United States Copper Powder Market Size, Share, and COVID-19 Impact Analysis, By Type (<100 Mesh, 100-200 Mesh, 200-300 Mesh, 300-400 Mesh, and >400 Mesh), By Process (Atomization, Electrolysis, Hydrometallurgy, and Solid-State Reduction), and United States Copper Powder Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Copper Powder Market Size Insights Forecasts to 2035

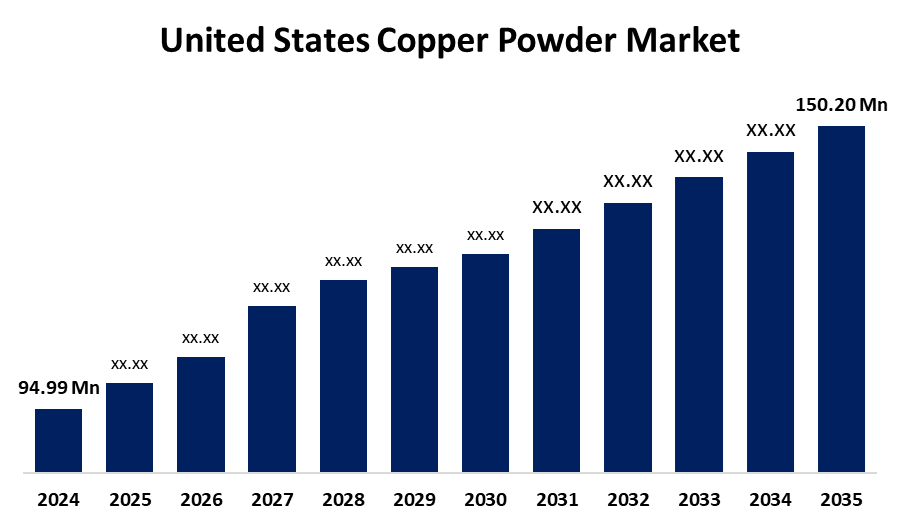

- The United States Copper Powder Market Size was Estimated at USD 94.99 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.25% from 2025 to 2035

- The United States Copper Powder Market Size is Expected to Reach USD 150.20 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States Copper Powder Market Size is anticipated to reach USD 150.20 Million by 2035, growing at a CAGR of 4.25% from 2025 to 2035. The U.S. Copper Powder Market grows due to rising demand from electric vehicles, renewable energy, and advanced manufacturing like 3D printing. Copper’s excellent conductivity and recyclability boost its appeal. Government support for domestic production and supply chain security, along with expanding clean energy and industrial automation sectors, further drive sustained market growth.

Market Overview

The United States Copper Powder Market defines the finely processed copper particles used across various industries such as electronics, automotive, and additive manufacturing. Market growth is driven by rising demand for electric vehicles (EVs), renewable energy technologies, and advancements in 3D printing, where copper’s excellent electrical and thermal conductivity is critical. The automotive sector’s shift to EVs significantly boosts copper powder consumption, given the metal’s essential role in batteries, motors, and wiring. Its strength lies in its adaptability to various manufacturing processes and strong demand from growing end-use sectors. Opportunities are growing in additive manufacturing, as copper powder enables the production of complex, high-precision components. Furthermore, government initiatives focused on reducing reliance on foreign copper imports and enhancing domestic production underscore copper’s strategic importance. These include executive orders to streamline mining permits and address national security concerns related to copper supply.

Report Coverage

This research report categorizes the market for the United States copper powder market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States copper powder market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States copper powder market.

United States Copper Powder Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 94.99 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.25% |

| 2035 Value Projection: | USD 150.20 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 136 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | United States Copper Powder Market Size is Expected to Grow from USD 94.99 Million in 2024 to USD 150.20 Million by 2035, growing at a CAGR of 4.25% during the forecast period 2025-2035. U |

| Companies covered:: | Mitsubishi Materials Corporation, Conductive Composites, Signum Technologies, KGHM International, American Elements, Hindalco Industries, Superior Materials, E3 Metals Corp, Gredmann, Coorstek, Others, and key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising demand for electric vehicles (EVs), which require significant amounts of copper for batteries, motors, and wiring, is due to copper’s superior electrical conductivity. Additionally, the rapid growth of renewable energy sectors, such as solar and wind power, fuels demand for copper powder in energy storage systems and power transmission components. Advancements in additive manufacturing (3D printing) also propel market growth by enabling the production of complex, high-precision copper parts that are lighter and more efficient. Moreover, increasing industrial automation and electronics manufacturing further boost copper powder usage. Sustainability trends, including the recyclability of copper and government initiatives promoting domestic production and supply chain security, add momentum to the market.

Restraining Factors

The volatile copper prices, strict environmental regulations, and high energy consumption in production. Limited availability of high-purity copper and complex manufacturing processes hinder scalability. Additionally, competition from cost-effective alternatives like aluminum and silver challenges market growth, creating barriers for smaller producers and affecting overall expansion.

Market Segmentation

The United States copper powder market share is classified into type and process.

- The <100 mesh segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States copper powder market is segmented by type into <100 mesh, 100-200 mesh, 200-300 mesh, 300-400 mesh, and >400 mesh. Among these, the <100 mesh segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its excellent conductivity, flowability, and packing density, making it ideal for electronics, brazing, and powder metallurgy. Its coarse particle size enhances structural integrity in additive manufacturing, while its versatility and cost-effectiveness support widespread industrial applications, driving strong demand across key U.S. manufacturing sectors.

- The atomization segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States copper powder market is segmented by process into atomization, electrolysis, hydrometallurgy, and solid-state reduction. Among these, the atomization segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to its ability to produce high-purity copper powders with controlled particle size and shape. This process is highly efficient and suitable for large-scale production, making it ideal for applications in additive manufacturing, powder metallurgy, and electronics. Atomized copper powder offers excellent flowability, density, and consistency, which are critical for industrial processes that require precision and uniformity.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States copper powder market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsubishi Materials Corporation

- Conductive Composites

- Signum Technologies

- KGHM International

- American Elements

- Hindalco Industries

- Superior Materials

- E3 Metals Corp

- Gredmann

- Coorstek

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S., regional, and country levels from 2020 to 2035. Spherical Insights has segmented the USA copper powder market based on the below-mentioned segments:

United States Copper Powder Market, By Type

- <100 Mesh

- 100-200 Mesh

- 200-300 Mesh

- 300-400 Mesh

- >400 Mesh

United States Copper Powder Market, By Process

- Atomization

- Electrolysis

- Hydrometallurgy

- Solid-State Reduction

Need help to buy this report?