals to the foliage, where pests, diseases, and weeds frequently reside. Foliar sprays provide complete coverage of the plant's surface, ensuring better contact with the target organisms and increasing the efficacy of the chemicals used. Additionally, foliar spray promotes systemic movement within the plant. The leaves absorb the spray droplets, which can then travel to other parts of the plant such as the stems, flowers, and fruits. This systemic movement helps to protect the entire plant from pests and diseases, including those that are not directly exposed to the spray. It offers a more comprehensive and integrated approach to crop protection.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States crop protection chemicals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF Corporation

- Syngenta Corporation

- Bayer CropScience

- FMC Corporation

- Monsanto Company

- Nufarm Americas

- Valent Biosciences Corporation

- The Dow Chemical Company

- E.I. du Pont de Nemours and Company

- Sumitomo Chemical America Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2023, Bayer collaborated with Oerth Bio, an agricultural biotech company, to create the next generation of sustainable crop protection products.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States crop protection chemicals market based on the below-mentioned segments:

United States Crop Protection Chemicals Market, By Product Type

- Herbicides

- Fungicides

- Insecticides

- Others

United States Crop Protection Chemicals Market, By Form

- Liquid

- Solid

United States Crop Protection Chemicals Market, By Crop Type

- Cereal & Grains

- Fruits & Vegetables

- Oilseed & Pulses

- Others

United States Crop Protection Chemicals Market, By Mode of Application

- Foliar Spray

- Seed Treatment

- Soil Treatment

- Others

Need help to buy this report?