United States Crocin Market Size, Share, and COVID-19 Impact Analysis, By Application (Food, Drug, Chemical Industry, and Others), By Purity (Purity >98% and Purity <98%), and United States Crocin Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Crocin Market Insights Forecasts to 2035

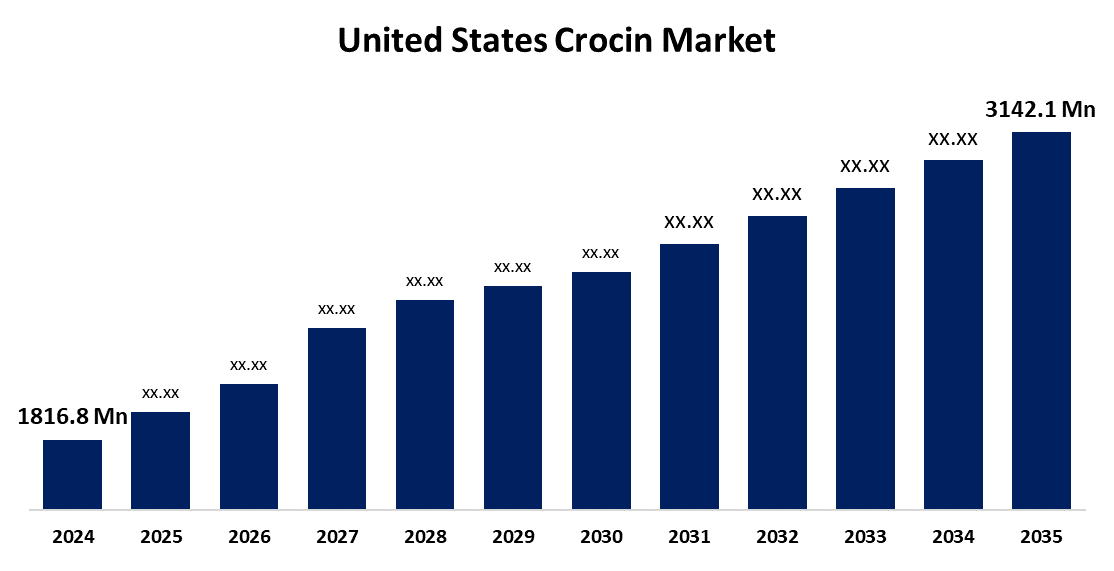

- The US Crocin Market Size Was Estimated at USD 1816.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.11% from 2025 to 2035

- The US Crocin Market Size is Expected to Reach USD 3142.1 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Crocin Market Size is Anticipated to Reach USD 3142.1 Million by 2035, Growing at a CAGR of 5.11% from 2025 to 2035. The expansion of the United States' crocin market is propelled by increased demand for painkillers, increased output of paracetamol, and the growing incidence of ailments like headaches, the flu, and other discomfort.

Market Overview

Crocin is a well-known over-the-counter pain reliever and antipyretic that contains paracetamol (acetaminophen) as its active ingredient. The rising cancer pain and chronic pain situations drive the need for painkillers. The market is forecast to increase as population growth, especially among older persons in many emerging economies, pushes the demand. There is a great opportunity for the crocin industry to expand in the US, as demand for OTC pharmaceutical products is growing significantly, with greater awareness of health care and economic improvement. The US is seeing the growth of a middle class that spends more on health care products. This is particularly true for OTC painkillers such as Crocin. Strong economic growth has resulted in increased disposable income to spend on health care products. Urbanisation has improved access to pharmaceuticals and healthcare in the US. Urbanization has enabled more retail pharmacies to operate, which improves overall access to prescription drug therapy.

The U.S. government encourages the availability of generic pharmaceuticals, such as paracetamol, in order to make necessary prescription treatments more affordable and accessible. After the time of exclusive marketing rights has passed, generic medications are not covered by the Patent Act, thus any business can produce and distribute them. Since this policy was implemented, acetaminophen has become widely accessible at affordable rates under a number of brand names, including Crocin.

Report Coverage

This research report categorizes the market for the United States crocin market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States crocin market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States crocin market.

United States Crocin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1816.8 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.11% |

| 2035 Value Projection: | USD 3142.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 170 |

| Segments covered: | By Application, By Purity and COVID-19 Impact Analysis. |

| Companies covered:: | Wilshire Technologies, APExBIO Technology, Cayman Chemical, McNeil, GlaxoSmithKline, Bayer AG, Teva Pharmaceutical Industries Ltd, Sun Pharmaceutical Industries Ltd, Novartis AG and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States crocin market is boosted primarily in the food and beverage space, due to increased consumer awareness and demand for natural health solutions. There is a remarkable increase in markets focused on health and wellness products, where natural is highly valued. Cromin can be considered part of the natural additive trend in the food and beverage space in 2024 due to its natural properties and health benefits. Consumers are increasingly looking for products that contribute to their health and well-being, which is a significant shift in consumer habits.

Restraining Factors

The United States crocin market faces obstacles like the regulatory parameters for licensing and distribution, especially over-the-counter (OTC) drugs like Crocin. The regulatory bodies, such as the U.S. Food and Drug Administration (FDA), have very strict guidelines for marketing, safety, and efficacy of pharmaceuticals.

Market Segmentation

The United States crocin market share is classified into application and purity.

- The drug segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States crocin market is segmented by application into food, drug, chemical industry, and others. Among these, the drug segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the increasing prevalence of conditions such as headache and flu, increasing utilization of painkillers, and increasing identification of sick patients. Typically, paracetamol is administered for headache, toothaches, osteoarthritis, menstrual cycles, chronic back pain, and symptoms of a flu or cold. As a powerful antipyretic, it is also administered to reduce fever.

- The purity >98% segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the purity, the United States crocin market is segmented into purity >98% and purity <98%. Among these, the purity >98% segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by experienced and specialised health care professionals may be indicative of the oversights related to this segment. The market admits that increasingly there are demands to allow for rapid post-operative pain management, purity >98% has surgical instruments that promise to allow patient admission.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States crocin market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Wilshire Technologies

- APExBIO Technology

- Cayman Chemical

- McNeil

- GlaxoSmithKline

- Bayer AG

- Teva Pharmaceutical Industries Ltd

- Sun Pharmaceutical Industries Ltd

- Novartis AG

- Others

Recent Development

- In April 2022, Genexa, Inc. launched Genexa Acetaminophen Extra Strength and Genexa Acetaminophen PM, offering OTC pain relievers without artificial preservatives, dyes, or synthetic fillers. These products cater to the growing demand for clean-label medications.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States crocin market based on the following segments:

United States Crocin Market, By Application

- Food

- Drug

- Chemical Industry

- Others

United States Crocin Market, By Purity

- Purity >98%

- Purity <98%

Need help to buy this report?