United States Corundum Market Size, Share, and COVID-19 Impact Analysis, By Type (Ruby, Emery, and Sapphire), By Application (Jewelry, Abrasive, Refractory, and Minerals), and United States Corundum Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsUnited States Corundum Market Insights Forecasts to 2035

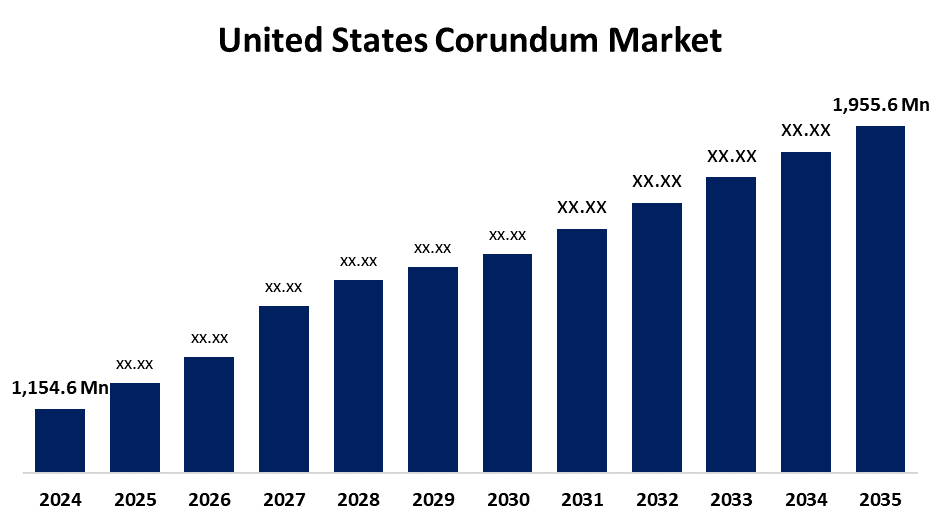

- The US Corundum Market Size Was Estimated at USD 1,154.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.91% from 2025 to 2035

- The US Corundum Market Size is Expected to Reach USD 1,955.6 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United States Corundum Market Size is anticipated to reach USD 1,955.6 Million by 2035, growing at a CAGR of 4.91% from 2025 to 2035. The expansion of the United States corundum market is propelled by the increasing demand for synthetic corundum in abrasive applications, as its exceptional hardness makes it ideal for grinding and polishing materials.

Market Overview

Corundum is a naturally occurring mineral with exceptional hardness that is widely used in many different goods, including jewellery and industrial abrasives. Because corundum is widely used in jewellery as a primary material for valuable stones like sapphires and rubies, it has a substantial impact on the corundum market. The industry is expanding due to the rising demand for colourful gemstones, especially in the luxury market. High-performance abrasives are needed for industrial applications, and the nation's robust luxury goods consumer base fuels demand in gemstones like sapphires and rubies. Further increasing demand for corundum materials is the continued recovery from economic shocks, which has resulted in more investments in construction and manufacturing. Furthermore, the U.S. market is anticipated to expand gradually as processing techniques are improved by technological improvements. Furthermore, corundum is used in many industrial applications outside of the jewellery industry, which fuels the expansion of the market. Because of their hardness, non-gemstone corundum types like brown and black emery are used as abrasives in cutting, sandblasting, and grinding operations. When high-speed performance without excessive heat generation is needed, white corundum is used in polishing applications. The industrial need for corundum in abrasive applications guarantees the corundum market's continuous expansion and diversification, even though the jewellery market continues to be its key driver.

Report Coverage

This research report categorizes the market for the United States corundum market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States corundum market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States corundum market.

United States Corundum Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,154.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.91% |

| 2035 Value Projection: | USD 1,955.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 277 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Type and By Application |

| Companies covered:: | Rubicon Technology, Allen Refractories Company, Rubicon Technology, Panadyne, Reade Advanced Materials, United States Borax, Norton, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States corundum market is boosted by the rising need for abrasives in several sectors. Because of its endurance and hardness, corundum is used extensively in the production of cutting tools, sandpaper, and grinding wheels. As the automotive, metalworking, and construction industries continue to grow, there will likely be a greater demand for high-quality abrasives. Strong demand for products based on corundum is being caused by the expansion of these industries. Also, new and creative uses for corundum are appearing as a result of technological breakthroughs. One example of how the corundum market business is changing is the use of corundum in waterjet cutting, which is becoming more popular because of its accuracy and efficiency.

Restraining Factors

The United States corundum market faces obstacles like the high expenses of corundum extraction and processing, particularly for premium gemstones like sapphires and rubies, which might render the material unaffordable for certain businesses and prevent its broad use in price-sensitive fields.

Market Segmentation

The United States Corundum Market Share is classified into type and application.

- The ruby segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States corundum market is segmented by type into ruby, emery, and sapphire. Among these, the ruby segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven as it has no gemstone cleavage and is extremely compact and thick. After diamond, it is among the hardest natural minerals. Ruby corundum of gem quality is likewise quite uncommon. Because of these characteristics, both ruby corundum varieties are among the most sought-after jewellery stones. Additionally, the increasing use of rubies in jewellery is driving the growth of this market.

- The jewelry segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States corundum market is segmented into jewelry, abrasive, refractory, and minerals. Among these, the jewelry segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled, as after diamond, corundum is regarded as a precious stone. As a result, corundum is in great demand in the jewellery industry. Additionally, the jewellery segment's corundum market is being driven by rising disposable income.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States corundum market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Rubicon Technology

- Allen Refractories Company

- Rubicon Technology

- Panadyne

- Reade Advanced Materials

- United States Borax

- Norton

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States corundum market based on the following segments:

United States Corundum Market, By Type

- Ruby

- Emery

- Sapphire

United States Corundum Market, By Application

- Jewelry

- Abrasive

- Refractory

- Minerals

Need help to buy this report?